Bitcoin price action cooled after failing to secure a sustained breakout above $100,000 in January. The rejection triggered short-term profit-taking, pushing the price higher. $BTC We are entering the integration phase.

Since then, price action has changed towards stabilization rather than aggressive selling. On-chain and macro indicators now suggest an improving situation. Investor positioning indicates a cautiously bullish setup for February.

Bitcoin profit taking reveals pattern

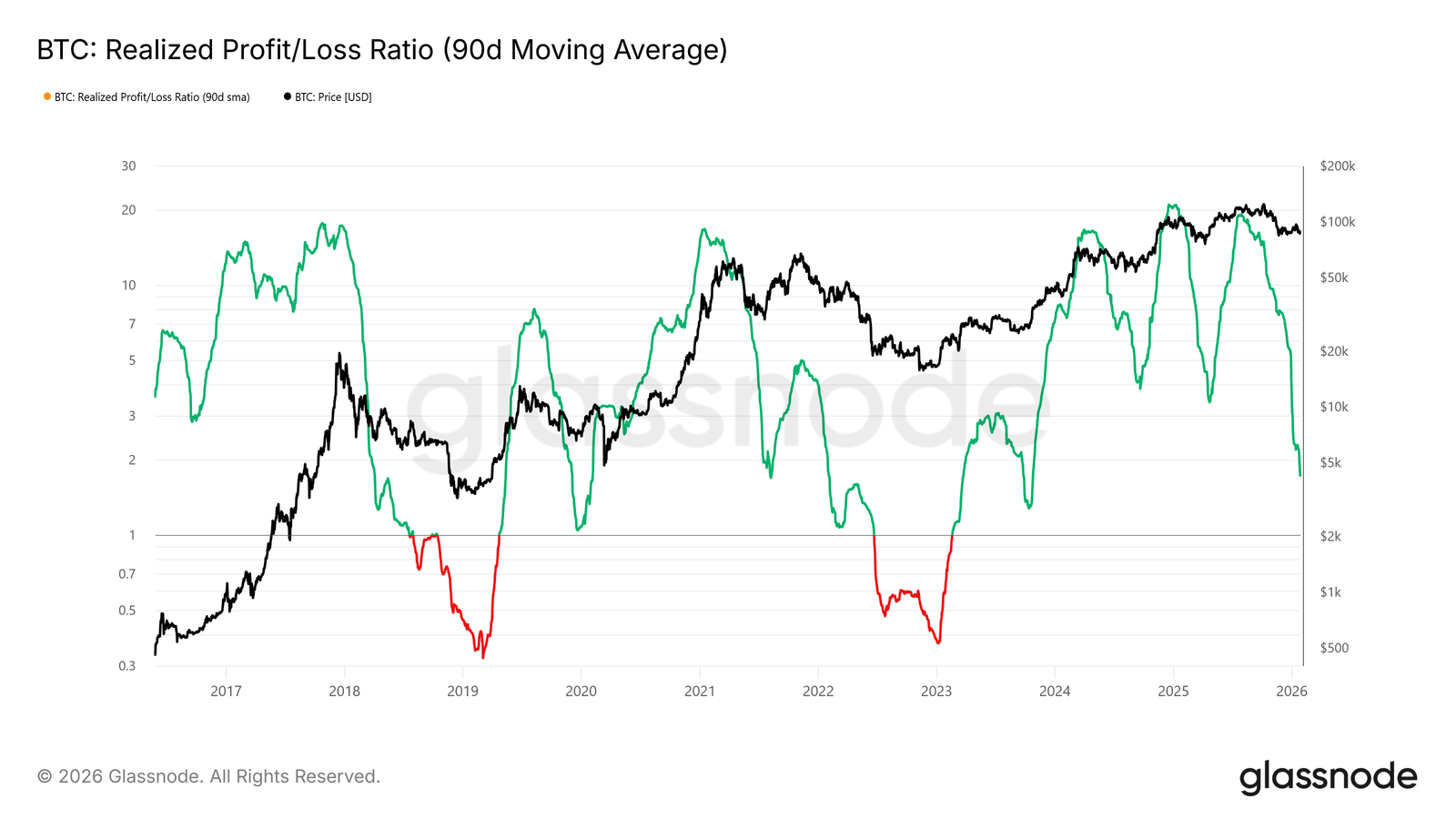

Any meaningful transition to sustained upside for Bitcoin must be reflected in liquidity-sensitive indicators. One of the most important metrics is the realized profit/loss ratio, which is based on a 90-day simple moving average. Historically, a strong uptrend has only emerged when this ratio exceeds a threshold of 5.0.

