Prominent crypto venture capitalists are clashing online over whether non-financial use cases for cryptocurrencies, Web3, and blockchain have failed due to lack of investor demand and product-market fit, or whether the best days are still ahead for non-financial applications.

The debate began on Friday when Chris Dixon, managing partner at venture capital firm a16z Crypto, published an article claiming that years of “fraud, predatory practices, and regulatory attacks” are the reason why non-financial use cases for cryptocurrencies have not caught on.

These use cases include decentralized social media, digital identity management, decentralized media streaming platforms, digital rights platforms, Web3 video games, and more.

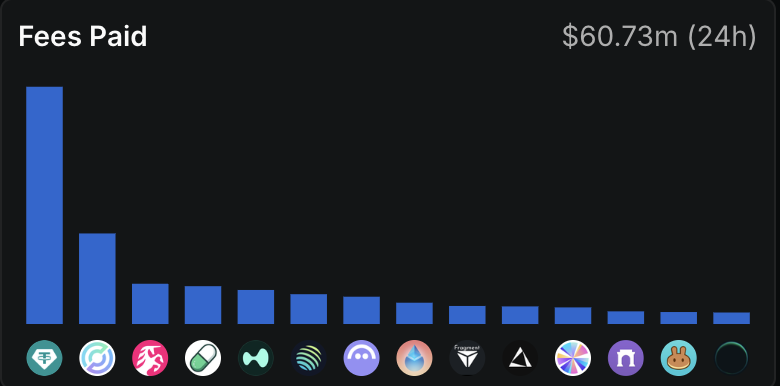

Over $60.7 million in fees were paid to cryptocurrency exchanges and decentralized finance applications in the past 24 hours. sauce: Defilama

“Non-financial uses of cryptocurrencies are failing because no one wants them,” Haseeb Kelesi, managing partner of crypto venture firm Dragonfly, said in a response on Sunday. He added:

“Let’s admit it. They were bad products. They failed market tests. The reason these products failed wasn’t Gensler or Sam Bankman Fried (SBF) or Terra. No one wanted it. To pretend otherwise is to cope.”

Dixon said that because funds in the a16z cryptocurrency are managed with a time horizon of at least 10 years, “building a new industry takes time.”

The top 10 crypto applications for fee generation and revenue are all financial use cases. sauce: Defilama

“In VC, you don’t have the luxury of ‘waiting for it to be right,'” Nick Carter, founding partner at venture firm Castle Island Ventures, said in a response to Kelesi. “We need to make the right decisions about the market during the two- to three-year fund deployment period,” he said.

The discussion follows a surge in VC investment in crypto projects in 2025, with most of it flowing into tokenized real-world assets (RWA), physical or traditional financial assets represented on-chain by digital tokens.

Related: Web3 revenue moves from blockchain to wallets and DeFi apps

Different approaches to portfolio construction

Dragonfly’s portfolio is built around financial use cases and blockchain infrastructure that help move value and risk through on-chain financial systems.

The company’s investments include the Agora stablecoin and payments platform, payments infrastructure provider Rain, synthetic dollar issuer Ethena, and Monad Layer 1 blockchain network.

As for a16z, its crypto portfolio includes many financial use cases such as Coinbase and decentralized crypto exchange Uniswap, but also features broader Web3 sectors such as community building, gaming, and media streaming.

These projects include community-building club Friends With Benefits, digital identity provider World, and Web3 gaming platform Yield Guild Games.

magazine: Web3 Games shuts down, Axie Infinity founder warns more games will ‘disappear’: Web3 Gamer