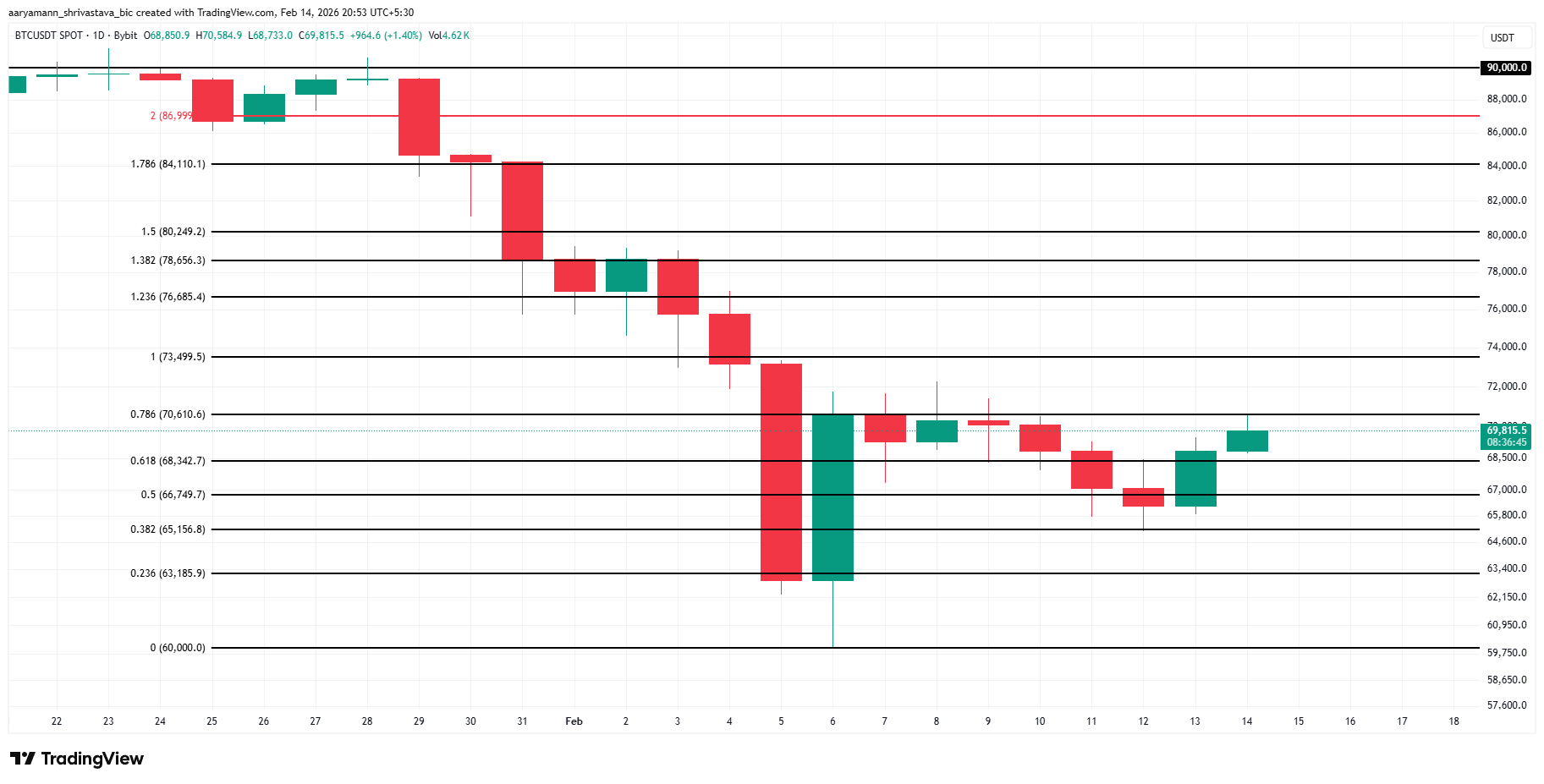

After weeks of volatility, Bitcoin prices are once again about to break out towards $70,000. $BTC At the time of publication, it was trading at $69,815, just below the resistance level of $70,610. The biggest cryptocurrencies are trying to recoup recent losses, but mixed on-chain and derivative signals make the near-term outlook uncertain.

Market participants are closely monitoring this psychological threshold. A sustained move above $70,000 could lead to a decisive shift in sentiment. However, sustained bearishness suggests that volatility may intensify before a clear trend emerges.

Bitcoin shorting is similar to the past

Aggregating funding rate data from major cryptocurrency exchanges reveals an extreme spike in short positions. Current negative funding levels are the deepest since August 2024. This period ended up being a significant trough for Bitcoin.

In August 2024, traders flocked to bet on the downside as funding rates plummeted. Instead of continuing to fall, Bitcoin reversed sharply. This reversal triggered widespread short-term liquidations and fueled a roughly 83% rally over the next four months.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Be careful of jumping when shorting Bitcoin. Source: Santiment

Significantly negative funding rates indicate strong bearish sentiment and widespread fear, uncertainty, and doubt (FUD). This setting does not guarantee a quick rise, but it does create a fragile structure. If prices rise, forced short covering can amplify volatility and accelerate upward momentum.