Past mid-cycle recoveries over the past two years followed the same structure. Once this ratio could not sustain above this level, the rally quickly lost momentum. A move above 5.0 again would indicate new capital flowing into the market. It would also suggest that profit-taking is absorbing new demand rather than suppressing prices.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Bitcoin realized profit/loss ratio. Source: Glassnode

Fed decision could affect prices

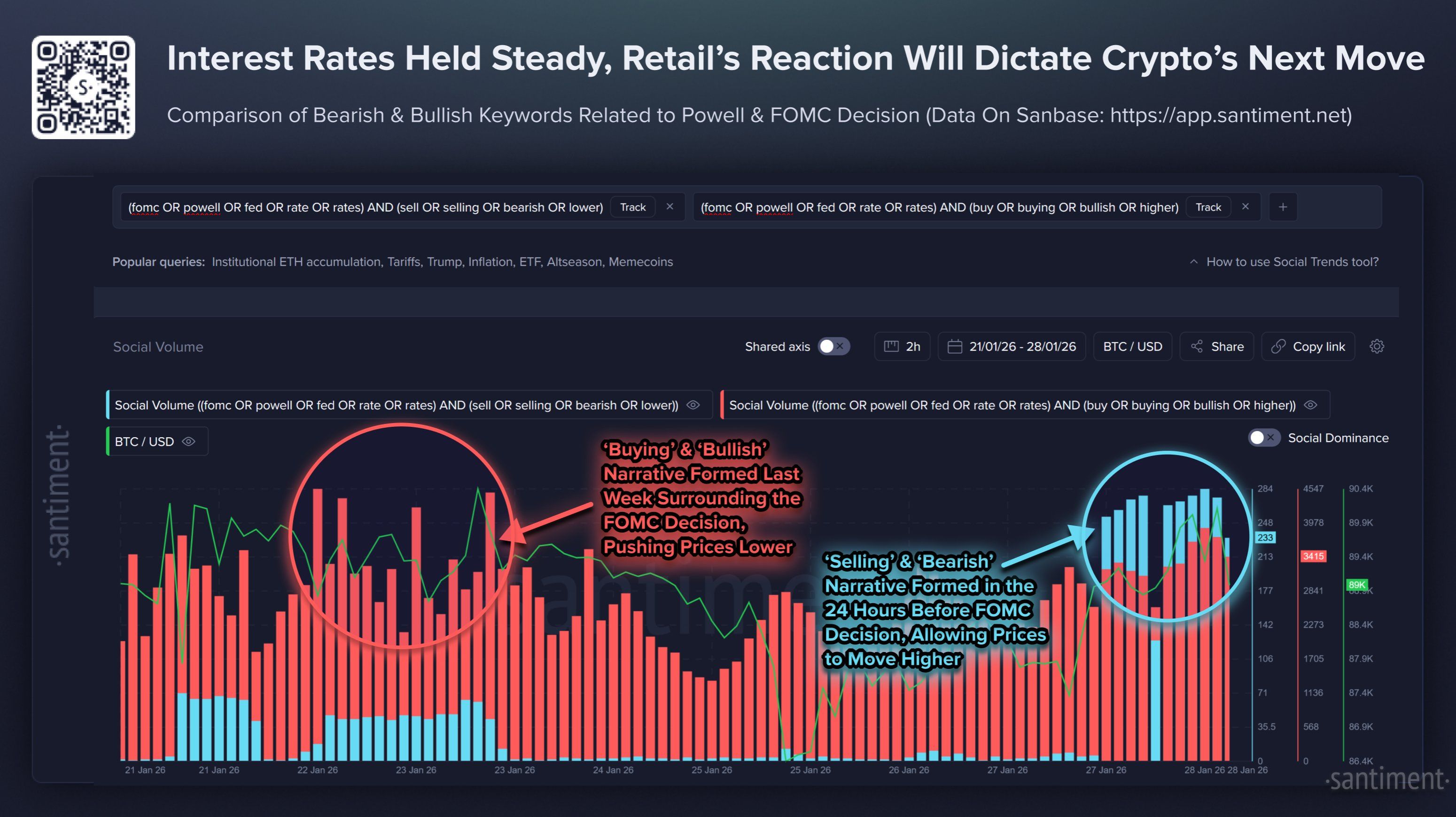

The macro environment remains supportive following the Fed’s latest policy decisions. The Fed left interest rates unchanged at its first meeting of the year. Chairman Jerome Powell said interest rates were in a “neutral range.” The statement suggests the suspension may be extended rather than new tightening.

Market sentiment further strengthens this backdrop. According to Santimento data, extreme sentiment often coincides with inflection points. Bullish and greedy sentiment tends to appear near the top of the market. Historically, pullbacks have been preceded by bearish and fearful sentiment. Current sentiment remains cautious and often favors a modest continuation of the upside.

