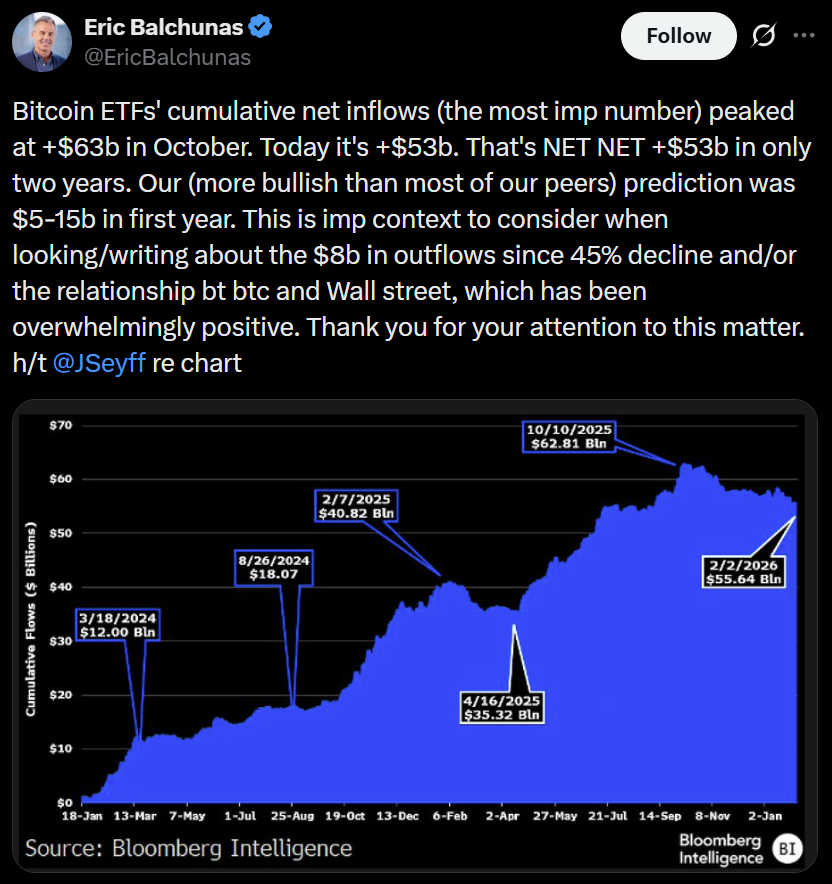

U.S. spot Bitcoin exchange-traded funds (ETFs) may have seen large outflows recently, but the broader picture is a different story.

Cumulative net inflows into Bitcoin (BTC) ETFs peaked at $63 billion in October and now stand at about $53 billion, even after months of redemptions, according to Bloomberg ETF analyst Eric Balchunas.

“NET NET +$53 billion in just two years,” Balchunas wrote on X, sharing data compiled by fellow analyst James Seyffart.

The figure far exceeds earlier estimates from Bloomberg, which had called for inflows of $5 billion to $15 billion over that period.

In other words, the recent exit hasn’t erased a larger success story. Even though Bitcoin has fallen about 50% from its highs, institutional money has not fled at the same pace, suggesting that many investors are holding for the long term rather than panic selling.

sauce: Eric Balchunas

The US Spot Bitcoin ETF was approved in early 2024 and quickly became a dominant force in the market. Bitcoin continued to hit all-time highs ahead of the April 2024 halving event, bucking historical trends, and ETF accumulation accelerated into 2025, peaking in October when the price soared above $126,000.

These launches are widely considered to be among the most successful in U.S. ETF history. In particular, BlackRock’s iShares Bitcoin Trust became the fastest ETF in history to surpass $70 billion in assets, reaching that milestone in less than a year.

Related: BlackRock predicts record quarter for iShares ETF as demand for Bitcoin and Ether soars

Bitcoin faces uncertain 2026 as cycle debate heats up

Indeed, 2026 is shaping up to be a difficult year for Bitcoin and the broader digital asset market. It fell again in late January and early February, with the largest cryptocurrency dropping to around $60,000.

