Exposure to HPC/AI drove minor valuations in 2025. The next stage is the separation of execution and narrative, which is where re-evaluation diverges. $IREN $APLD $CIFR $WULF $HUT.

The following guest post is from bitcoinminingstock.io, A public market intelligence platform that provides data on companies exposed to Bitcoin mining and crypto treasury strategies. First published by Cindy Feng on January 30, 2026.

Over the past few weeks, we have noted a clear shift in the way capital markets value public Bitcoin miners in 2025. Since the second half of this year, investors have increasingly favored companies with reliable HPC/AI exposure.

This was not a sentiment-based trade. It coincided with a sharp acceleration of execution. Core Scientific, a public miner, was the only one to sign a hyperscaler contract in 2024. In 2025, that number will increase to five. What was once framed as an experimental diversification is now shaping the balance sheet, development pipeline and long-term strategy of the entire sector.

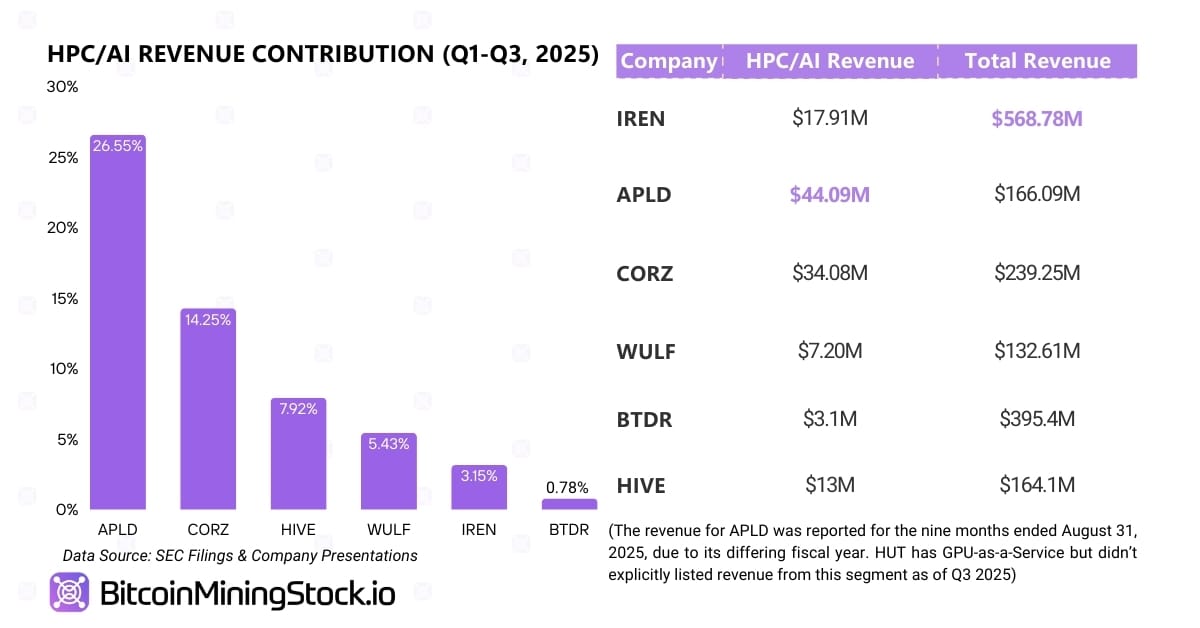

Revenues are still small, but revenue visibility is improving

Despite the proliferation of announcements, HPC/AI’s contribution to revenue remains limited until the expected 2025. Most hyperscaler deals are structured as long-term contracts with phased infrastructure deployments. Capacity is built and activated in stages, resulting in significant returns expected to increase from 2026 And beyond that.

