Tokenworks’ NFT Strategic Token was launched at NFT Marketplace Opensea after traders achieved widespread market success in the influence of the “flywheel” that combines Defi and NFT.

summary

- All eight NFT Strategic Tokens by Tokenworks are listed in the Opensea NFT Marketplace.

- The NFT Strategy Token combines NFT and Defi to manage assets related to a particular NFT collection through automated trading strategies.

On September 30th, Opensea announced that all NFT strategic tokens are now available for trading in the NFT market. The latest list includes original Punk Strategy Tokens, Punk Strolls, and several other well-known NFT collections tied to new trading models that allow traders to invest in NFTs as a way to acquire yields.

The NFT Strategy Token combines NFT and Defi models to manage assets related to a particular NFT collection through automated trading strategies and creates the value or yield of the holder. This kind of strategy is known as the “flywheel” because it allows for automatic relisting of NFT collections at 1.2 times the initial purchase price.

As part of the new launch, Opensea has added a reward pool of selected tokens worth 20 ETH. These tokens include Punkstr, Pudgystr, Apestr, Toadstr, Birbstr, and more.

With this new model, NFTs are no longer considered to be just a collection of digital art. They become investment vehicles that have value and generate yields for the holder, just like the way tokens are done. The team behind TokenWorks, the NFT strategic investment mechanism, began the model in September 2025 with the launch of Punkstrategy.

The NFT Strategy Token began with a Punk Strategy based on the Cryptopunkks NFT Collection | Source: Opensea

You might like it too: NFT Sales Jump Jumps Jump to $109.8 million, cryptopunks recovers 136%

The token was dubbed as an automated trading protocol exclusively for Cryptopunks, the iconic 10,000-character NFT collection launched by Larva Labs, which was later acquired by Yuga Labs in 2022.

“Punkstrategy started out as an art project and became a whole new token meta. It was going to branch out. And we felt we should create a way to launch yourself while being authorized and safe for buyers,” Tokenworks wrote on its official account.

“We also wanted to make sure each one strengthened $pnkstr and also gave value to the project creator/artist who was slowly cut from the loyalty,” the project added.

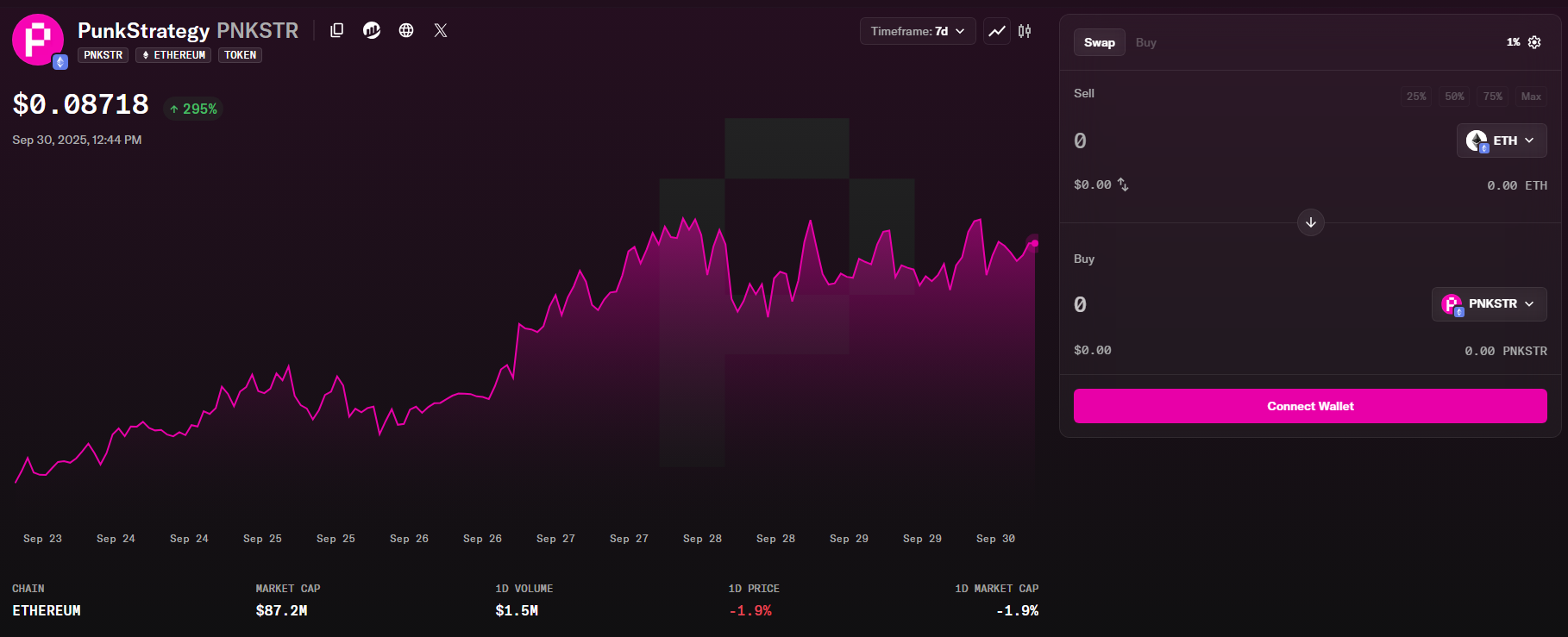

According to Opensea data, Punkstr Token has generated a market capitalization of $87.2 million since its launch on Ethereum (ETH). The daily trading volume of the token is $1.5 million, and is currently valued at $0.08718. Prices have fallen slightly 1.9% in the last 24 hours, but have seen a 392% rise since its first launch on September 15th.

How do NFT Strategic Tokens work?

According to TokenWorks, each ERC-721-based NFT collection can be deployed as a single NFT strategy token on a one-to-one basis. Essentially, once the Treasury reaches the cheapest Cryptopunk floor price, the smart contract will automatically buy it and instantly play it into the market with a value of 20% markup or 1.2 times the purchase price.

When NFTs are sold in the market, all ETHs obtained from Cryptopunk’s sales are used to purchase and burn NFT strategic tokens. The cycle then continues as more NFTs are purchased and relisted, producing token holder yield.

All PNKSTR swaps in Dexs like Uniswap cost 10% and 8% is poured into the ETH Treasury. The other 1% will go to the supporters, and an additional 1% will be sent to the Tokenworks team.

According to the post, other NFT strategy tokens have slightly different fee structures. Each token costs 10% and 8% is sent to the NFT accumulation pool. 1% will be sent to the collection owner as royalties, and 1% will use PNKSTR as a major product for purchase and combustion.

You might like it too: Cryptopunks collection featured in an 800-page book that recorded an incredible rise