Prime Minister Sanae Takaichi, also known as Japan’s “Iron Lady,” secured a historic landslide victory in the snap general election on February 8, 2026. The Liberal Democratic Party (LDP), which he leads, is expected to win between 274 and 326 of the 465 seats in the House of Representatives, marking the largest electoral margin of any party in Japan since the war.

This decisive result strengthens Takaichi’s authority and positions him to pursue ambitious economic and regulatory reforms.

Japan’s Sanae Takaichi secures landslide victory, setting the stage for crypto tax reform

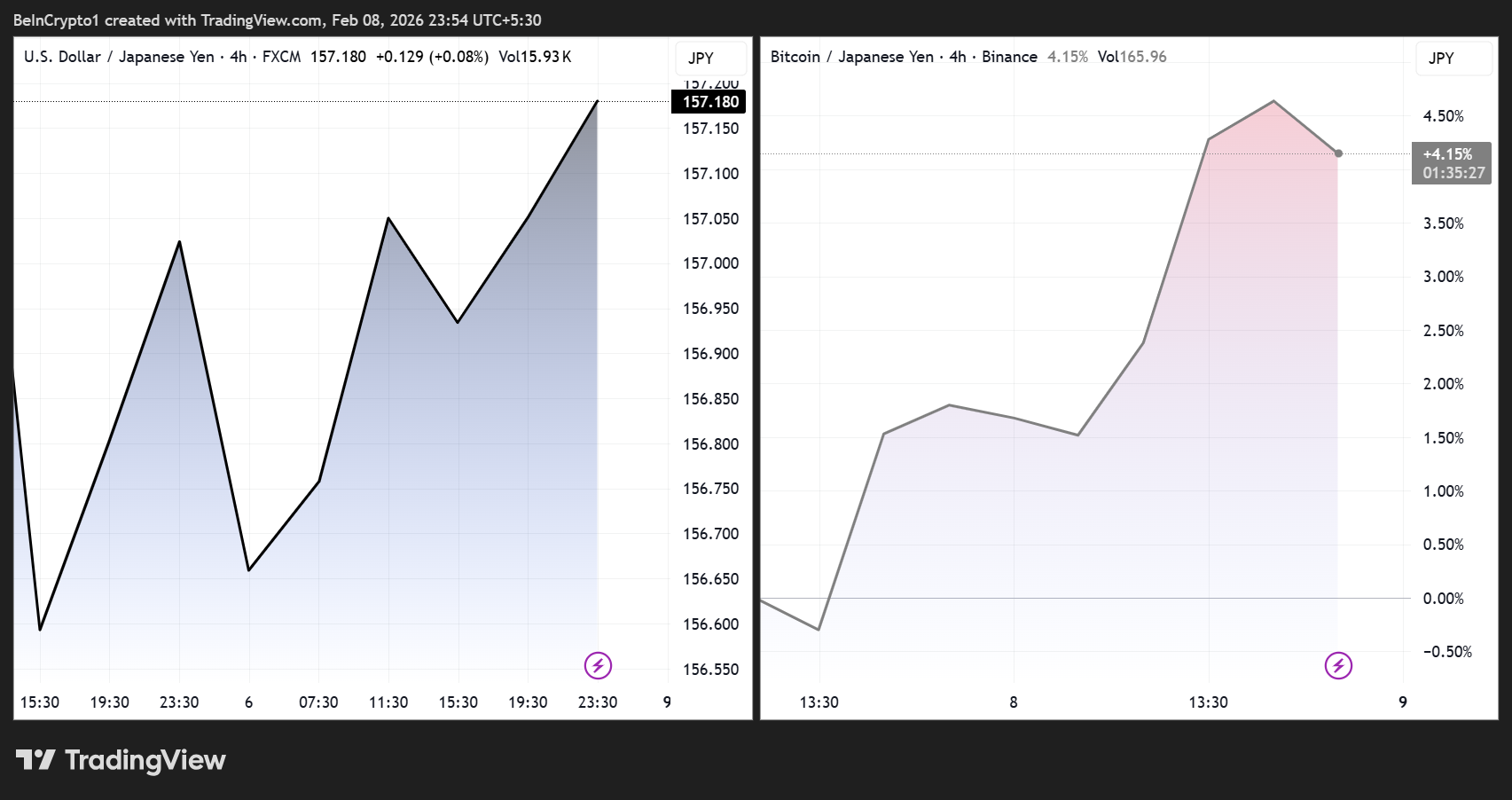

The market reacted quickly to this result. The dollar/yen pair rose 0.2% to 157 yen. $BTCThe /JPY trading pair rose nearly 5%, showing investors’ confidence in Takaichi’s pro-growth policies.