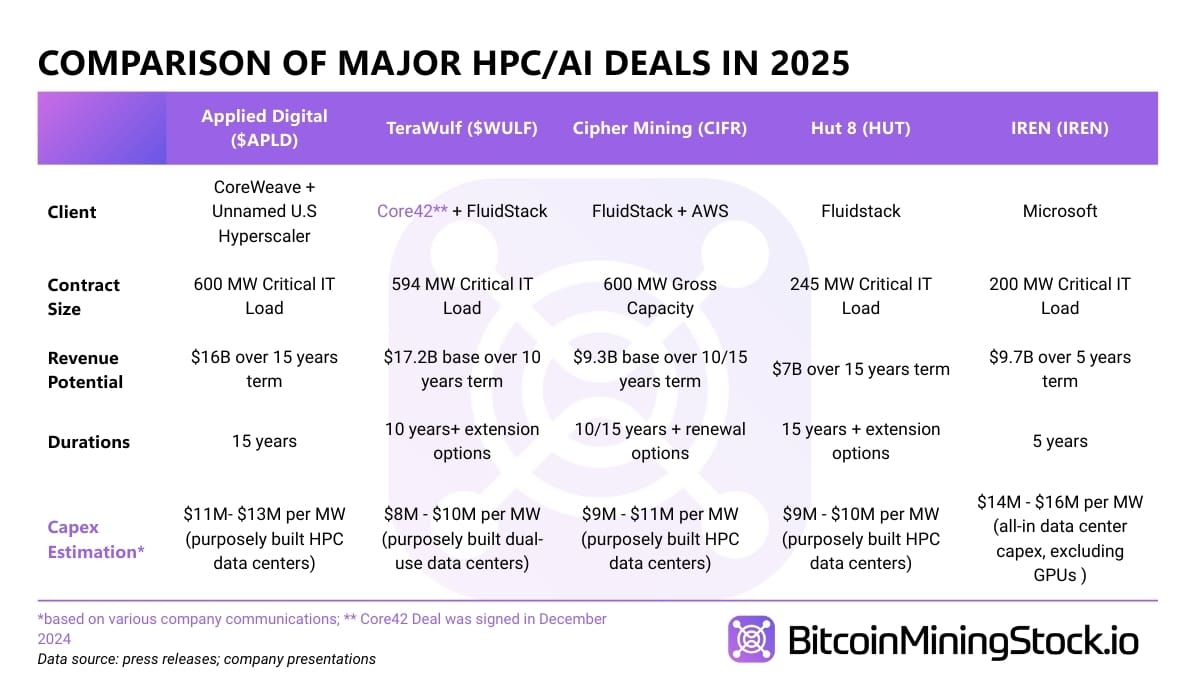

Not all hyperscaler deals are the same

All of the announced deals have hyperscaler exposure, but the underlying business models are very different. Most often, miners position themselves as: HPC infrastructure provider, not an AI cloud operator. Their role is primarily colocation, providing power, cooling, and physical infrastructure, not directly selling AI clouds.

The distinction is important because capital expenditures, margins, and execution requirements are different. Two contracts with similar headline values can yield very different economic outcomes depending on whether the miner is operating GPUs or simply hosting them.

※reference original report Get complete details about individual company transaction breakdowns, data center locations, and more.

For some miners, this is no longer diversification

More interesting changes are happening under the heading. For some companies, HPC is no longer a side hustle. That’s where future capital will go.

Some miners will continue to operate Bitcoin fleets as long as they continue to make money. However, their development pipeline is now almost entirely HPC-focused, including IREN and TeraWulf. Companies like Bitfarm have gone further and suggested that Bitcoin mining itself may end over time.

