As Bitcoin ($BTC) is trading approximately 50% below its all-time high, investors are once again asking the common question: “How long does a recovery typically take?” Market analyst Sam Daodu believes history provides valuable clues.

Will Bitcoin as a whole not collapse this time?

Doto memo Sharp corrections are not uncommon for Bitcoin. Since 2011, cryptocurrencies have endured more than 20 declines of more than 40%. Mid-cycle declines in the 35% to 50% range often defuse overheated bull markets without permanently derailing the long-term uptrend.

In situations where there was no systemic collapse in the broader market, Bitcoin typically regained its previous high in about 14 months. He contrasts the current environment with 2022, when multiple structural flaws shook the crypto industry.

There is currently no comparable system-wide collapse. Analysts emphasized that $BTCrealized priceCurrently near $55,000, long-term holders have historically accumulated the coin around that level, potentially providing a psychological and technical lower bound.

Whether the current recession develops into a prolonged recession or a shorter-term reset will largely depend on global liquidity conditions and investor sentiment, Daodu suggested.

Looking back at the historic stock market decline

During the 2021-2022 cycle, Bitcoin peaked at $69,000 in November 2021 and fell 77% to $15,500 a year later. This economic downturn coincided with monetary tightening by the US Federal Reserve, paralleling the collapse of the Terra (Luna) ecosystem. FTX bankruptcy.

It ultimately took 28 months for Bitcoin to surpass its previous high set in March 2024. At the bottom of the market, long-term holders controlled about 60% of the circulating supply and were absorbing coins from forced sellers.

The 2020 coronavirus disease (COVID-19) crash unfolded in a completely different way. In March of the same year, Bitcoin plummeted by about 58%, falling from about $9,100 to $3,800 as global lockdowns caused a liquidity shock.

Bitcoin rebounded quickly. Within six weeks, it was back to the $10,000 level, and by December 2020, about nine months after the bottom, it had regained its 2017 high of $20,000. It eventually soared to $69,000 in November 2021, but that happened about 21 months after the crash.

The 2018 bear market presents yet another contrast. Bitcoin, which reached $20,000 in December 2017, had fallen 84% to $3,200 by December 2018. Initial coin offering The (ICO) boom, coupled with regulatory crackdowns and limited institutional participation, has drained the market of speculative energy.

Active addresses fell by 70%, and miners were forced to capitulate as revenues dwindled. Without significant new capital or a compelling growth story, it took Bitcoin nearly three years to return to its previous peak.

not yet surrendered

The depth of the drawdown itself plays an important role. Historically, corrections in the 40% to 50% range took approximately nine to 14 months to recover, while collapses of more than 80% took more than three years.

Bitcoin is currently down about 50% from its peak, and this decline falls into what Daodu calls the “moderate to severe category”, which is significant but not indicative. complete surrender.

He estimates, based on past events of similar magnitude, that it could take more than 12 months to return to historic highs, and that macroeconomic conditions will ultimately determine the speed of that recovery.

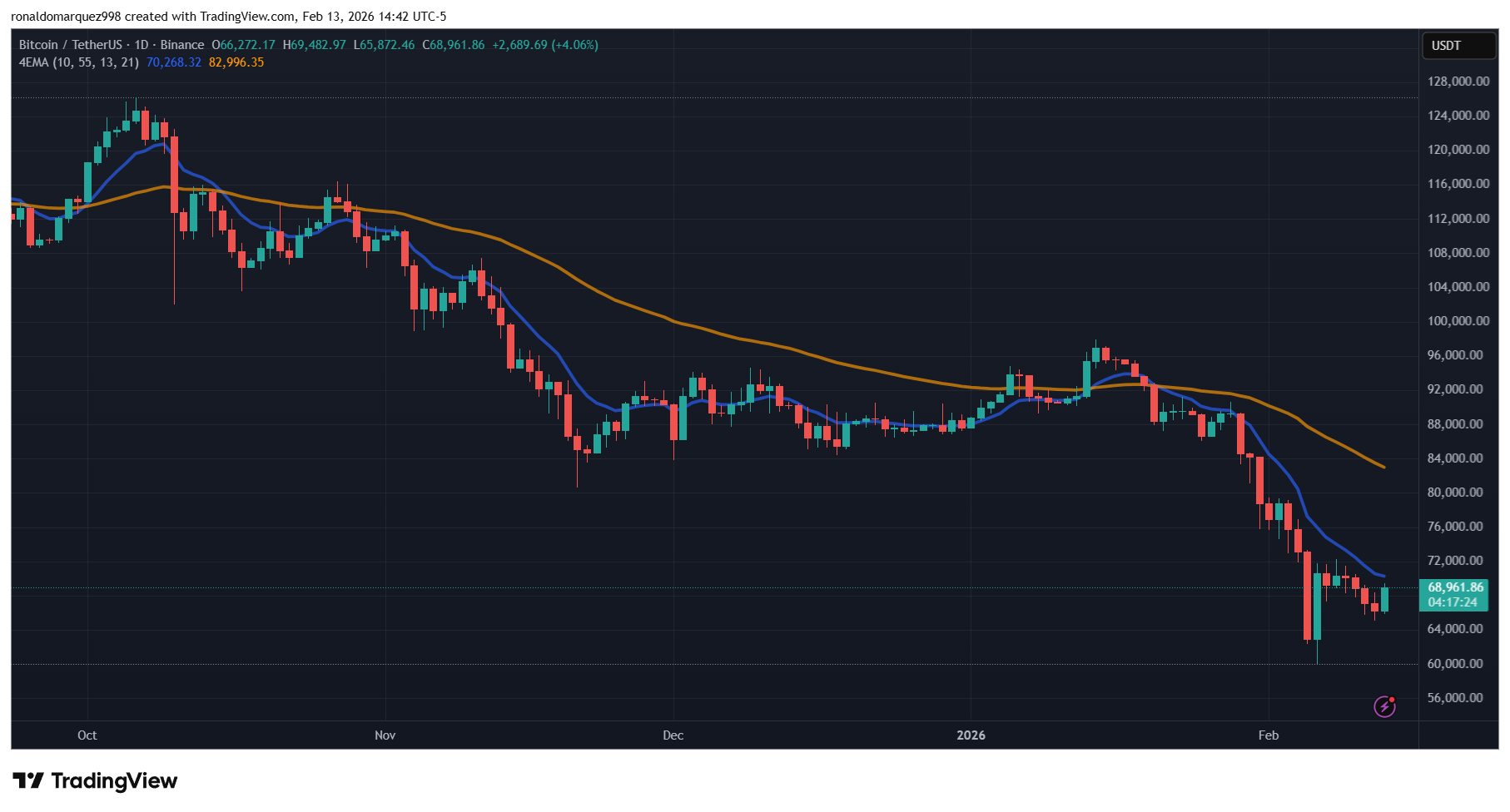

At the time of writing, $BTC is trading at $68,960 and has rebounded slightly on Friday, rising 5% to break above the short-term resistance barrier at $70,000.

Featured image from OpenArt, chart from TradingView.com