$BTC/JPY price performance”>

$BTC/JPY price performance”>

USD/JPY and $BTC/ Yen price performance. Source: TradingView

This so-called “high market trade” derives its momentum from fiscal stimulus, easy monetary policy, and hopes for increased liquidity.

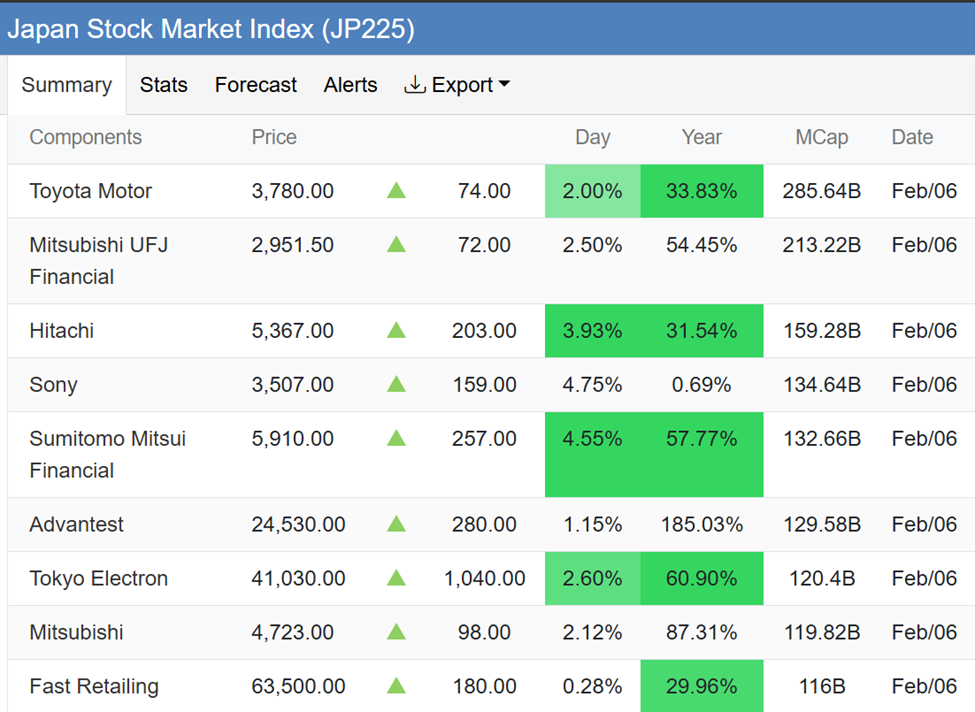

This has already pushed Japanese stocks to record highs, but government bonds and the yen are under pressure.

Performance of Japanese stocks. Source: Trade Economics

U.S. officials were quick to assess the results, with Treasury Secretary Scott Bessent calling the victory “historic” and highlighting the strength of the U.S.-Japan relationship under Takaichi’s leadership.

@takaichi_sanae I would like to offer my heartfelt congratulations to the Prime Minister on his historic victory, securing the largest electoral margin in Japan’s postwar history.

As @POTUS said, she has no intention of letting the Japanese people down.

When Japan is strong, the US is also strong in Asia, and… pic.twitter.com/v7KHHflAkH

— Treasury Secretary Scott Bessent (@SecScottBessent) February 8, 2026

A few days ago, President Donald Trump also expressed his full support, highlighting her leadership qualities and recent trade and security successes.

In response, Mr. Takaichi expressed his gratitude and reaffirmed his plans to visit the White House in the spring of 2026, stating that the Japan-U.S. alliance has “unlimited possibilities” built on deep trust and cooperation.

I would like to express my sincere gratitude to President Donald J. Trump for his kind words.

I look forward to visiting the White House this spring and continuing to work together to further strengthen the Japan-U.S. alliance.

Our alliance and friendship with the United States… pic.twitter.com/EKeowvyeDo— Sanae Takaichi (@takaichi_sanae) February 8, 2026

Mr. Takaichi’s mission suggests the possibility of reviewing virtual currency taxes and creating blockchain-friendly policies.

Takaichi’s electoral mandate is widely seen as a green light to accelerate Japan’s cryptocurrency reform. The country currently taxes virtual currency profits as miscellaneous income at a rate of up to 55%.

