The Decibel Foundation has announced the introduction of USDCBL, a protocol-native stablecoin issued by Bridge, ahead of the February mainnet launch of its Aptos-based decentralized derivatives exchange.

According to an announcement shared with Cointelegraph on Thursday, the USD-denominated token will serve as collateral for on-chain perpetual futures trading, allowing the platform to internalize reserve-related economics rather than relying on third-party stablecoin issuers.

Decibel, backed by Aptos Labs, plans to launch a complete on-chain perpetual futures exchange using a single cross-margin account later this month. The exchange said its testnet in December attracted more than 650,000 unique accounts and over 1 million trades per day, but these numbers have not been independently verified.

At launch, users will make a deposit $USDC ($USDC) to USDCBL as part of the onboarding process. USDCBL is published through Bridge’s open issuance platform. This allows projects to create a regulated and fully collateralized stablecoin with integrated on- and off-ramps. Bridge was acquired by Stripe at the end of 2025.

According to Decibel’s Thursday X post, the foundation said USDCBL’s reserves will be backed by a combination of cash and short-term U.S. Treasuries, and the yield earned from these assets will be held within the protocol.

It added that by securing backup revenue, it could reduce its reliance on transaction fees and incentive programs as its primary source of income, and reinvest value into protocol development and ecosystem efforts.

“This is not about launching another stablecoin,” the foundation wrote, explaining that USDCBL is a core exchange infrastructure rather than a standalone retail token.

sauce: bridge

Related: US credit union regulator proposes path to stablecoin licensing

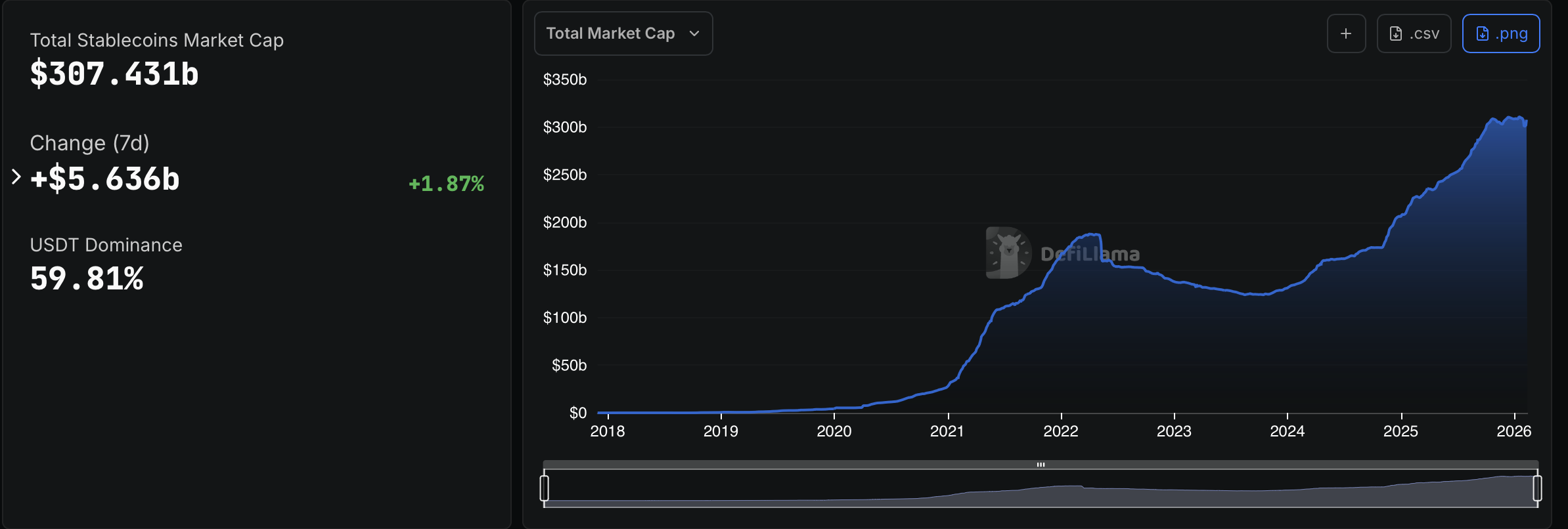

The Rise of Ecosystem-Native Stablecoins Across Cryptocurrency and Banking

The shift towards ecosystem-aligned dollar tokens spans both cryptocurrencies and traditional finance, with platform operators increasingly issuing stablecoins for use within their own networks, rather than relying solely on external issuers.

The closest counterpart to Decibel would be HyperLiquid, a decentralized perpetual futures exchange that launched its native stablecoin USDH in September after a fierce bidding war for issuance rights.

Dollar-pegged tokens are minted on HyperEVM, the platform’s Ethereum-compatible execution layer, and are designed to serve as exchange-wide collateral while reducing dependence on external issuers.

sauce: Defilama

This trend extends beyond crypto-native platforms. In November, JPMorgan Chase introduced JPM Coin for institutional payments on blockchain infrastructure, representing tokenized US dollar deposits held in banks.

The deposit token was piloted on Coinbase’s Base network, giving institutional investors 24/7 access to blockchain-based money transfers. Unlike publicly circulating stablecoins, JPM Coin is licensed and available only to institutional customers of banks.

Fintech platforms are also participating. PayPal started $PYUSD In 2023, it will be integrated directly into payment systems as a dollar-backed stablecoin, giving the company greater control over payment flows within its network.

In 2025, the company introduced a 3.7% annual rewards program for US users. $PYUSD into your PayPal or Venmo wallet, further integrating stablecoins into the consumer payments ecosystem.

magazine: IronClaw is OpenClaw’s rival, Olas launches bot for Polymarket — AI Eye