TL;DR

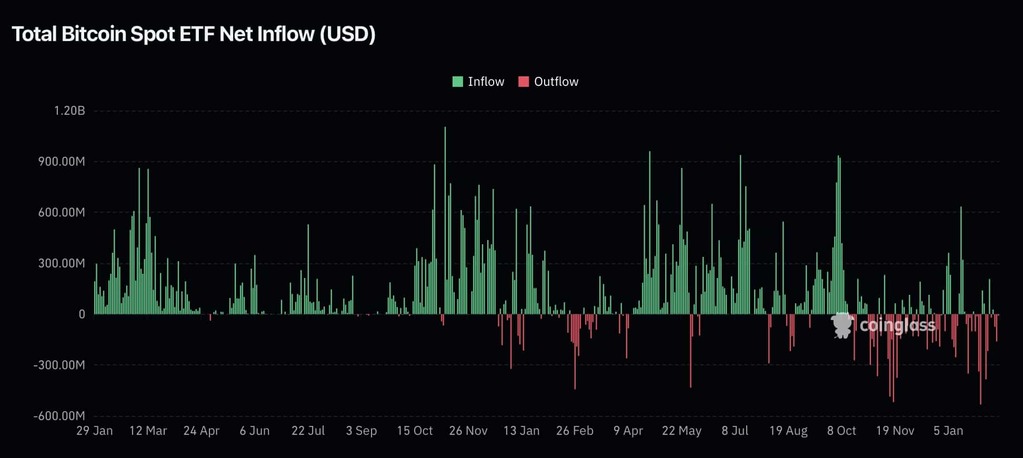

- Bitcoin fell 25% for the month to $69,000 as crypto ETFs faced $5.8 billion in outflows.

- BlackRock’s IBIT lost $2.8 billion in the quarter, compared with previous inflows of $21 billion.

- Matt Hogan points out that financial advisors are holding positions. The selling is coming from hedge funds.

Bitcoin record a decrease of more than 25% compared to last monthwhile cryptocurrencies Exchange Traded Fund (ETF) Experiencing a huge outflow of institutional capital. Current prices are subject to change $69,000well below its all-time high. $126,000 It arrived in October of last year.

black rock iShares Bitcoin Trust (IBIT) The cumulative net outflow amount is approximately $2.8 billion last quarter. However, this diagram is approximately $21 billion net inflow Recorded during the previous year. Spot ETFs generally reflect the same trend and are close to exit. $5.8 billion in 3 months.

Matt Hogan, chief investment officer at Bitwise Asset Management, said the selling pressure is primarily coming from short-term traders and hedge funds. Administration officials say financial advisers are holding positions despite market volatility.

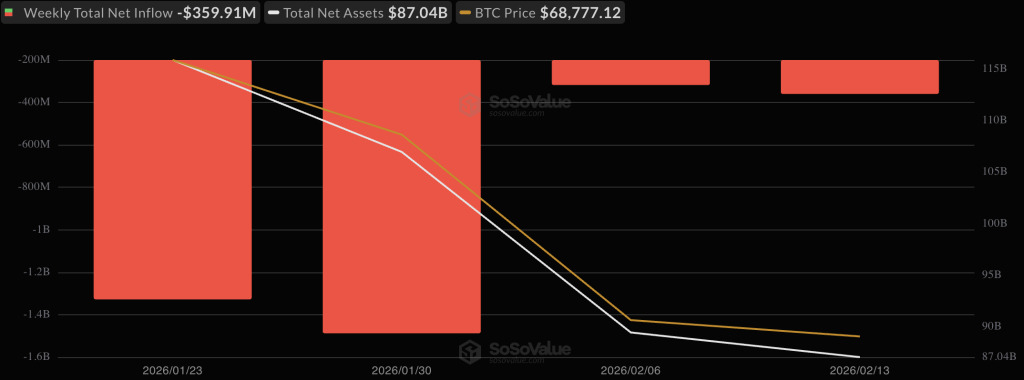

According to Amber Data data, cumulative flow in 2026 entered negative territory for the first time since the product was launched. In early February, net outflows from crypto products were recorded. $1.7 billionindicating a pause in the constant accumulation regime.

The week of February 9th to 13th shows a divergence in assets.

The entire second week of February saw mixed performance among the various crypto ETFs. Spot Bitcoin ETF closed with net outflows of $359.91 millionmeanwhile Ethereum lost $161.15 million.

BlackRock IBIT endured sustained pressure throughout the week. Fund registered $20.85 million leaked on Monday, February 9thfollowed by $73.41 million on Wednesday, Thursday $157.56 millionand one more $9.36 million on Friday.. Tuesday’s $26.53 million inflow barely offset the loss, leaving the balance about $26.53 million negative. $234 million weekly.

Fidelity FBTC It started with an inflow of $3.08 million, then skyrocketed mid-week with $92.6 million and a loss of $104.13 million. On Friday, $11.99 million was recovered, with the following results: Net loss of $124 million. Grayscale GBTC ended with $77 million negativeOn the other hand, ARKB and 21 Shares’ ARKB almost lost. $19 million.

Updated on February 16th: #Bitcoin ETF:

1D NetFlow: -1,444 $BTC(-$98.86 million)🔴

7D Netflow: -5,555 $BTC(-$380.44M)🔴#Ethereum ETF:

1D NetFlow: -22,492 $ETH(-$44.42 million)🔴

7D Netflow: -91,151 $ETH(-$180.02M)🔴#Solana ETF:

1D Netflow: +27,729 $SOL(+$2.34 million)🟢

7D NetFlow: +148,057… pic.twitter.com/K6h747Gg6L— Lookonchain (@lookonchain) February 16, 2026

According to the data on February 16th, 1,444 $BTC equivalent to $98.86 million and 22,492 $ETH worth it $44.42 million In just one day. in contrast, Solana recorded 27,729 inflows $SOL or $2.34 million every day and 148,057 $SOL or $12.51 million Over 7 days.

This divergence reflects institutional rotation from established assets such as Bitcoin and Ethereum to altcoins. Solana attracts institutional investors thanks to its scalability and adoption in decentralized finance.

black rock ETHA leads Ethereum losses If the cumulative redemption amount exceeds $112 millionwhile Fidelity’s FETH fell off roughly $40 million Over multiple sessions. Grayscale’s Ether Mini Trust received $49.9 million in inflows, providing limited offset.

The total amount held is 1.26 million $BTC, 5.71 million $ETHand 8.72 million $SOLhighlighting the maturity of the Solana ETF with major inflows into Bitwise.