Bitcoin is on the verge of capitulation

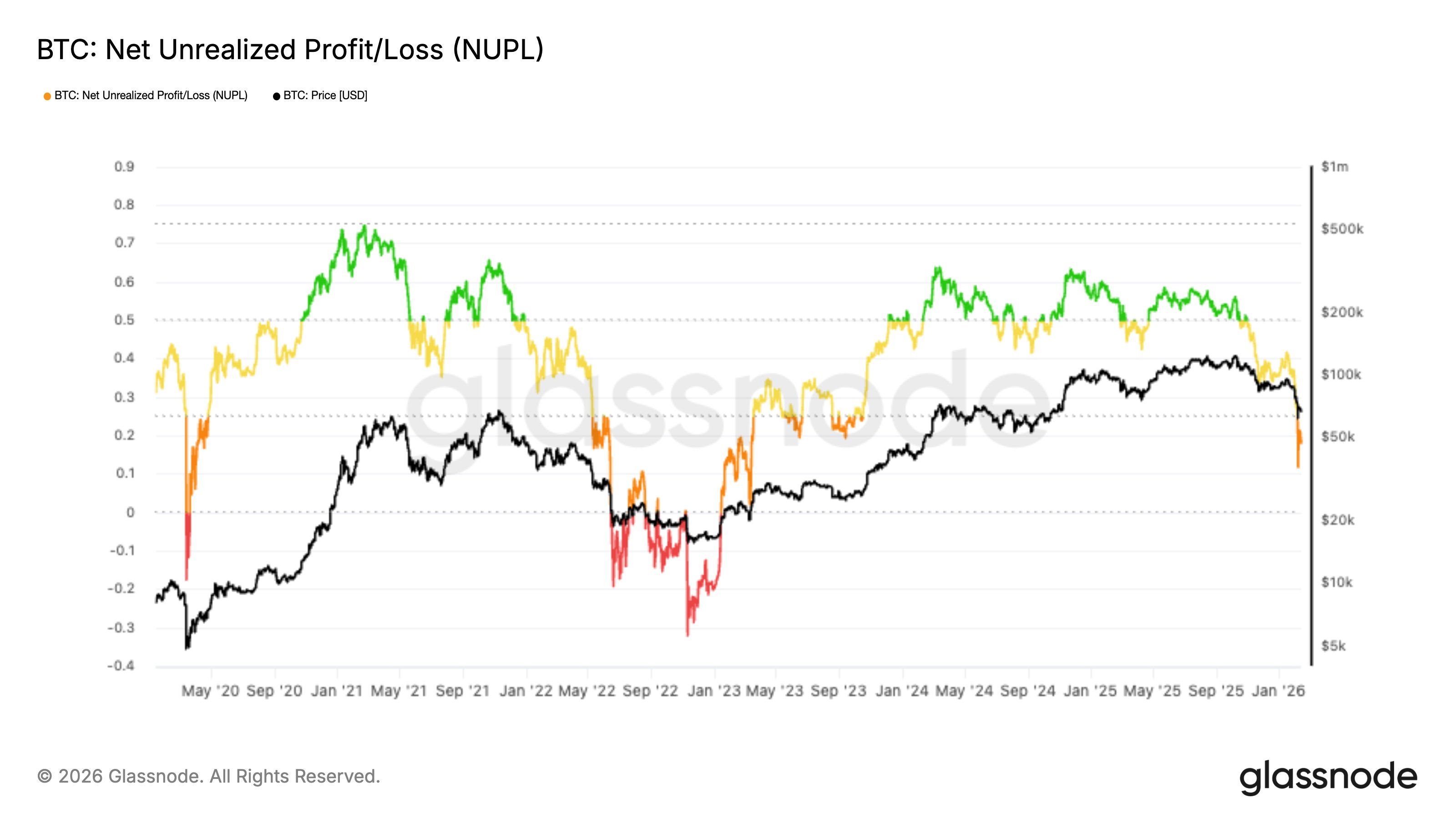

The Net Unrealized Gain/Loss (NUPL) indicator has returned to the hope/fear zone around 0.18. This number indicates a thin profit cushion among holders. When NUPL enters this regime, market behavior tends to become reactive.

Historically, decline into this zone often preceded a long period of decline. Panic selling usually intensifies before a durable bottom forms. Unless the capitulation resets sentiment, Bitcoin may remain vulnerable to further declines before stabilizing.

Bitcoin NUPL. Source: Glassnode

What is the short-term outlook?

