Bitcoin has fallen to a six-month low after recent highs as crypto analyst Income Sharks reviews the chart for the 2022 sub-$20,000 buy zone.

Bitcoin is trading at $97,242 in a turbulent month in which major crypto assets have fluctuated between $97,000 and $111,000. BTC started November near $110,000, but was unable to sustain the gains and finally returned to levels last seen in May.

In the past 24 hours, Bitcoin fell by 6.2%, further widening its monthly losses to 13.6%. The current price is about 23% below the all-time high of $127,000 set in early October.

Interestingly, Bitcoin has soared 471% since its 2022 low of $17,000, demonstrating its resilience through multiple cycles and reinforcing lessons from past market behavior.

Today, analysts confirmed that while market bottoms often feel like the worst time to buy, they are often the smartest opportunities. He said this as BTC falls to lows again and many believe it will be a great entry opportunity.

Bitcoin current structure and predictions

In particular, technical indicators suggest that Bitcoin may be poised for a rebound. crypto express mentioned Bitcoin is trading above the support trendline of a descending wedge, indicating a potential rebound if this level holds. However, the 21-day moving average and 50-day moving average are acting as resistance levels, and a break below these support levels could lead to further losses.

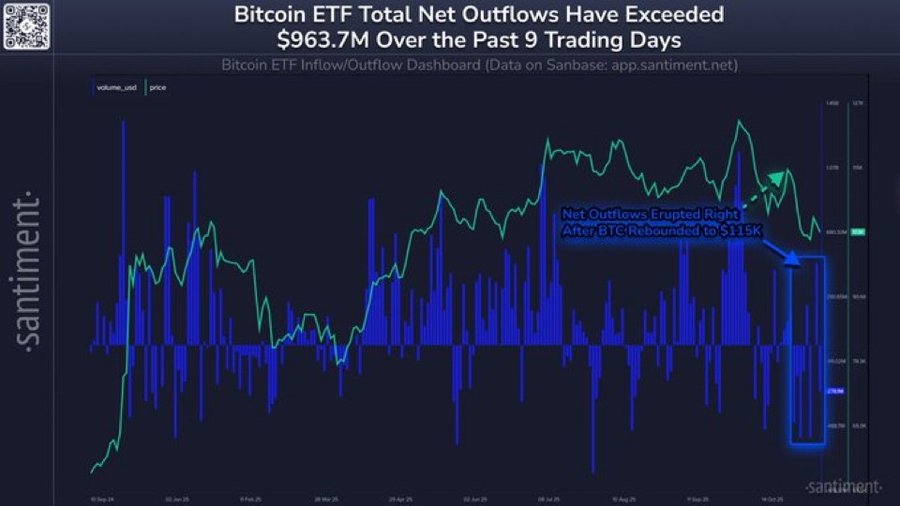

Meanwhile, Ki Young Ju, founder of CryptoQuant, said: Bitcoin whale is selling This has contributed to the recent downward pressure since the price exceeded $100,000. Additionally, the Bitcoin ETF experienced net outflows of $963.7 million over the past nine trading days, starting with BTC’s surge to $115,000 on October 28th.

He suggested that although the bull cycle is likely to end in 2025, institutional support and ETFs could help ease the market due to favorable macroeconomic conditions, and current levels could represent a potential buying opportunity.

Similarly, CryptoQuant analyst Moreno emphasized: Bitcoin has liquidity It is often seen before large gatherings. Despite the bearish trend and cautious market sentiment, the current situation could provide a favorable entry point for traders.