Arbitrum, the top Ethereum Layer 2 (L2) scaling solution, recorded strong momentum in the second quarter of 2025. This was documented thanks to new product launches, partnerships with retail brokerage giant Robinhood, and more activity around tokenized real-world assets (RWAS).

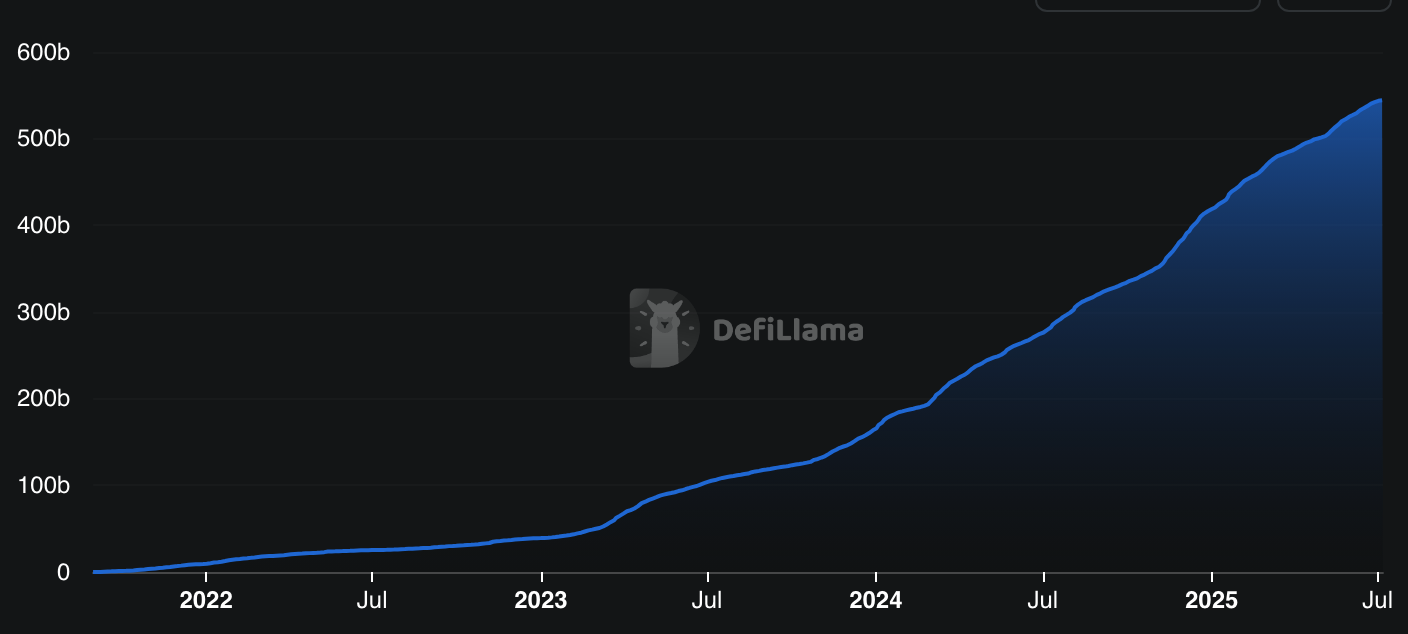

According to data from Defillama, the total L2 value locked (TVL) total (TVL) rose nearly 32% from $1.9 billion in April, over $2.5 billion on July 8th. Meanwhile, Arbitrum’s Decentralized Exchange (DEXS) has processed a cumulative amount of over $5.444 billion, up 12% since April.

Aribtrum cumulative Dex volume. Source: Defilama

According to RWA.xyz, RWA on the network has grown to around $288 million on TVL. Arbitrum is currently ranked as the seventh largest network in total RWA on-chain values.

Recent growth has arisen as tools aimed at institutions and developers, including Time Boost, a new gas pricing system. Alchemy developer Uttam Singhk said that the upgrade that launched in April has already won over $2 million, which he posted yesterday in X’s post.

Robin Hood Effect

However, the biggest news about Arbitrum is its partnership with Robinhood. As of June 30, Robinhood had access to over 200 US stocks and exchange trade funds (ETFs) to its 24/7 European users, and began offering it as well as other new products.

The stock token will initially be issued in the main L2, but Robinhood has made a note of its plans to launch its own L2 blockchain in the future. The chain, built using Arbitrum’s orbital framework, is expected to be performing live within the next year, according to Johann Kerbrat, VP and general manager of Robinhood Crypto, who spoke with Defiant last week.

“The Robinhood choice validates the value proposition for the entire L2 blockchain,” AJ Warner, chief of Offchain Labs strategy, told The Defiant.

“Tokenized Stock Programs require a fast, secure and reliable infrastructure to provide tokenized stocks with low fees and plug-and-play tools to meet the needs they need. Only L2S can provide successfully.”

“Arbitrum’s strong growth should not be considered an astounding breakout. It is likely to reflect the ultimate maturity of the L2 market.” “The base is still leading, but people rarely want monopoly.”

The base developed by Coinbase is actually the largest Ethereum L2 by TVL, with nearly $3.5 billion followed by Arbitrum. However, Moneta added that users “need a viable and equally useful alternative, and now Arbitrum is beginning to play its role based on chain data.”

Arbitrum’s native token ARB is currently trading at $0.33, up 1.2% today, trading at 5% over the past two weeks