Bitcoin prices were rejected this week, indicating insufficient bullish momentum in the market.

Nevertheless, the assets face substantial support coverage at the $80,000 mark, which is expected to hold prices in the short term.

Technical Analysis

By Shayan

Daily Charts

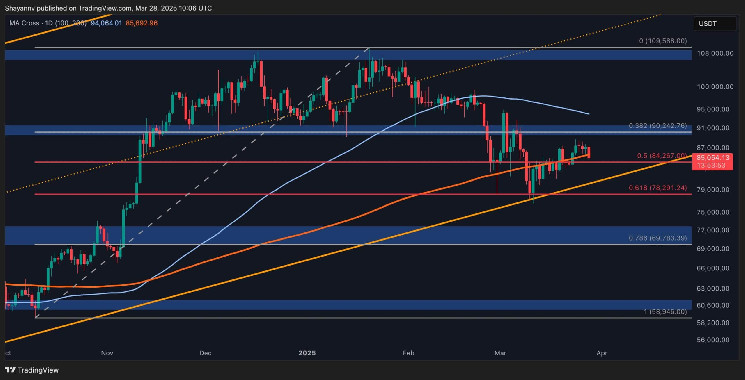

Bitcoin has recently experienced a notable rejection after temporarily breaking its 100-day MA, showing false breakouts and insufficient bullish momentum. This intrusion failure reinforces the bearish sentiment that is common in the market.

Nevertheless, BTC is approaching substantial support range, including the psychological $80K level and the 0.5 ($84K)-0.618 ($78K) Fibonacci retracement zone. This critical area is expected to serve as a support zone, potentially leading to a new integration phase around the $80,000 mark.

Given these conditions, Bitcoin could continue to decline to $80,000 in the short term, with price action determining the next important move.

4-hour chart

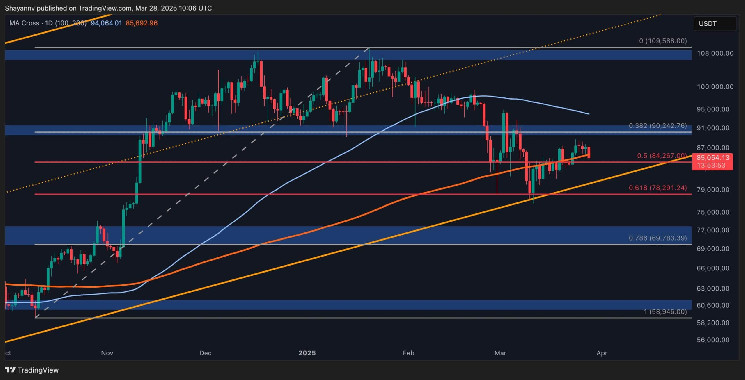

In the lower time frame, Bitcoin encountered increased sales pressure at the upper limit of the downward channel, leading to strong rejection. Currently, the price is testing short-term support at $83,000 and collaborates with previous low swings. While some purchase rights may be available at this level, the overall market situation lacks bullish momentum and sellers remain dominant.

As a result, BTC could fall below $83,000 and move to 80K towards the midboundary of the channel. This is an important inflection point. It could support prices and begin the integration phase, but breakdowns below this level could lead to a deeper reduction to the $77,000 threshold.

