Bitcoin traded around $66,400 on February 19, remaining stable after several days of volatility. However, growing concerns about a possible military attack on Iran by the United States has added new uncertainty to global markets, including cryptocurrencies.

U.S. military officials have told President Donald Trump that strike options against Iran are ready and could be carried out as early as this weekend, according to confirmed reports in multiple U.S. media outlets.

BREAKING: Axios reports that there is evidence that war between the US and Iran is “imminent” and that Israel is preparing a scenario for “war within days.” The scenarios are expected to include:

1. Sources say that unlike the Venezuela operation, a “full-scale” war lasting several weeks

2. Joint US-Israel…

— Kobeissi Letter (@KobeissiLetter) February 18, 2026

US and Iran on the brink of war as Bitcoin support weakens

The Pentagon has already deployed additional aircraft and is moving Carrier Strike Group 2 toward the Middle East. At the same time, Iran conducted military exercises and threatened to retaliate if attacked.

The developments come in the wake of stalled nuclear negotiations and rising tensions over Iran’s uranium enrichment and missile programs.

The White House has said diplomacy remains preferable, but officials also acknowledged that military action is being actively considered. This escalation is increasing risks across global markets.

Satellite images show that Iran may be building concrete shields over military facilities in preparation for a U.S. attack. Source: Reuters

Bitcoin’s recent price movements reflect this uncertainty. The asset has fallen sharply from cycle highs of over $100,000 and is currently trading in the mid-$60,000 range.

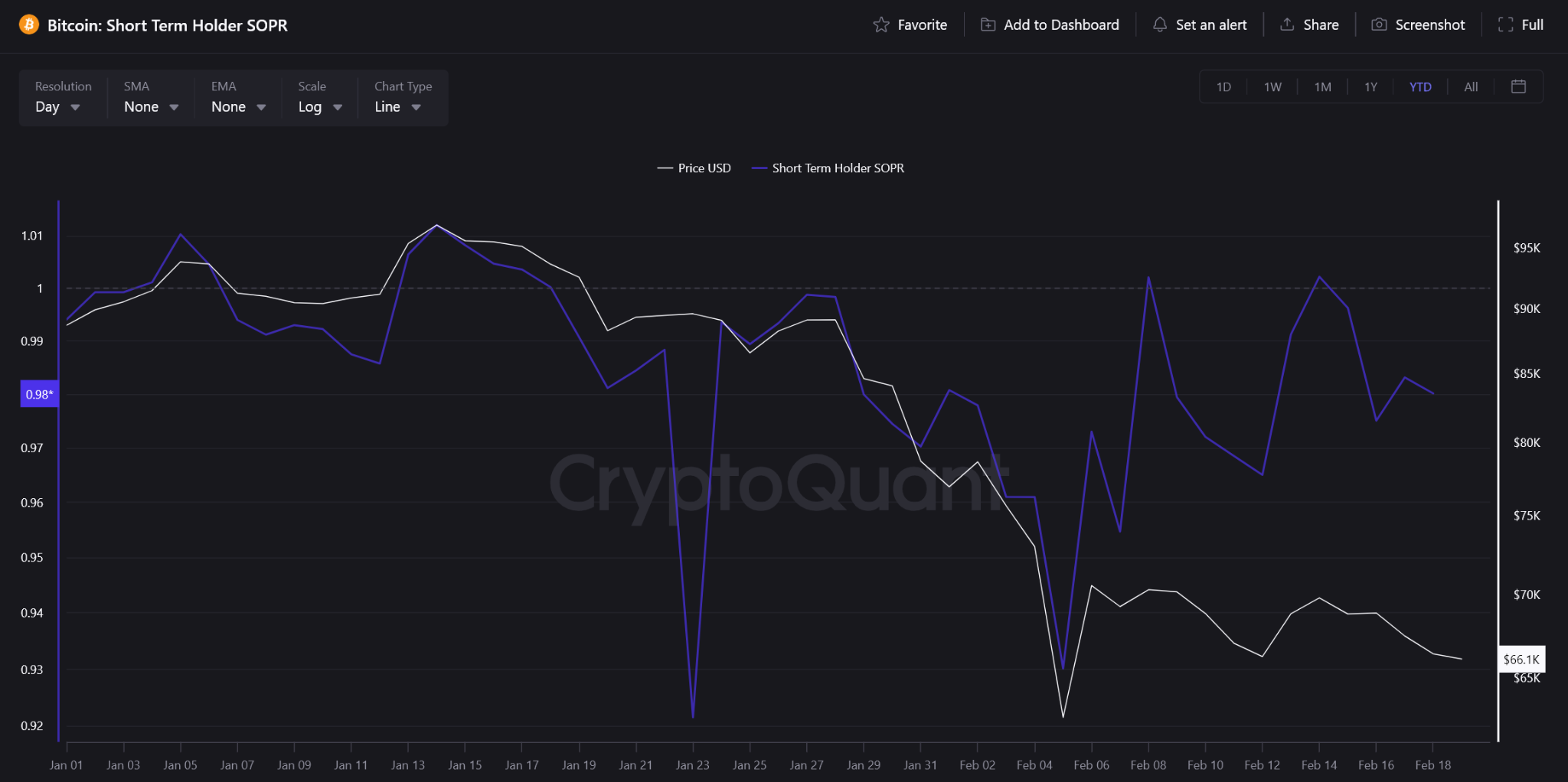

Short-term investors are selling at a loss, according to the SOPR indicator for short-term holders, which is currently below 1. This means that many recent buyers are exiting their positions under pressure.

At the same time, Bitcoin’s short-term Sharpe ratio has fallen to extremely negative levels. This indicates that recent returns have been low relative to volatility. Historically, situations like this emerge during times of market stress and fear.

According to the SOPR (expended production return) chart, short-term Bitcoin investors are selling at a loss. Source: CryptoQuant

If the US launches an attack this weekend, Bitcoin will likely respond in two stages.

Bitcoin on-chain signals suggest panic could cause volatility

First, the market can fall instantly. When sudden geopolitical shocks occur, investors often move into cash and safer assets. Bitcoin has historically behaved like a risk asset during the early stages of global crises. SOPR data confirms that short-term holders are already weak and sensitive to fear.

However, the second phase could be different.

The Sharpe ratio suggests that Bitcoin is already heavily oversold in the short term. Many weak hands were eliminated. This reduces the amount of forced sales that can still occur.

As a result, the plunge could be short-lived if buyers intervene at lower levels.

Bitcoin’s short-term Sharpe ratio reaches a level historically designated as a generational buy zone

“The arrows in the chart clearly show this. Previous extremely negative readings were followed by violent recoveries to new highs.” – via @MorenoDV_ pic.twitter.com/nxFBUgHxi9

— CryptoQuant.com (@cryptoquant_com) February 19, 2026

Additionally, geopolitical uncertainty may ultimately increase Bitcoin’s attractiveness. When global tensions rise, investors often turn to assets outside the traditional financial system. This change does not occur instantly, but tends to progress over time.

Right now, Bitcoin is at a critical point. Fear remains high and geopolitical risks are rising. However, on-chain data suggests that much of the damage from the recent fix has already been done.

The next move will largely depend on whether tensions escalate to actual military conflict or are eased through diplomacy.

How will Bitcoin react if the US military attacks Iran this weekend? The post appeared first on BeInCrypto.