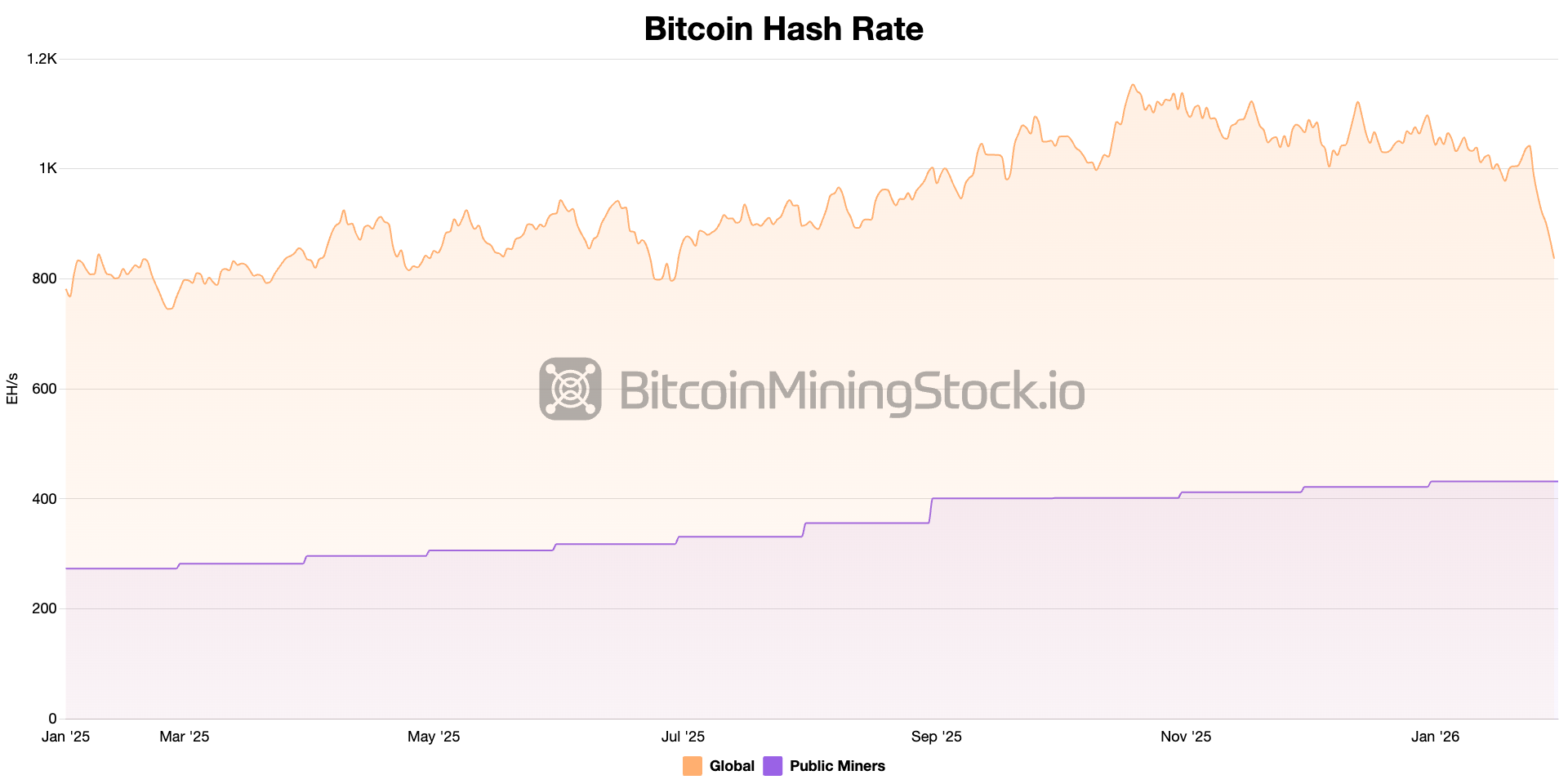

With this shift, secondary effect. As public miners increasingly allocate capital and power capacity to AI/HPC workloads, aggregate hash rate growth from publicly traded companies could slow, plateau, or even decline.

