Peter Schiff, an economist and longtime Bitcoin critic, warned that if Bitcoin loses key support near $50,000, it could crash to $20,000.

The remarks come amid heightened geopolitical tensions following reports that the US military is preparing attack options against Iran.

If Bitcoin breaks through $50,000, which seems likely, it seems very likely that it will at least try $20,000. This is an 84% drop from ATH. I know Bitcoin has done this before, but never with so much hype, leverage, institutional ownership, and market capitalization at stake. Sell your Bitcoin now!

— Peter Schiff (@PeterSchiff) February 19, 2026

Peter Schiff’s anti-Bitcoin perception is stronger than ever

Schiff argued that it is now likely to drop below $50,000, potentially triggering an even deeper decline. He suggested that despite increasing institutional adoption and broader mainstream interest, Bitcoin could repeat the historic crash pattern seen in past cycles.

His warning comes as Bitcoin has fallen sharply from recent cycle highs and is trading near $66,000.

Schiff has been one of Bitcoin’s most consistent skeptics for more than a decade. He repeatedly described Bitcoin as a speculative bubble and argued that it has no intrinsic value.

Peter Schiff criticizes Bitcoin with X

Throughout previous bull markets, he predicted massive crashes while continuing to tout gold as a great store of value.

However, Bitcoin has also repeatedly recovered from severe corrections and reached new highs over time.

His latest warning comes at a vulnerable time for the crypto market. Global risk sentiment has weakened due to concerns about possible military action by the United States against Iran.

Historically, Bitcoin often falls during the early stages of geopolitical shocks as investors reduce their exposure to volatile assets.

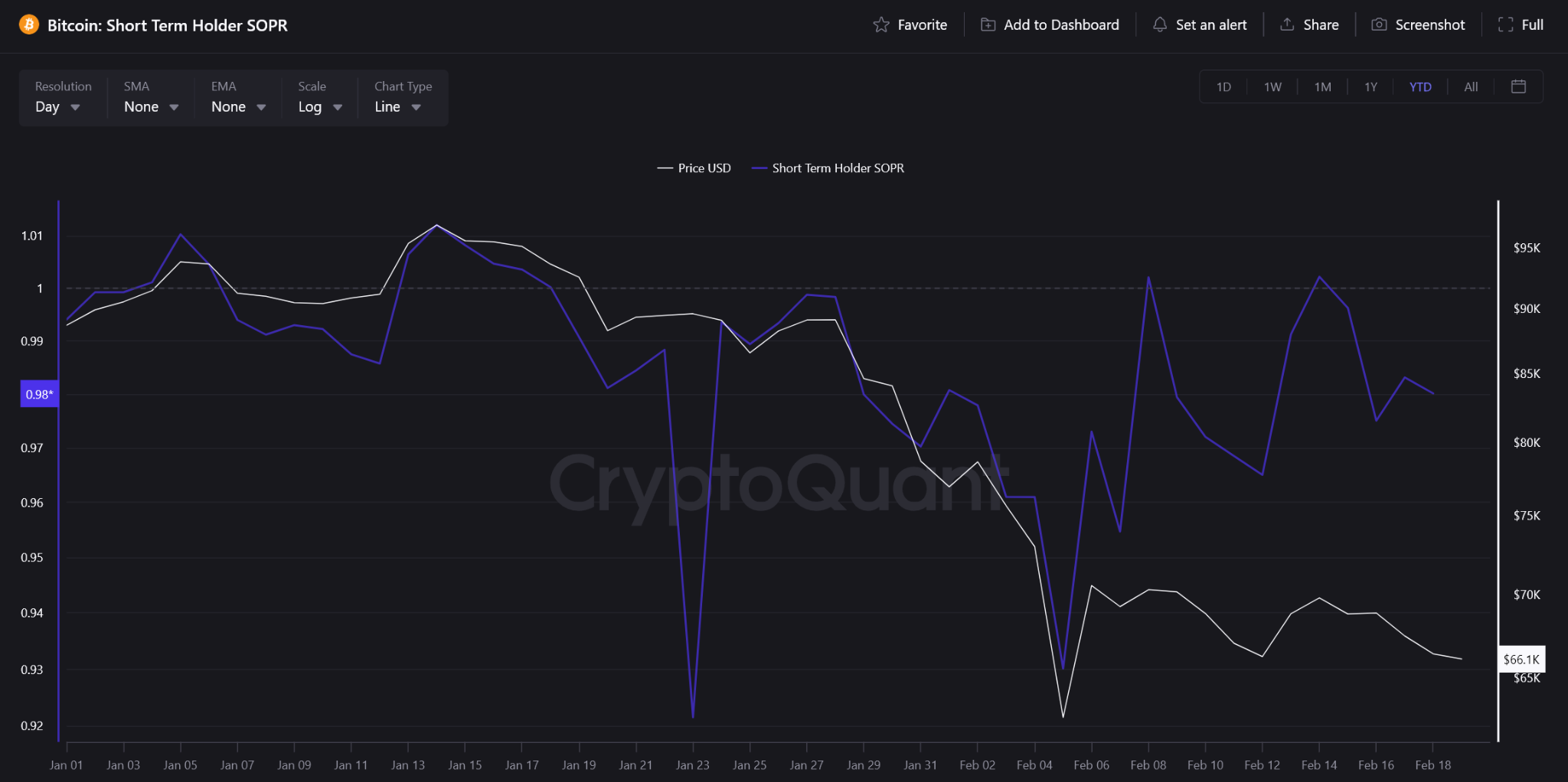

On-chain data supports the view that weakness is still likely in the short term. The SOPR indicator for short-term holders is currently below 1, indicating that recent buyers are selling at a loss.

This reflects fear and continued capitulation among weak investors.

According to the SOPR (expended production return) chart, short-term Bitcoin investors are selling at a loss. Source: CryptoQuant

At the same time, other important metrics tell a different story. Bitcoin’s short-term Sharpe ratio has fallen to extremely negative levels.

This suggests that Bitcoin is already experiencing abnormally low returns relative to its volatility.

In past cycles, such conditions often appeared near local troughs rather than at the beginning of a long-term collapse.

Bitcoin’s short-term Sharpe ratio reaches a level historically designated as a generational buy zone

“The arrows in the chart clearly show this. Previous extremely negative readings were followed by violent recoveries to new highs.” – via @MorenoDV_ pic.twitter.com/nxFBUgHxi9

— CryptoQuant.com (@cryptoquant_com) February 19, 2026

This creates a mixed outlook. Geopolitical stress and weak sentiment could cause Bitcoin to fall in the short term, but much of the speculative excess appears to have been washed away.

While Schiff’s prediction reflects heightened uncertainty, on-chain data suggests the market may be closer to a reset phase than the beginning of a full-blown collapse.

Peter Schiff warns that Bitcoin could crash to $20,000 – is it possible? The post appeared first on BeInCrypto.