Bitcoin briefly fell to $72,863 on Bitstamp on Tuesday, but listed mining stocks posted mixed to positive daily performance even as U.S. stock indexes closed in the solid red.

Bitcoin miners ignore red screen amid geopolitical unrest

Bitcoin’s decline continued in a risk-off shock after Reuters reported that the US shot down an Iranian drone approaching an aircraft carrier, rattling global markets. Stocks like Strategy (MSTR) and Coinbase (COIN) fell along with the move, but Bitcoin remained stable around $76,000 at the time of writing, helping miners avoid further damage.

Among the top miners by market capitalization, IREN Limited rose 2.61% on the day to trade at $54.47, despite declining 8.97% in 5 days, according to statistics from bitcoinminingstock.io. Applied Digital rose 5.37% to $36.67, narrowing its weekly loss to 3.67%, while Cipher Mining rose 2.81% to $16.25, but was still down 8.16% in five days.

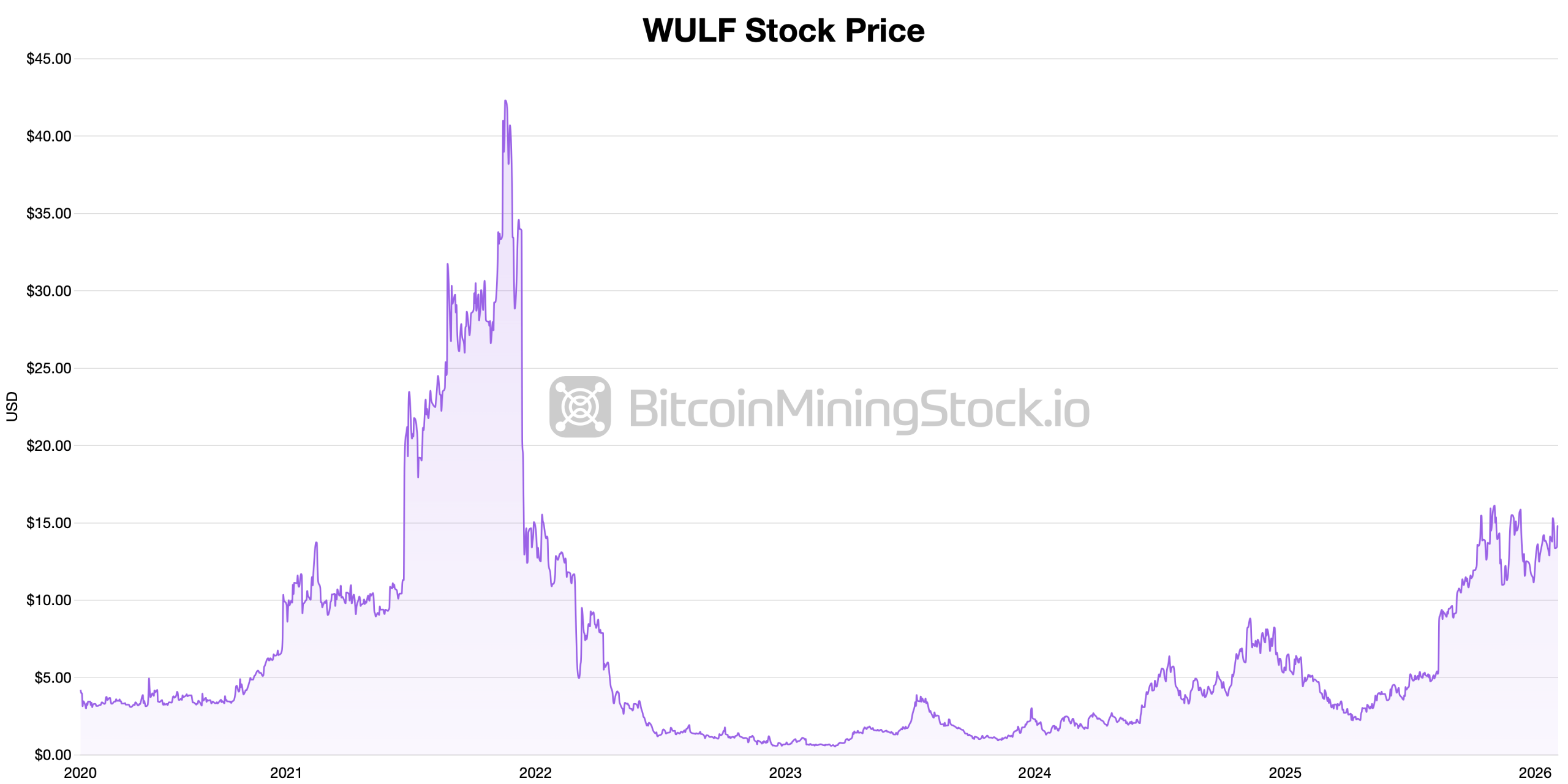

Hut 8 Corp. rose 5.01% to $59.00, outperforming its peers on a daily basis, while Terawulf, Inc. stood out as the only miner to rise in both time frames, gaining 10.08% on the day and 1.75% in five sessions. TerraWolf explained on Tuesday that the company’s new acquisitions now provide approximately 1.5 gigawatts (GW) of new capacity.

TerraWolf said it has secured “strategically located” brownfield infrastructure sites in Maryland and Kentucky, converting old industrial footprints into new mining sites. This is why WULF outperformed the rest of the top 10 packs.

Not all miners were shared on bounces. Riot Platforms rose just 0.19% to $15.35, but is still down 9.54% for the week. Core Scientific fell 0.72% to $17.74, and MARA Holdings fell 0.76% to $9.05.

Also read: Prediction markets provide short-term estimates for 2026 government shutdown

Weekly pressures were evident elsewhere as well, with Cleanse Park up 2.89% on the day but down 9.76% over five days, and Bitdia Technologies down 1.74% on the day to $12.96 and down 2.26% for the week.

Split’s performance suggests investors are selectively rotating within the mining sector, prioritizing balance sheet strength and scale as Bitcoin seeks to stabilize after a volatile session. Nevertheless, from an operational perspective, the hash price on the network on Tuesday was very low at $34.18 per petahash per second (PH/s).

Frequently asked questions ❓

- Why did Bitcoin plummet on February 3, 2026? Bitcoin fell as geopolitical news increased risk aversion across global markets.

- Were all Bitcoin miners up on Tuesday?No, daily profits have been mixed, with some miners recording minor losses.

- Which miner performed best in both time frames?TeraWulf is the only top miner to show profits on both 1-day and 5-day views.

- Where is Bitcoin traded now? At the time of writing, Bitcoin is hovering around $76,000.