Cryptocurrency analyst Joanne Wesson, in her latest assessment of Bitcoin (BTC) price movements, suggested that statistical indicators suggest that a new high (ATH) is very close.

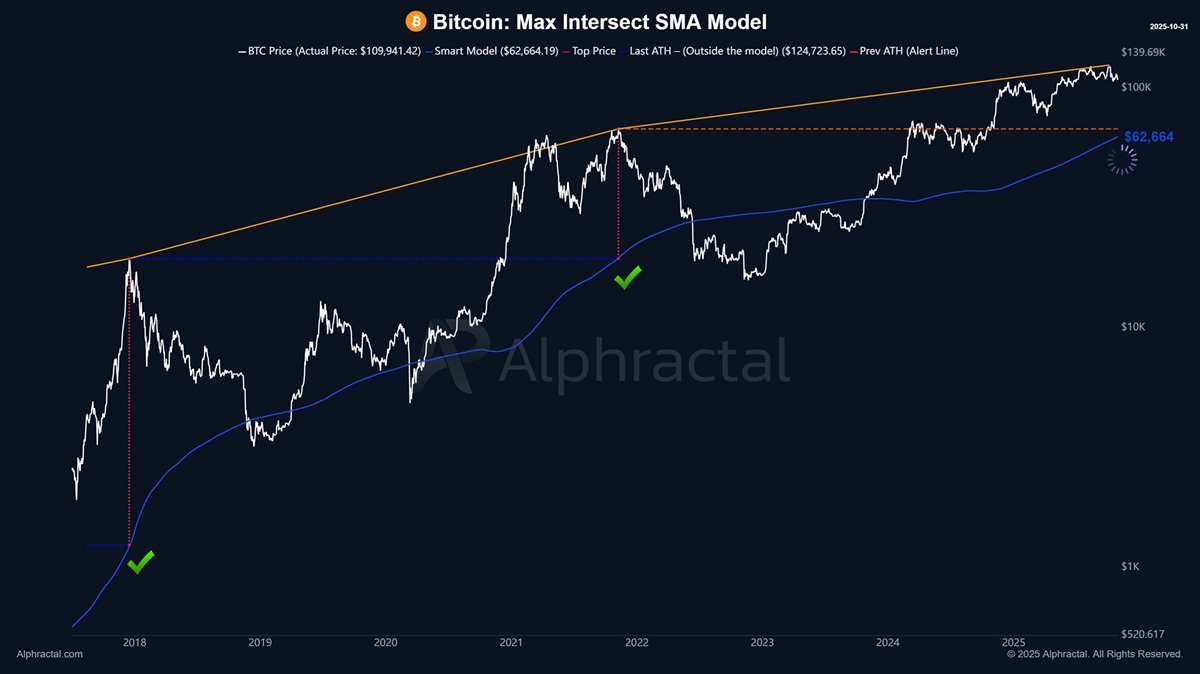

Wedson noted that Alpharactal’s indicator, known as the “Max Intersect SMA model,” still shows the peak has not yet occurred.

“The last time I mentioned this model, BTC rose from $60,000 to $62,000,” Wesson said in a statement. “As we approach $68,000, this could be the day we see a new ATH,” he said. The analyst noted that the model accurately predicted the peaks in 2017 and 2021, adding: “This is no coincidence. aria-descriptedby=”caption-attachment-184344″>.

Metrics shared by Alphactal.

Wesson also noted that many analysts focus on macro indicators such as liquidity, the yield curve, and monetary policy, but these indicators may not be sufficient to predict market movements. According to the analyst, Bitcoin is still in the “circulation phase” of the cycle. He noted that a sideways consolidation is likely to occur at this stage as the market seeks liquidity on both the upside and downside.

“Based on Bitcoin’s four-year cycle, the full ATH will occur between $143,000 and $146,000,” Wesson said, insisting that this prediction is based on data and not speculation. However, he noted that the risk-reward ratio is no longer as attractive as it was in 2022 or 2023, as many investors are hesitant to sell.

*This is not investment advice.