Investor sentiment remains fragile, with some analysts arguing that Bitcoin’s recent bull run, which coincides with its historic four-year cycle, may have run its course.

Some argue that this cycle is simply evolving. They argue that longer economic cycles and changing macro conditions could extend Bitcoin’s traditional rhythm rather than end it.

Bitwise analysts Matt Hogan and Ryan Rasmussen go further, suggesting that Bitcoin may be completely breaking out of its long-standing four-year pattern due to the increasing influence of institutional capital.

“The wave of institutional capital that began entering the space in 2024 is likely to accelerate in 2026,” the analysts said, pointing to greater access to major wealth platforms such as Morgan Stanley and Merrill Lynch.

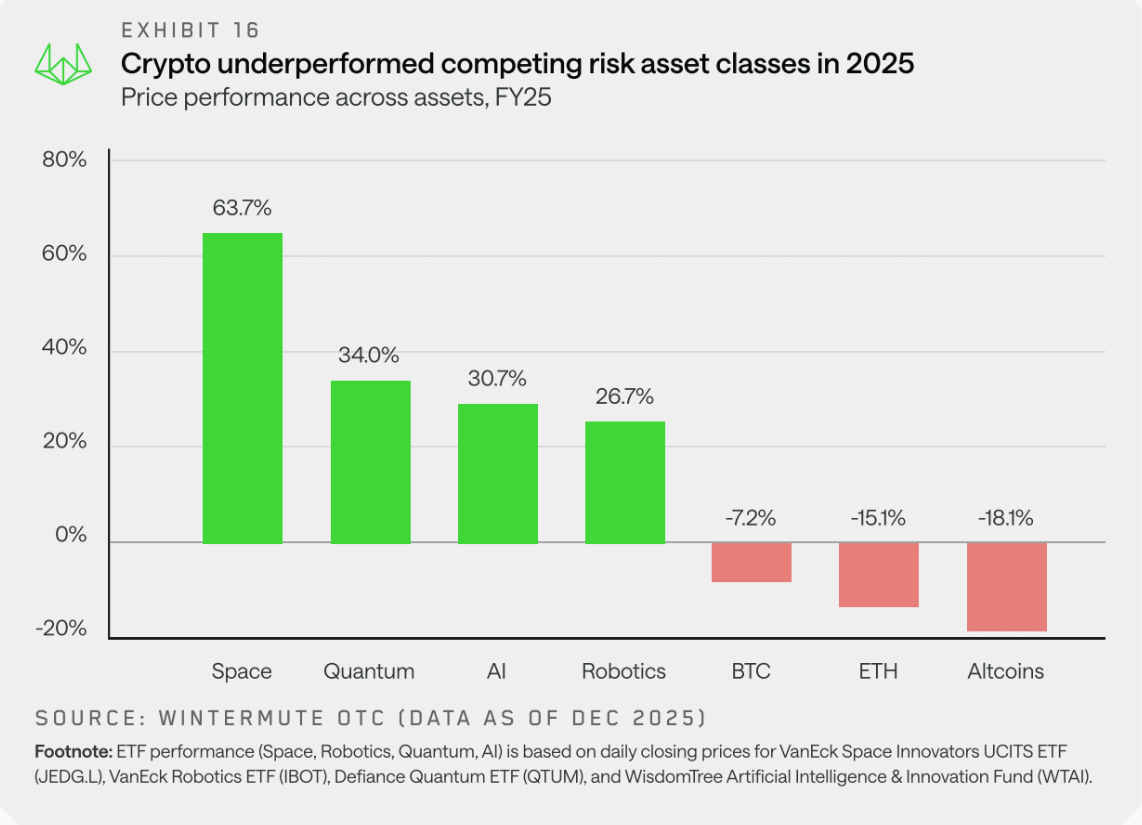

Bitcoin and cryptocurrencies generally underperformed other risk assets in 2025. Source: Wintermute

Despite rapid institutional adoption through spot ETFs, Bitcoin looks set to lose retail attention in 2025 as investors gravitate toward other high-growth themes, according to data from crypto market maker Wintermute.

Related: Bitcoin Mining 2026 Prediction: AI Turnabout, Margin Pressure, and Fight for Survival