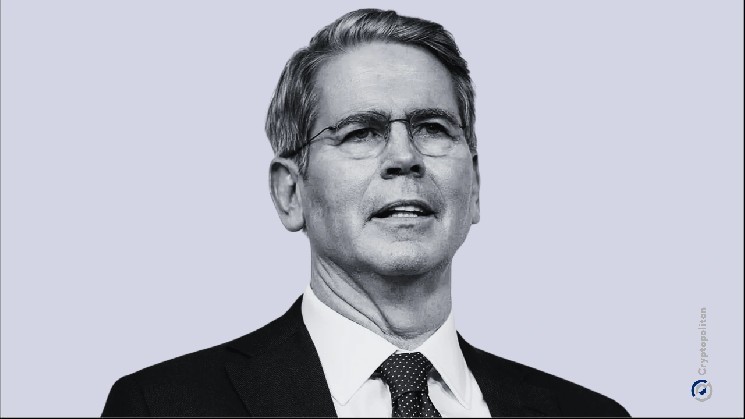

Gold prices collapsed last week after a record rally, which Scott Bessent blamed on reckless trading in China.

“The way gold is moving, things are getting a little bit out of hand in China. Margin requirements need to be tightened. So gold looks to me like a classic, speculative blowout,” Scott said live on FOX News’ Sunday Morning Futures.

This was his way of saying that the sudden rise and sudden fall had little to do with demand and everything to do with panic buying by leveraged traders.

The rally in precious metals was driven by fears of global conflict, loose speculation, and growing concerns about whether the Federal Reserve was still functioning freely. Then it fell apart.

Funds dried up as Chinese authorities raised margin requirements. Prices haven’t come down because of the economy. It fell as Chinese regulators put the brakes on overreaching traders.

Scott urges Senate to open hearing despite Powell investigation

While traders were taking a big hit in the gold market, Scott was also dealing with political conflicts in Washington. He said the Senate should begin moving toward confirmation hearings for Kevin Warsh, President Donald Trump’s nominee to the Federal Reserve Board.

Kevin was named to replace Jerome Powell on January 30, but the process has been blocked.

North Carolina Sen. Thom Tillis is behind the delay. He said he would not allow any of Trump’s Fed nominations to pass until the Justice Department concludes its criminal investigation into Powell.

The lawsuit concerns comments Mr. Powell made to Congress last year about the cost of renovating the Fed’s headquarters. Mr. Tillis said he was a witness and claimed it was a threat to the Fed’s independence.

Still, Scott reminded everyone that Tillis also called Kevin a strong candidate. “Senator Tillis came forward and said he thought Kevin Warsh was a very strong candidate,” Scott said. “So what I would say is, let’s get the hearings started and see where the Jeanine Pirro investigation goes.” Pirro is the U.S. attorney handling the case in Washington, D.C.

Scott outlines Fed policy, relationship with Japan, and Trump economy

Scott also talked about how the Federal Reserve is handling its huge balance sheet. He said he did not expect sudden cuts.

“I don’t expect them to do anything right away,” he said. “They’re moving towards deep-pocketed regime policy, which requires a bigger balance sheet, so I think they’re probably going to sit back and take at least a year to decide what they want to do.”

Regarding Kevin Warsh’s independence, Scott said Kevin “will be very independent, but mindful of the Fed’s responsibility to the American people.” He also said it would be up to the president to decide whether to sue Kevin if he doesn’t cut rates the way Trump wants.

Outside of the Fed turmoil, Scott congratulated Japanese Prime Minister Sanae Takaichi’s coalition government on its election victory.

“She’s a great ally and great relationship with the president,” Scott said. He added that Japan’s strength supports America’s Asia strategy, especially now that Donald Trump is back in the White House.

Asked about the economic situation, Scott said:

“President Trump’s economy is delivering real results for Americans. His policies are driving strong growth, reducing inflation, and driving the stock market to historic highs, while achieving the lowest crime rate in more than 100 years.”

Scott added that in 2025, President Trump laid the foundation for strong job growth and income growth in 2026.

“The stock market lives in the future, and its historic performance is a signal from Wall Street that Main Street will soon reap the benefits of the president’s economic policies,” Scott said.