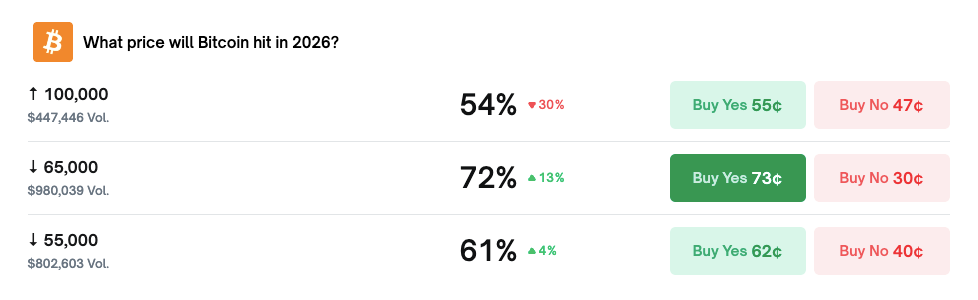

Prediction markets turned even more bearish on Bitcoin after a weekend selloff sent the price briefly below $75,000 on Monday.

Polymarket offers Bitcoin odds ($BTC) Price below $65,000 in 2026 rose 72% on Monday, with volume at nearly $1 million.

Other high-value bets include: $BTC The implied probabilities of falling below $55,000 and getting back $100,000 by the end of the year are 61% and 54%, respectively.

A surge in downside bets suggests a reversal in sentiment. The market has erased the gains from President Donald Trump’s victory in the November 2024 election.

The decline also marked a notable moment for Michael Saylor’s Strategy, the world’s largest publicly traded Bitcoin holder, as the price fell below the average purchase cost for the first time since late 2023.

Bear market: US liquidity crunch pointed to as traders search for reasons for decline

Some analysts believe that the recent decline in cryptocurrencies is due to a broader bearish trend in Bitcoin. CryptoQuant reiterated that the bear market has been ongoing since November 2025, when Bitcoin fell below its 365-day moving average.

“Don’t try to find a bottom after a new bar down,” Julio Moreno, head of research at CryptoQuant, said in an X post on Saturday, adding that “bear market bottoms take months to form.”

The probability is $BTC It is expected to fall below $65,000, which was up 13% at the time of writing. Source: Polymarket

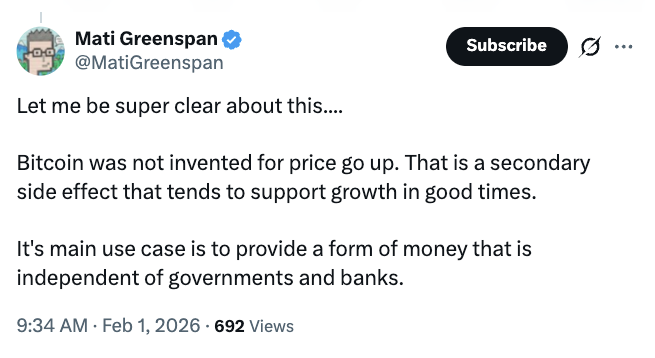

Matty Greenspan, CEO of Quantum Economics, said Bitcoin was not designed to increase in price, arguing that it was a side effect rather than its core purpose.

“Its primary use case is to provide a form of money independent of governments and banks,” Greenspan wrote in Monday’s X.

sauce: dead greenspan

Separately, Raul Pal, founder of Global Macro Investor, linked the economic downturn to tight liquidity conditions in the US rather than to factors specific to cryptocurrencies.

If Bitcoin falls below $65,000 this year, it could go against the expectations of major investment firms and banks.

Late last year, Grayscale Investments predicted that Bitcoin could surpass an all-time high of $126,000 by June 2026, citing institutional demand and clearer U.S. regulations.

Related: Bitcoin price may have had its ‘deepest pullback’ at $77,000: analyst

Standard Chartered and Bernstein had predicted that Bitcoin would reach $150,000 in 2026, but both companies had previously revised their higher targets amid slowing inflows into exchange-traded funds (ETFs).

The news comes as Polymarket faces a Nevada court order enjoining the event contract as unauthorized betting. Other states, including Tennessee, have recently targeted the platform with enforcement actions.

magazine: How will cryptocurrency law change in 2025 and how will it change in 2026?