Pivoting is not possible for everyone

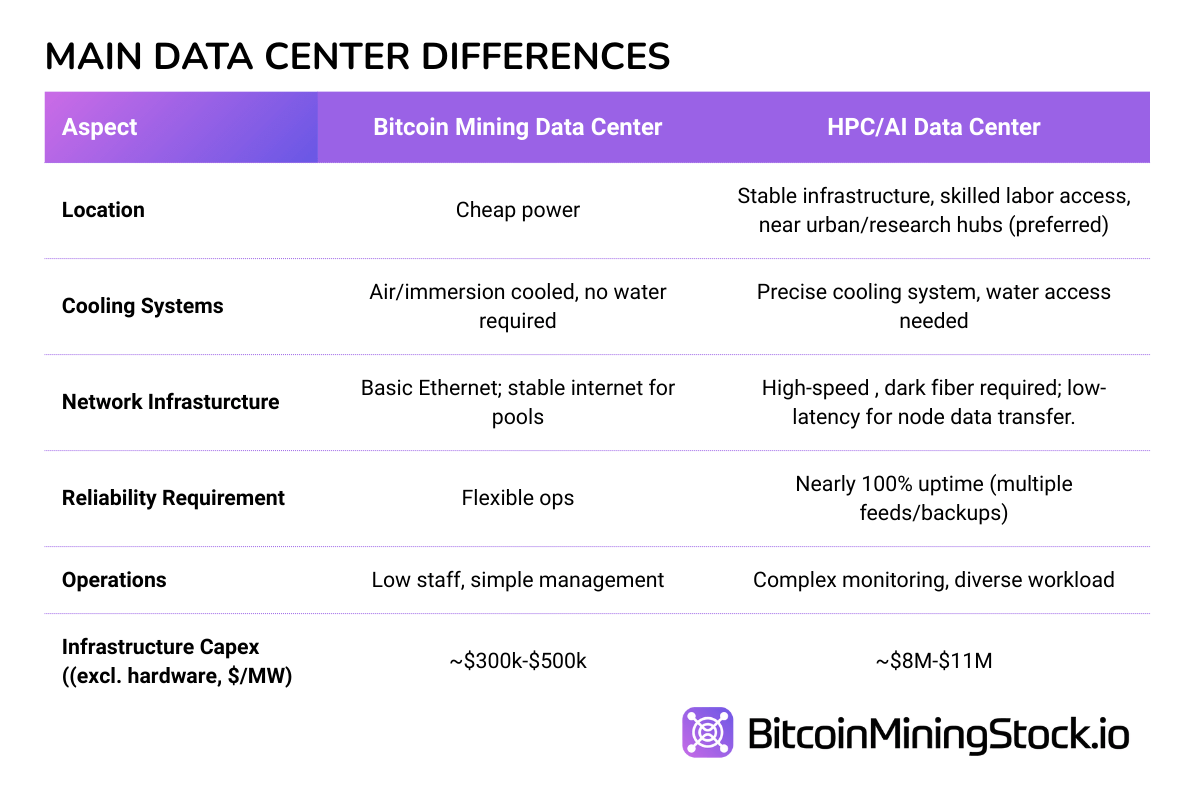

While an HPC/AI pivot may be debated, it would be a mistake to think that anyone with power and land can make the transition. actuallymost mining sites are designed for speed and flexibility (mining containers are widely used) rather than the density, redundancy, and operational discipline required for hyperscale workloads. Some sites are adaptable. For example, Core Scientific is making changes. (approximately $1.5 million to $3 million per MW) An existing Bitcoin mining data center to fulfill our contract with CoreWeave. Many simply can’t do that, or the costs just make pivoting less economical.

Capital and execution are the real constraints. HPC buildout requires: Large upfront investment ($8 million to $11 million per MW vs. $300,000 to $500,000 per MW) Diverse operational expertise. Even with the right infrastructure and technical capabilities, monetizing HPC operations takes time, and unlike Bitcoin mining, there are no guaranteed block rewards to fall back on.

One prediction: More transactions, less storytelling.

Hyperscaler announcements are likely to continue into 2026, given that miners already control what AI buyers need most, such as permitted land, power access, and development capacity.

However, the market response is changing. Megawatts and prime contract amounts are no longer enough. What investors are looking for more difficult questions: Who financed its construction? When earnings actually start. What happens if a customer walks? Is the risk really at the project level, or is it quietly flowing back to the parent company?

Essentially, Not all HPC trades revalue stocks the same way. That premium will increasingly be paid to operators with structures that de-risk their business models and can do so without adding expensive capital to already circulating mine cash flows.

After the HPC pivot: What’s next for Bitcoin mining?

(The following perspective was not included in the original report, but many readers have raised the same question, so it’s worth sharing here.)

For some, the growing shift of public miners to AI and HPC infrastructure is seen as a threat to Bitcoin mining. In fact, this could be the beginning of the evolution of mining. The Bitcoin mining landscape is starting to look different as capital, expertise, and energy capacity flows into high-value AI workloads. If large-scale miners scale back or withdraw from Bitcoin miningprevious capacity, hardware, and resources are redistributed to new geographies and business models.

One of the visible effects is that shift in where mining happens. AI data centers will compete for the best power sites in mature markets, especially North America, while Bitcoin miners will be relegated to locations with stranded energy, flare gas, and small-scale or off-grid power sources. In these environments, flexibility is prioritized over scale. A mining load that once resided on a hyperscale campus in Texas could reemerge as a set of modular containers in Paraguay, Ethiopia, or Scandinavia, where fleets still contribute to network security but with vastly different economics and risk profiles.

at the same time, Mining operation methods will evolve. Unlike AI workloads, Bitcoin mining does not require continuous uptime or redundancy. This makes them ideal for hybrid configurations where mining acts as a buffer to absorb excess power, participate in demand response programs, and reduce overall energy costs. In such an environment, mining is not the primary product, but a valuable tool in an integrated energy infrastructure.

This evolution also Raise the bar for miners People who continue to pay attention to Bitcoin. Older models: buy an ASIC, connect it to a cheap power supply, and wait. – more difficult to maintain. In an increasingly competitive environment, operators may need to offer grid services, reuse heat, or develop closer relationships with electricity suppliers so that they can generate multiple revenue streams.

None of these guarantee results. But one thing is for sure: Bitcoin mining will continue to evolve.

📙 Note: This article intentionally omits details. If you would like to learn more about individual companies and their contract structures, delivery schedules, capital intensity, etc., please refer to the original report.