Bitcoin social volume. Source: Santiment

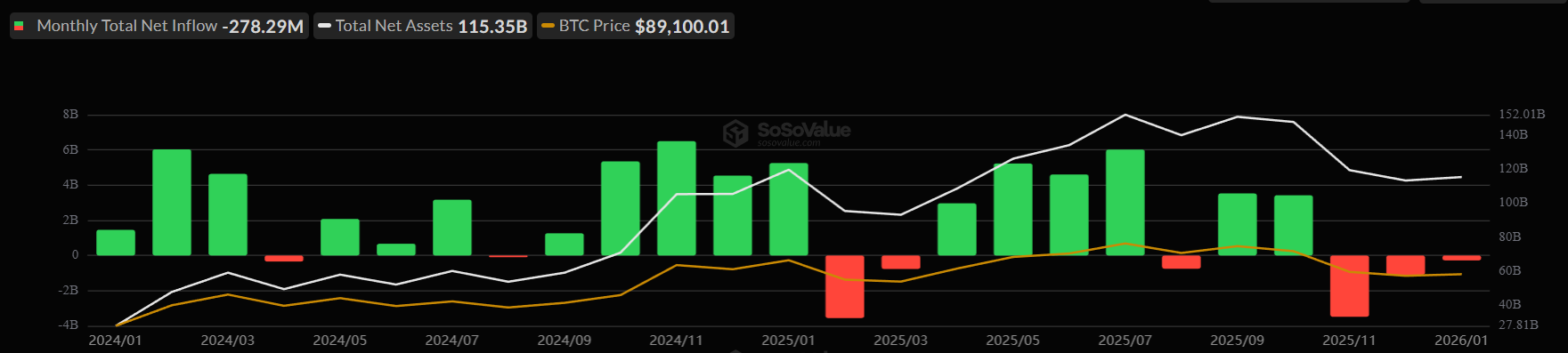

Spot Bitcoin ETFs could be the deciding factor in February. Over the past three months, these products recorded continued net outflows. In November 2025, $3.48 billion of ETFs exited the market. There was another $1.09 billion outflow in December.

There was a noticeable slowdown in January 2026, with outflows decreasing to $278 million. This slowdown suggests that selling pressure from institutional investors is waning. If flows turn positive in February, ETF demand could strengthen market stability. New capital inflows will provide structural support and increase the probability of an increase.

Bitcoin Spot ETF Flow. Source: SoSoValue

$BTC Prices have ambitious goals

From a technical perspective, Bitcoin price continues to move within an upward-expanding wedge. Price has recently rebounded from the lower bound of this structure. Bitcoin is currently trading around $88,321. The bulls need to clear $89,241 and regain the psychological $90,000 level. An acceptance above $90,000 would confirm the strengthening momentum.

