Bitcoin is once again testing investor confidence. After falling below $66,000 and causing long-term liquidations of approximately $177 million. $BTC It quickly rebounded above $69,000, forcing us to close out nearly $140 million in short positions. This sharp movement in both directions indicates that the market is driven more by leveraged trading than stable buying and selling.

At the time of this writing, Bitcoin is trading at around $68,752. However, the market mood remains weak. Bitcoin’s Fear and Greed Index has dropped to 9, indicating extreme fear. Even when prices appear to be stable, many traders are hesitant and unsure of their next move.

Major Bitcoin price levels to watch

Currently, price movements are concentrated in key support and resistance zones.

On the downside, the $63,000-$65,000 range is an important support area. If selling pressure increases, Bitcoin could revisit this zone. Anything below this could lead to further declines.

On the upside, strong resistance lies in the $69,000-$71,000 range. If buyers can push the price above this level and sustain it, Bitcoin could aim for higher levels. If not, the price may drop again before attempting another rally. Bitcoin has recently hovered between $65,000 and $73,000, according to data from Glassnode, but traders in the options market are predicting even bigger price moves soon. This suggests that the current peace may not last long.

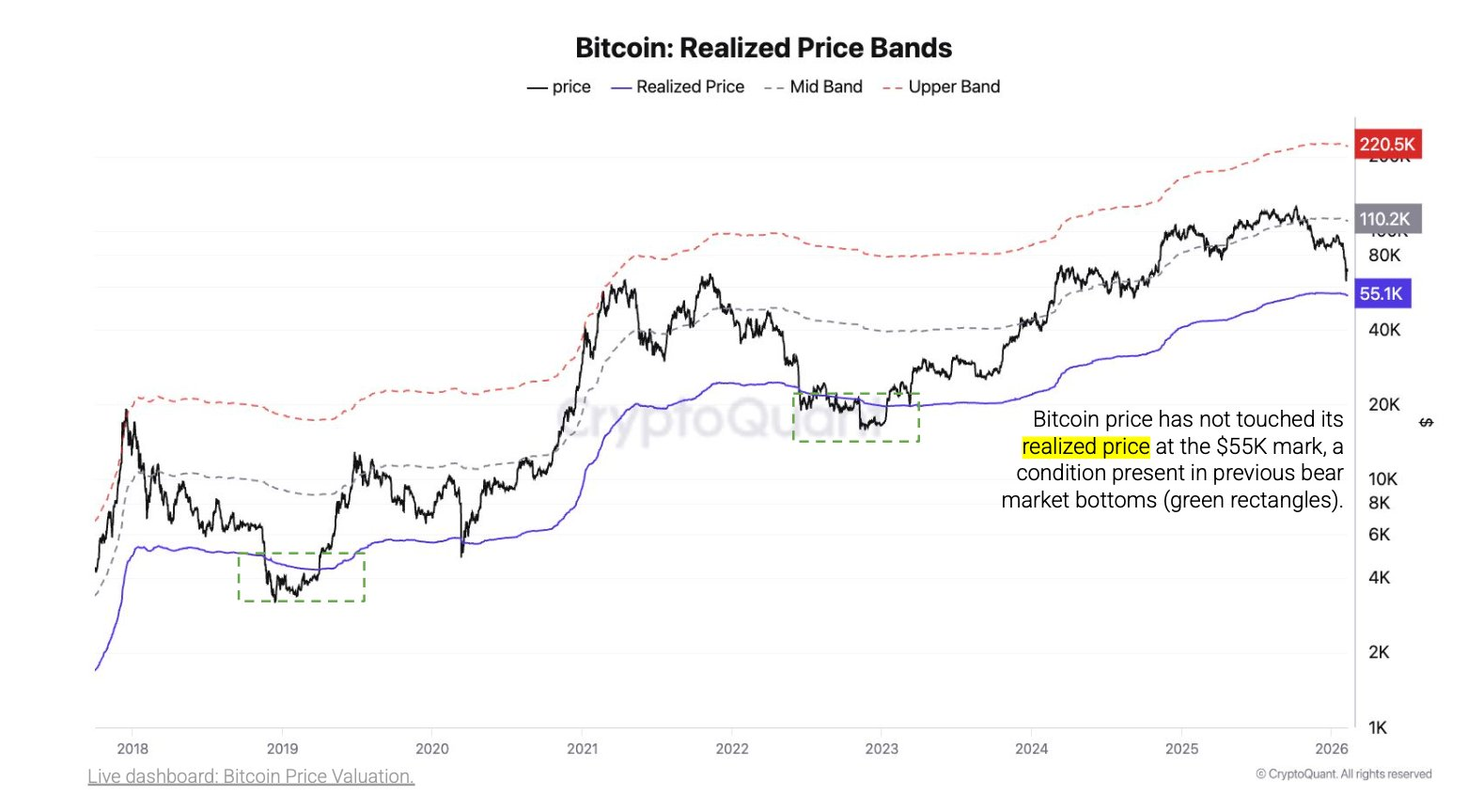

Why is $55,000 important for Bitcoin price?

According to CryptoQuant, the realized price of Bitcoin is close to $55,000. The realized price represents the average price a coin last moved on-chain. During previous bear markets, Bitcoin would often fall 24% to 30% below this level before forming a strong bottom.

For now, Bitcoin is still well above $55,000. This means that the market has not yet experienced full-blown panic selling. On-chain data also shows that more than half of the Bitcoin supply is still profitable. Long-term holders have not sold heavily, suggesting that the market has not reached a serious crisis point.

Historically, big bottoms are not formed by one sudden crash. This typically involves repeated testing of lateral movements and support levels over several months.

what happens next $BTC?

If selling pressure increases, Bitcoin could head towards the $55,000 level or even the low $50,000 level. On the other hand, confidence could gradually return if buyers push prices above $70,000 and sustain them.

For now, Bitcoin is still in a sensitive stage. Fear is rising, volatility is rising, and prices are hovering between major support and resistance levels. The coming months will probably determine whether this is the beginning of a deeper correction or the early stages of a recovery.