Total value of tokenized RWA $XRP Leisure is finally here strike billion dollar milestone middle Rapid expansion since the beginning of the year.

meanwhile $XRP and broader cryptocurrency market is facing obstacles Adding to previous bullish momentum, the tokenization of real world assets (RWA) continues to expand across multiple blockchains. $XRP Ledger (XRPL) continues to be the main beneficiary of of growth.

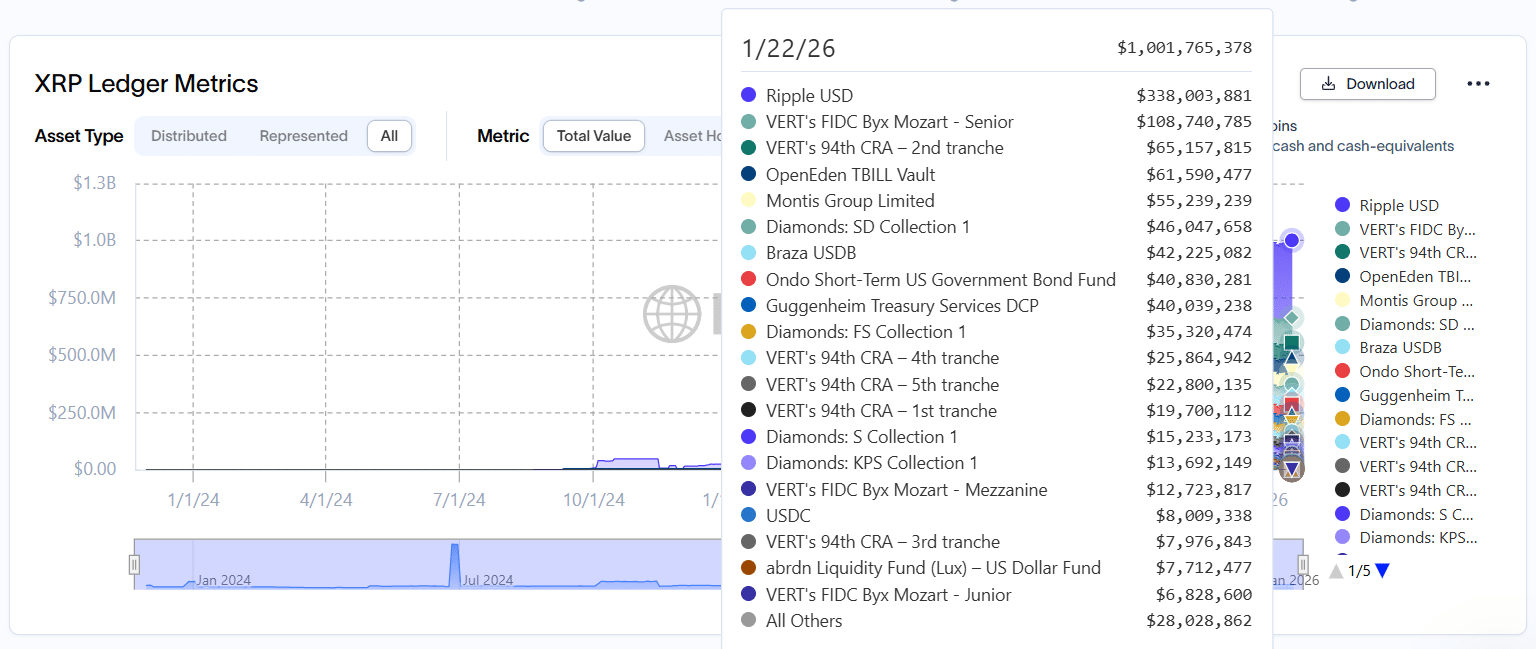

Specifically, the data confirms that we have tokenized RWA. $XRP Leisure is currently crossed surpassed $1 billion for the first time in history, After starting Total sales for the year reached $885 million. This means that the tokenized RWA value is $XRP Ripple stablecoin ($RLUSD) has contributed the most to this growth.

Important points

- Tokenized RWA $XRP Ledger added $115 million worth of value in 2026, reaching the $1 million milestone.

- Ripple stablecoin is $RLUSDcontributed most to this growth, accounting for over 90% of this year’s value added.

