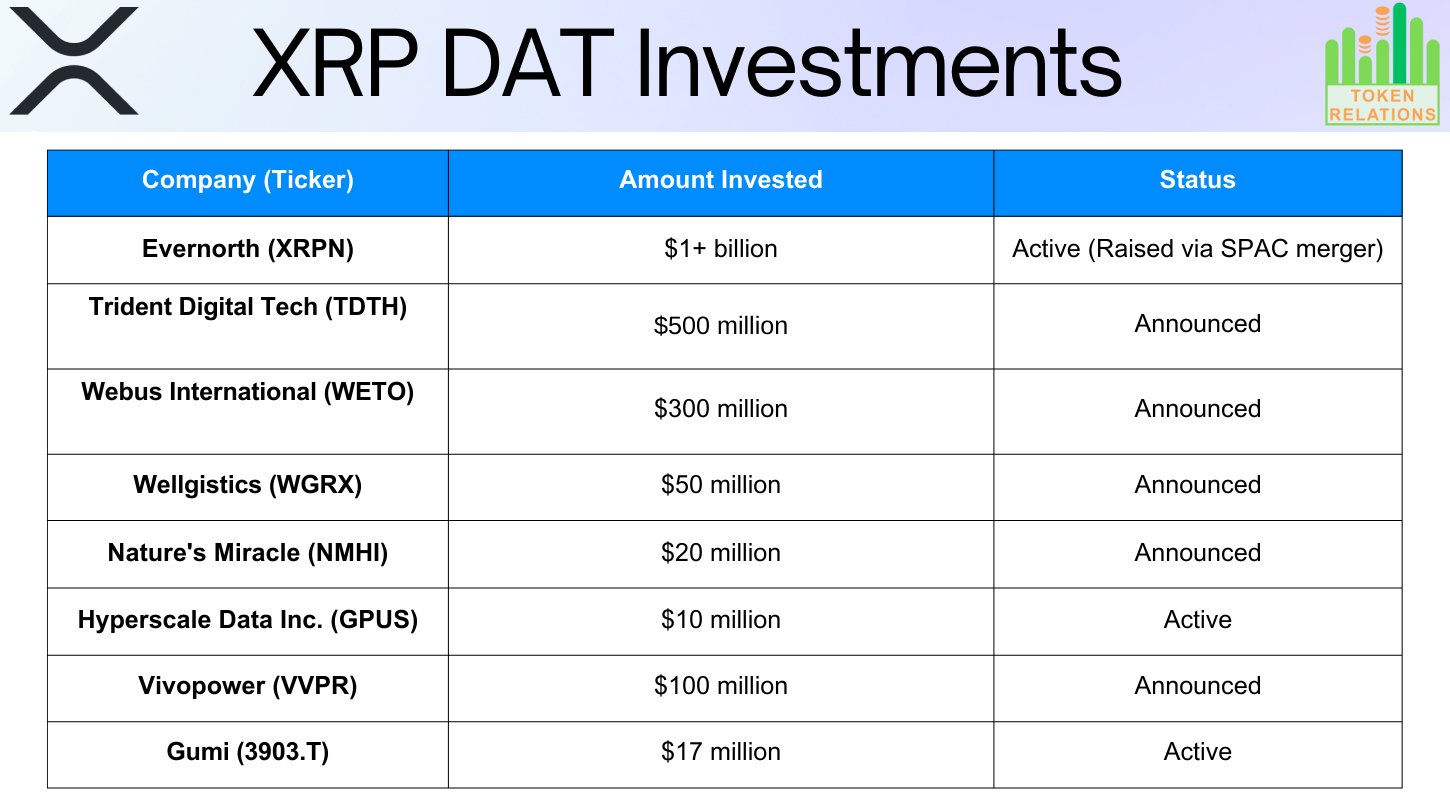

The number of listed companies is increasing. $XRP In line with our announced financial strategy, we have committed more than $2 billion ($2 billion) to our balance sheet.

At least eight publicly traded companies have disclosed, according to a breakdown shared by crypto educator X Finance Bull. $XRP National treasury allocation based on public application or official announcement. The data is cause We perform analysis on TokenRelations and compare its trends to MicroStrategy’s initial Bitcoin financial strategy. This time we will focus on the following points. $XRP.

Important points

- More than $2 billion invested across eight publicly traded companies

- Financial institutions are positioning themselves early on, ahead of regulatory clarity.

- $XRP May shift from payment instrument to treasury reserve asset

- Monitor market filings, timelines and balance sheet impact

$XRP From speculation to balance sheet

X Bull Finance claims this move signals a change in the view of financial institutions $XRPfrom short-term trading to long-term government bond assets. He emphasized that these companies are not private funds or venture capital firms, but are public companies spanning multiple industries, including healthcare, energy, gaming, technology, and agriculture.

In fact, some companies have already started deploying capital, and others have formally announced future capital allocations.

Largest allocation: Evernorth leads with more than $1 billion

largest reported $XRP The financial commitment comes from Evernorth (XRPN).

- Investment: More than $1 billion

- Status: Active due to SPAC merger

Evernorth has already raised funds and started deploying capital, making it the largest company, according to the report. $XRP Financial strategies revealed so far.

Commitments of $500 million to $300 million

Other companies are also making big decisions about their balance sheets. Trident Digital Tech (TDTH) revealed a $500 million investment, and Webus International (WETO) also announced a $300 million investment. $XRP.

These 9-digit assignments are $XRP It is considered on a large scale rather than as an experimental exposure.

Energy, healthcare and logistics participate

Not only high-tech companies but also traditional industries appear on the list

Vivopower (VVPR)

- Investment amount: $100 million

- Field: Sustainable Energy

Welgistics (WGRX)

- Investment amount: $50 million

- Sector: Healthcare Logistics

X Bull Finance pointed out that these are not crypto companies chasing short-term trends, but traditional companies making official decisions from the Treasury.

Small assignments increase industry diversity

Several more companies round out the reported list.

- Nature’s Miracle (NMHI) – $20 million (AgTech)

- Gummy (3903.T) – $17 million (Japanese gaming company Active Holdings)

- Hyperscale Data Inc. (GPUS) – $10 million (data infrastructure, active holdings)

Although small in size, the quota further expands the range of sectors and regions it employs. $XRP as a reserve asset.

$2 billion in total, spread across multiple sectors.

The report states that a total of more than $2 billion has been invested across the eight listed companies. X Bull Finance says financial institutions are taking positions early, ahead of clearer regulations and market conditions. This movement is $XRPprimarily from disbursement assets to Treasury reserves held by public companies.