Over the past few weeks, Ethereum prices have been depressed thanks to the bearish pressure caused by the decline in Bitcoin prices. After losing support above $4,000, the second-largest cryptocurrency by market capitalization is now showing further signs of a collapse that could trigger a spiral. Multiple analysts have already shared their outlook for Ethereum’s price going forward, and let’s take a look at two that focus on opposite ends of the spectrum.

Recovery and subsequent crash

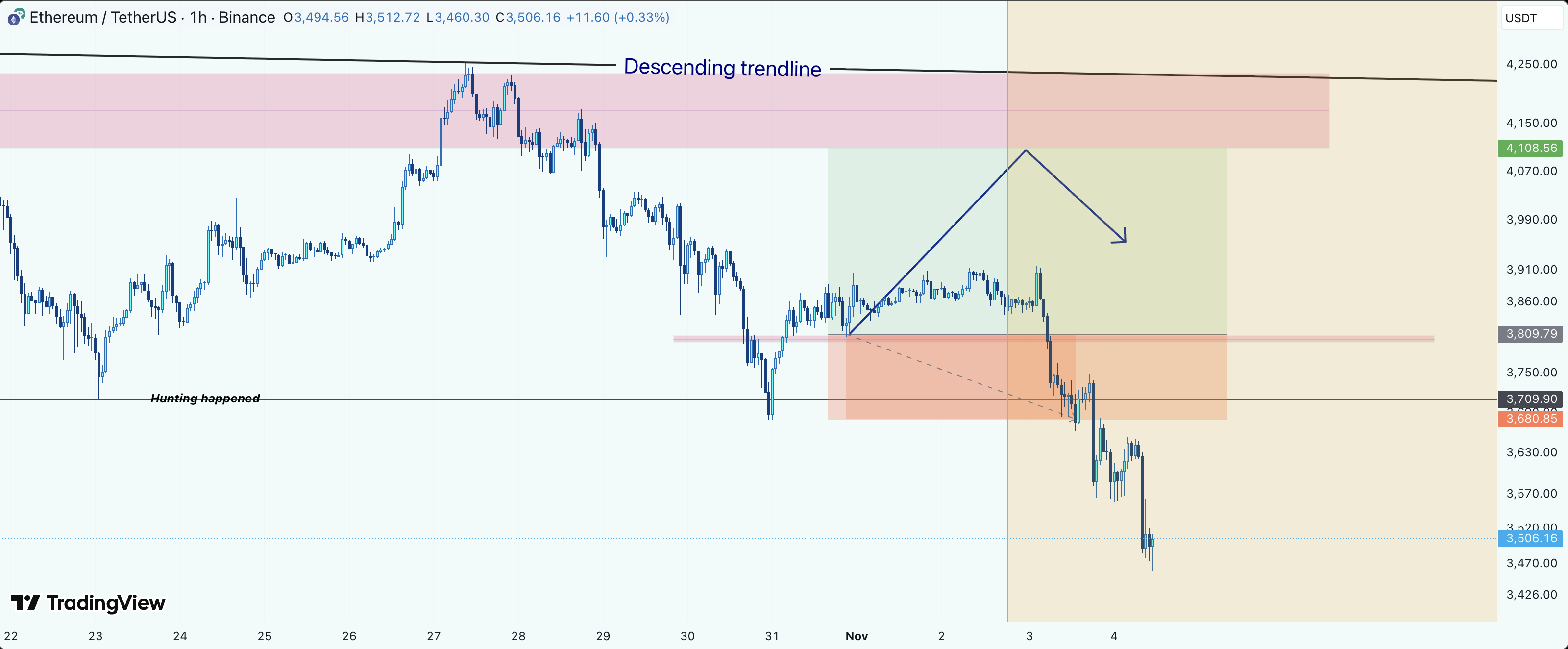

Cryptocurrency analyst Mericatrader highlighted the important structure that the Ethereum price has formed recently, and that it is a clear recovery structure. This occurred after the cryptocurrency completed a liquidity sweep around $3,700 called the “hunt.”

Now that the liquidity sweep is complete at this level, analysts believe this forms a potential foundation for an upward correction in Ethereum price. Under these circumstances, altcoins are also seeing some consolidation in the price range between $3,700 and $3,800, making this range an important area of interest.

If the bulls can assert and sustain this level, Ethereum could be on a new uptrend path. If this happens, the accumulation trend will end and a bullish development will begin again. Such a rally would send Ethereum price into the next supply zone at $4,080 to $4,180 before we see a significant downward correction.

Despite expecting the price to rise, crypto analysts also highlight the fact that Ethereum still exhibits bearish market structure. With an uptrend line underway, the price is expected to reach resistance near $4,100. If the bears are successful in rejecting the price from this level, Ethereum price is expected to crash below $4,000.

Analysts predict top for Ethereum price

While many in the industry believe the current downtrend is only temporary, crypto analyst CRYPTO Damus believes this could actually be the top of the cycle. In his post on X, he uses weekly charts to compare current trends to cycle-top trends from 2018 and 2021.

Dams points out that: Similarities between previous cycle tops And the price of Ethereum is currently following a similar strategy. This is followed by a consistent green candlestick on the weekly chart, followed by a red candlestick, and ends in a bearish market.

The analyst explained that given the divergence in previous market cycles, things could be different this time around. However, if the trend is similar to the last two bull cycles, it means the Ethereum bull run is over and investors should brace for a crash.

Featured image from Dall.E, chart from TradingView.com