Despite Japan being a leader in blockchain adoption, this framework has driven some investors overseas.

The following reforms are being discussed for 2026.

- Lower profits tax to around 20%

- Allowing loss carry forward for 3 years,

Reclassify certain digital assets as financial instruments.

The general feeling is that her pro-growth policies and willingness to work with crypto-friendly opposition parties such as the Japan Restoration Party and the Democratic Party of Japan may finally push these long-awaited policies by 2028.

Early in his tenure, Takaichi championed policies that support technology, innovation, and economic security, in conjunction with broader blockchain and Web3 developments.

Although she has not made cryptocurrencies a central issue in her campaign, her aggressive fiscal stance, modeled after her mentor Shinzo Abe’s Abenomics, could create a favorable economic environment for risky assets such as Bitcoin, Ethereum, and Japan-linked digital projects.

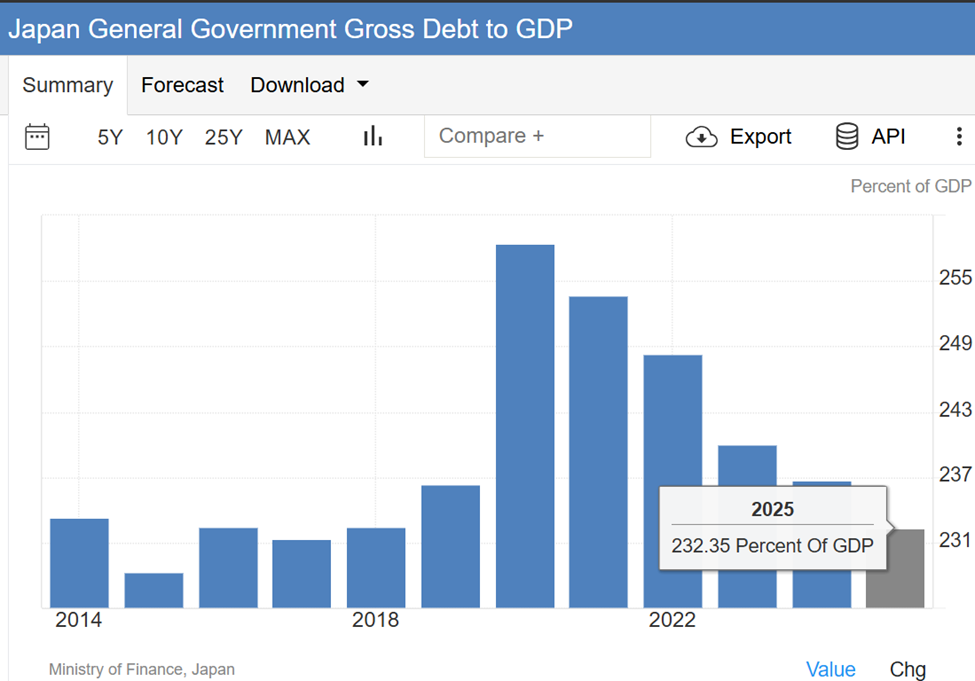

“Takaichi has pledged an aggressive fiscal policy, primarily financed by bond issuance… With investors still worried about Japan’s large debt burden and the recent spike across the bond yield curve, will Takaichi’s election momentum support even more massive stimulus, or will it give her political cover to proceed more cautiously?” asked Rob Wallace.

Uncertainty certainly remains. Japan’s national debt will peak at 232.35% in 2025, exceeding 250% of GDP. Meanwhile, a recent spike in government bond yields has heightened investors’ concerns about fiscal sustainability.

Japan’s general government total debt to GDP. Source: Trade Economics

Key ministerial appointments and regulatory priorities will be critical in shaping the pace and scope of cryptocurrency reform. Finance Minister Katsunobu Kato’s continued role may maintain policy continuity, but his limited involvement in crypto issues may dampen ambitious changes.

Digital Minister Masaki Taira has not yet clarified his specific position regarding cryptocurrencies and Web3.

Nevertheless, the Financial Services Agency’s ongoing proposals, coupled with Takaichi’s strong political mandate, signal a turning point for Japan’s digital asset sector.

Successful reforms could result in a clearer regulatory framework, tax cuts, and legal recognition of cryptocurrencies, laying the foundations for a more innovation-friendly ecosystem.

The post Market and Crypto Eye policy reforms come as Japan’s Sanae Takaichi scores historic victory appeared first on BeInCrypto.