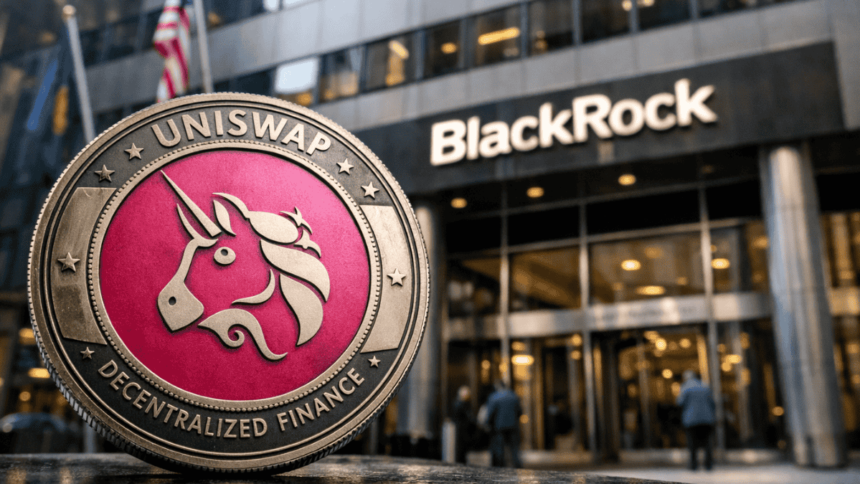

BlackRock, the world’s largest asset management company, has added its U.S. Treasury-backed BUIDL tokenized fund to the Uniswap decentralized platform, the largest decentralized exchange for Ethereum and other networks. As part of this strategy, the company will also invest in UNI, the governance token for the Uniswap protocol.

As reported by Fortune magazine on February 11, 2026, the move will be carried out in collaboration with tokenization company Securitize, making BUIDL digital assets available for institutional investors to trade in a smart contract environment.

The fund, which has a market capitalization of nearly $180 billion since its inception in 2024, aims to leverage automated market maker (AMM) infrastructure to optimize liquidity and asset settlement.

Despite the open nature of DeFi protocols, Access to this integration is restricted. Securitize introduced a “whitelist” to allow only eligible buyers (buyers with assets of $5 million or more) and authorized market makers such as Wintermute to participate.

CriptoNoticias can confirm that as of the publication of this article, the genuine BUIDL fund is not available to the public on Uniswap (although it is, in fact, available). There are several tokens with that name, but they have nothing to do with the original token.).

Robert Mitchnick, BlackRock’s global head of digital assets, noted that the agreement will foster interoperability between dollar-yielding funds and the crypto market.

On top of that, Fortune assured that “as part of the partnership, BlackRock will also purchase an undisclosed amount of UNI tokens from Uniswap.”

This novelty is Immediate impact on UNI pricesUniswap Governance Token, as shown in the following image.

UNI rose 22% on the day, reaching an intraday high of $4.28. The market will probably wait for official confirmation before making further investments in this digital currency.