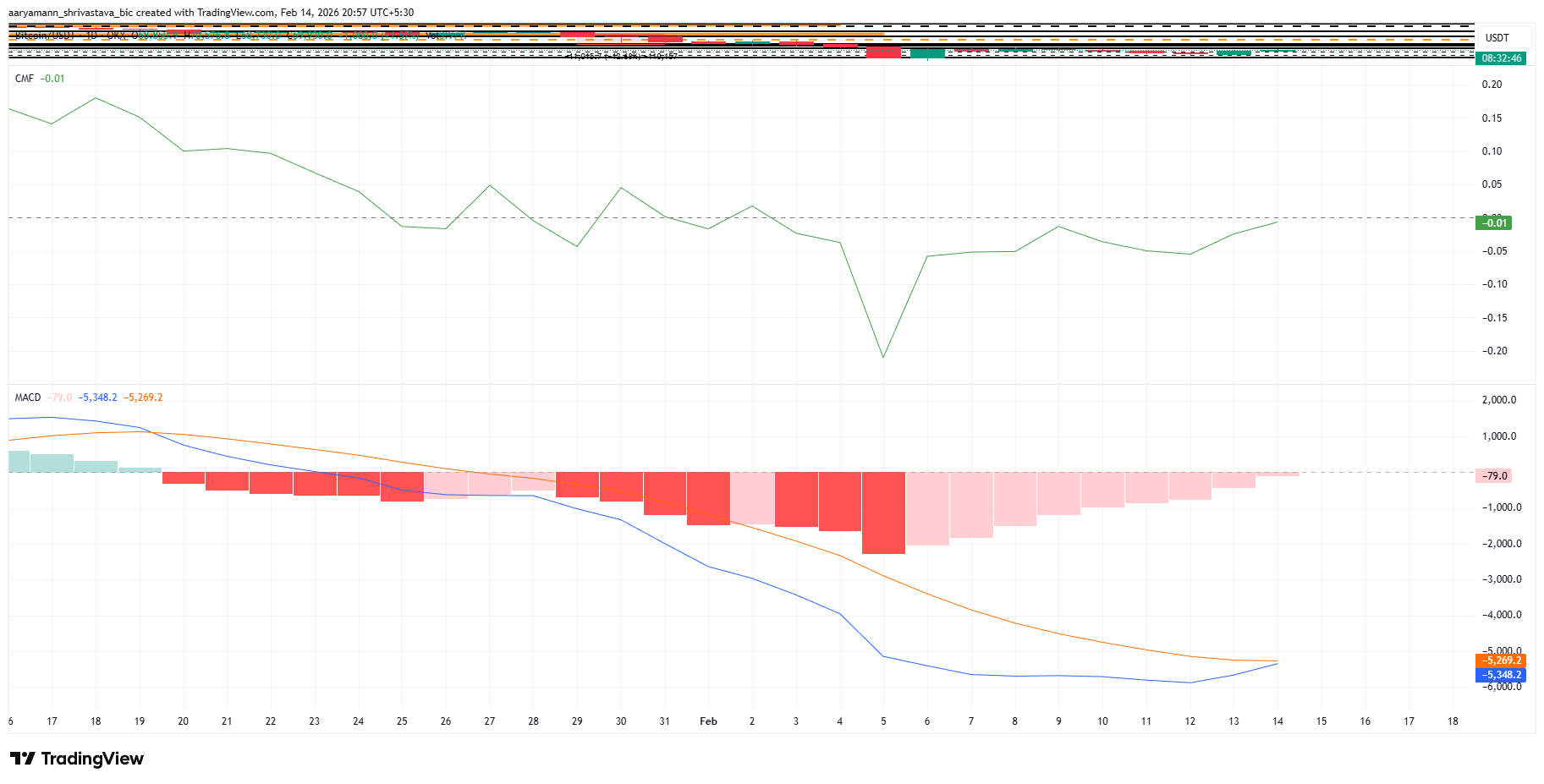

Short-term technical cues suggest improving momentum. Chaikin Money Flow, which measures capital inflows and outflows, is nearing the zero line. A rise into positive territory would indicate that demand for Bitcoin is once again on the rise.

At the same time, the moving average convergence-divergence indicator is approaching a bullish crossover. A confirmed crossover indicates a change in momentum from bearish to bullish. However, early signals need to be validated through sustained price strength.

Bitcoin netflow and market momentum. Source: TradingView

Although the indicators are improving, broad sentiment remains cautious. Under weak conditions the short is unlikely to close spontaneously. This dynamic increases the likelihood that a price-driven liquidation event will catalyze a recovery.

$BTC Prices need a strong push

Bitcoin is trading at $69,815, still below the $70,610 resistance. The $70,000 level represents a significant psychological barrier. A decisive close above this threshold could trigger new bullish momentum and attract new capital inflows.

However, bearish pressure continues in the derivatives market. Short-term contracts may continue to have an advantage $BTC Under $70,000. A break below the $65,156 support could trigger an extended liquidation and increase downside volatility.

Bitcoin price analysis. Source: TradingView

If Bitcoin secures strong investor support and overcomes selling pressure above $70,000, an upside target will emerge. The rally towards $73,499 could develop quickly.

Sustained strength could extend the rally towards $76,685, invalidating bearish theories and confirming a broader recovery attempt.

The post Bitcoin Short Reaches Most Extreme Level Since 2024 Bottom appeared first on BeInCrypto.