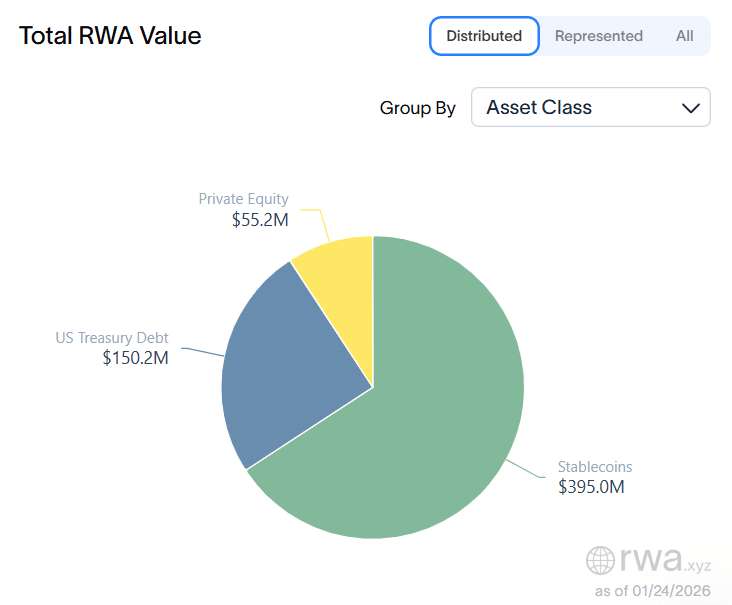

- Currently, the value of RWA on XRPL is $1.01 billion, and the U.S. Ministry of Finance Debt and stablecoins account for $150.2 million make up 395 million dollars.

- Just one year ago, XRPL hosted just $45 million worth of tokenized RWA. This means the network has added more than $956 million in the past year.

Tokenized RWA $XRP Leisure reaches $1 billion

This is accordingly Data provided by industry standard data aggregator RWA.xyz focused on Tokenized real-world assets. Notably, the recent $1 billion figure accounts for all RWA value on XRPL, including decentralized and representative assets.

Tokenized RWA $XRP ledger

Since the beginning of this year, XRPL has added $115 million in tokenized value. $RLUSD stable coin It accounted for 90% of this growth, contributing $104 million. In response to this rapid rise in prices, $RLUSD market capitalization of $XRP Ledger has now grown to $338 million. make up 33.7% of the total RWA value on the network.

Contribution from each asset class

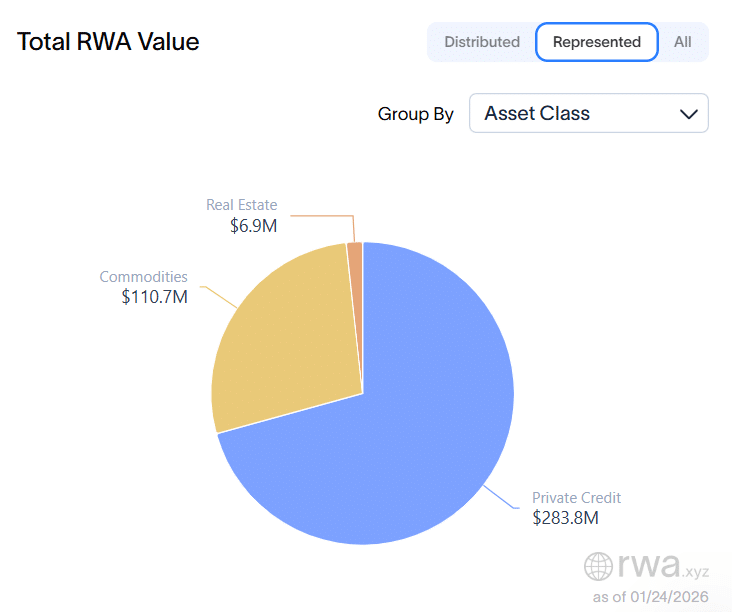

Currently total RWA on XRPL sit correctly 1.001 billion including distributed representative assets. For context, decentralized assets refer to assets that users can hold and transfer on a blockchain for trading or DeFi. use, meanwhile Assets represented stay It resides on the publishing platform and cannot be transferred externally. Particularly representative assets activity As an internal digital record of ownership, do not have Tradable assets.

Of the $1.001 million, diversified assets accounted for $604 million, accounting for 60% of the share. These assets include private equity ($55.2 million); us treasury debt ($150.2 million), stablecoins ($395 million). Interestingly, $RLUSDcurrently has a market capitalization of $338 million on XRPL, accounting for 85% of all stablecoin value on the network.

On the other hand, representative assets are compensate $401.4 million, represent 40% of XRPL’s total value of $1.01 billion. Notably, these assets include merchandise ($110.7 million), real estate ($6.9 million), and private credit ($283.8 million). Vert Capital’s token, which represents Brazilian private equity, accounts for $269.8 million worth of private credit.

Assets represented | RWAxyz

Rapid expansion of XRPL RWA tokenized records

The recent $1 billion milestone reflects the rapid expansion that XRPL continues to record in the tokenization scene. BlackRock CEO Larry Fink Call it “inevitable.”

For comparison, just one year ago, XRPL hosted $45,179,000 worth of tokenized RWA. The current figure of $1.01 billion is based on the RWA value of blockchain. grew up That’s an increase of $956.6 billion over the past year. set itself above You can profit from the growing tokenization story. please remember bit by bit I proposed purchasing it last year. $XRP This was one of the “cleanest” ways to invest in the future of tokenization.