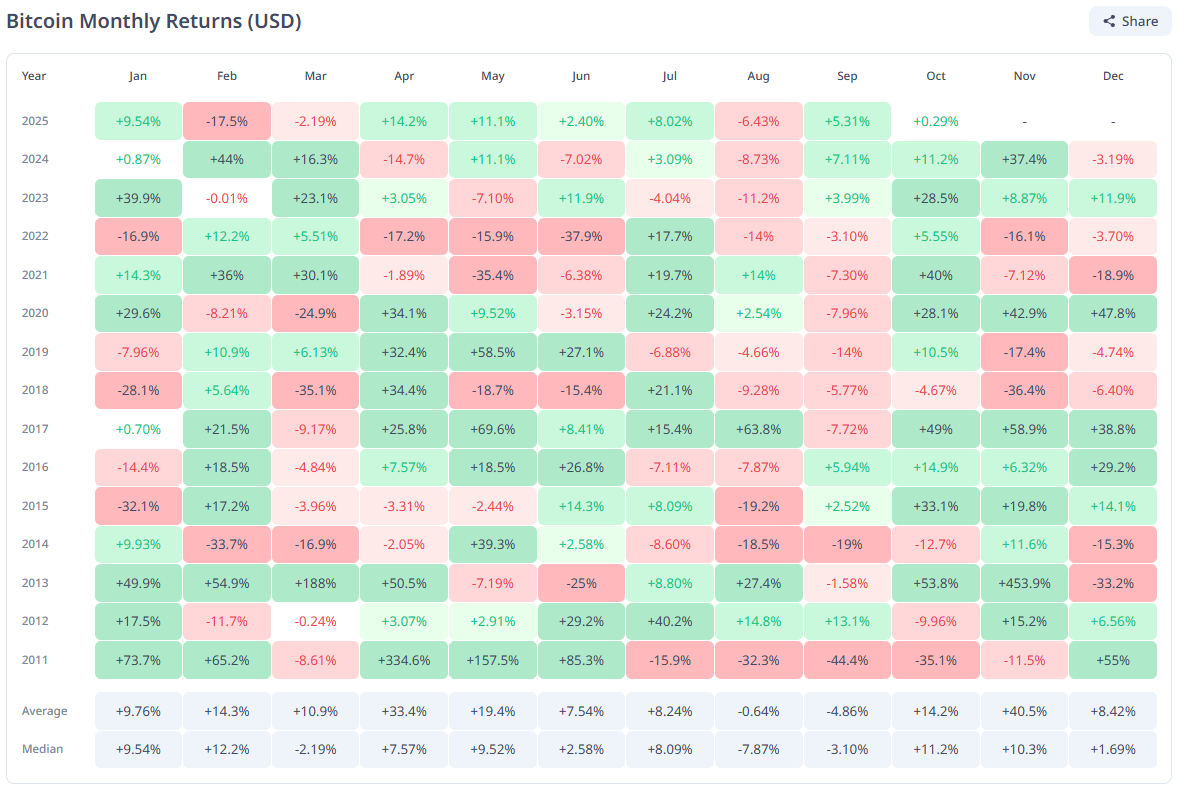

February is always a bullish month for Bitcoin prices, with an average historical return of just 14.3%. The factors listed above point to a similarly bullish outlook. $BTCan increase of 14%. $BTC Up to $101,000.

Bitcoin historical monthly returns. Source: CryptoRank

If he can confirm a breakout from the wedge, it will open the door to higher goals. The first major upside target is near $98,000. Once this level is reached, a controlled decline towards $95,000 is likely to follow. This reinforced zone is important for establishing durable support. Such structures often precede larger continuation movements.

Bitcoin price analysis. Source: TradingView

Downside risk remains a key consideration. If selling pressure returns or the macro environment deteriorates, Bitcoin may not be able to sustain its current levels. A break below $87,210 will increase the downside. In that scenario, a retracement towards $84,698 is more likely. Such a move would invalidate the bullish setup and delay the breakout theory.

Post Bitcoin Price Prediction: What to Expect $BTC February 2026? The post appeared first on BeInCrypto.