On-Chain Analysis

By Shayan

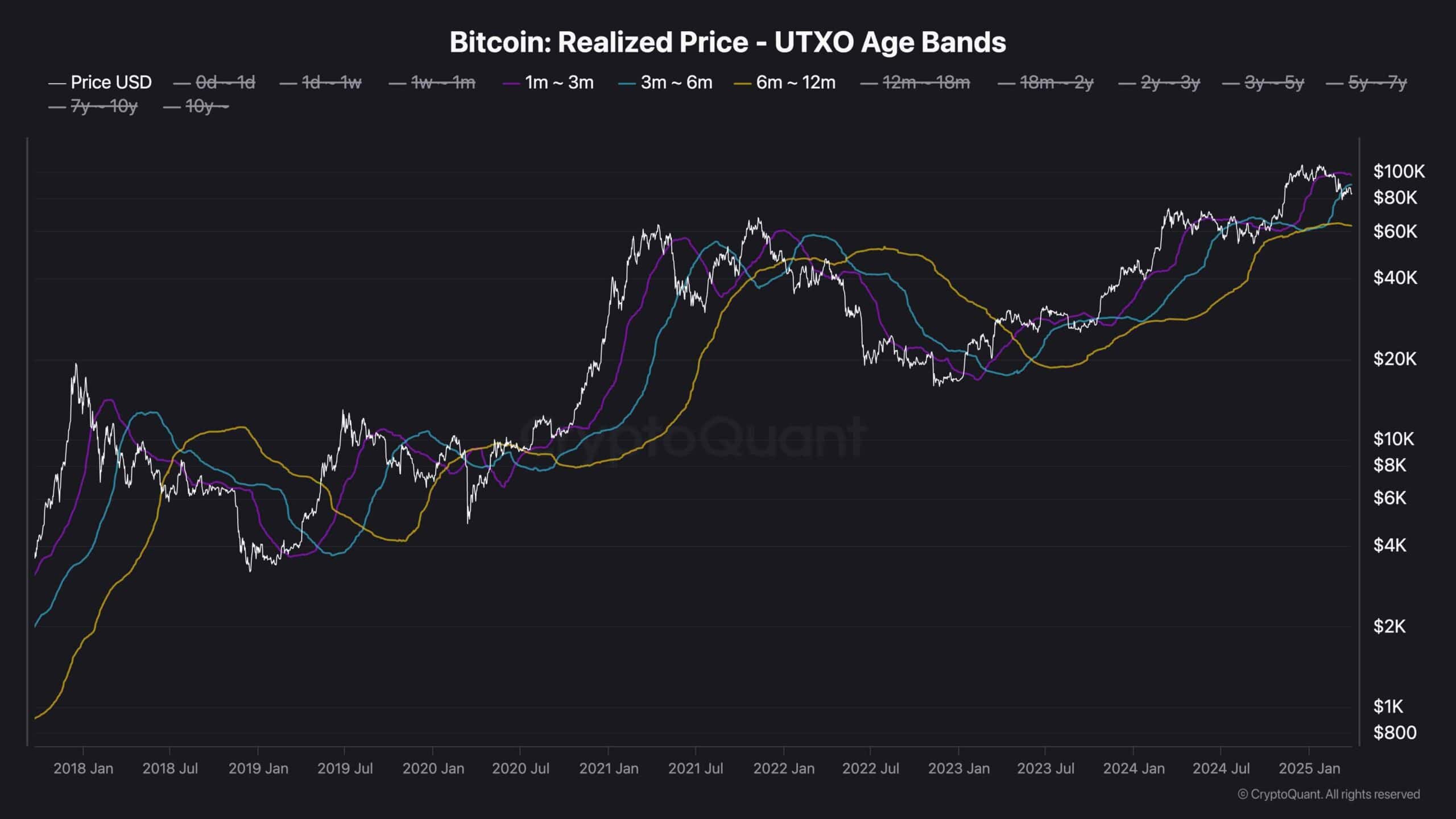

The interaction between Bitcoin and the realised prices of UTXOS for long-term holders has historically been an important indicator of market direction as it represents the average acquisition cost of these holders. Typically, bare markets start when they fall below the realised price of a cohort of six to 12 months and lower the price of potential distribution by these large investors.

Currently, BTC trades realised prices for a 3-6-month cohort at under $88,000, while realised prices for a 6-12-month cohort exceed $62,000. This suggests that it is too early to confirm the start of the bear market while the market is undergoing a deep revision.

Bitcoin could continue to rectified setbacks within this range until new demand enters the market. The $88,000 level remains a significant threshold, with breakouts likely indicating the onset of fresh uptrends.