Bitcoin (BTC) has risen nearly 5% in 10 days and is currently trying to regain its $90,000 level. The recent rise and strong technical indicators in whale activity are to promote optimism about potential breakouts.

The bullish pattern across both the one-sided cloud and EMA structures suggests that the market may be preparing for a higher movement. As momentum builds, traders are looking closely to see if BTC can push towards the $100,000 mark in the coming weeks.

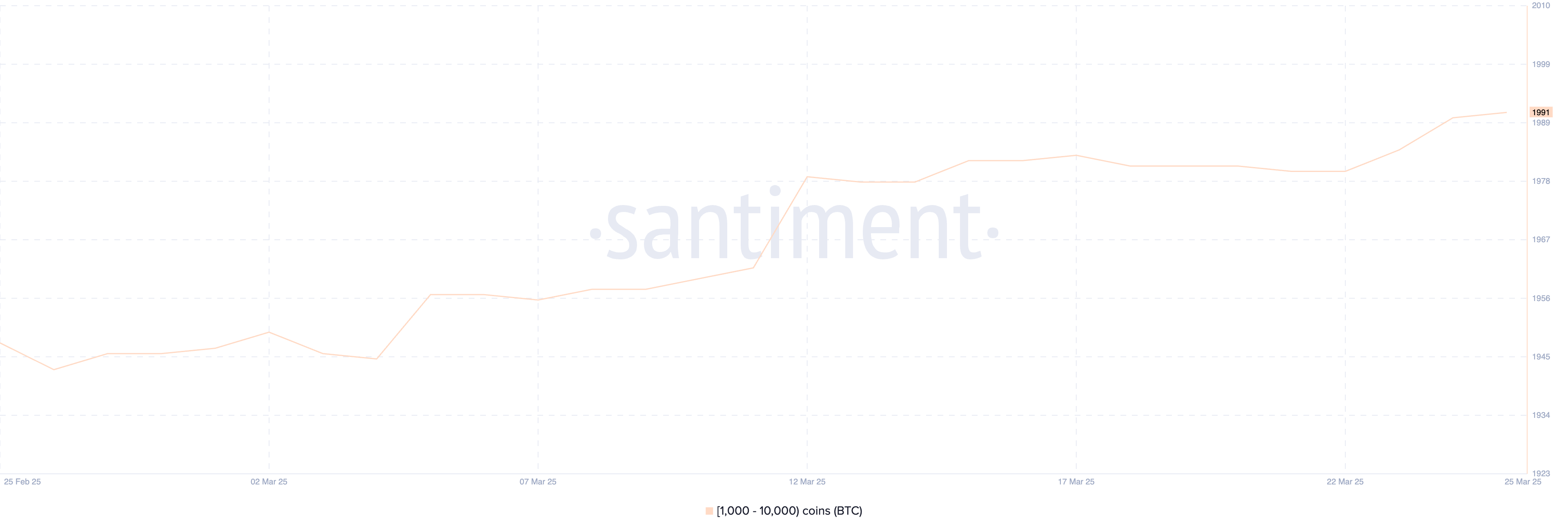

BTC whales have reached their highest level since December 15th

The number of Bitcoin Whale (sheds holding 1,000-10,000 BTC) increased from 1,980 on March 22 to 1,991 on March 25, marking its highest count since December 15th.

Although modest, this rise is significant as it reflects new accumulation by large holders after more than three months of restrained activity.

As these large players often move through the market, it is important to track whale wallets. Their accumulation or distribution patterns serve as early signals for a broader emotional shift or major price movement.

Bitcoin jelly. Source: Santiment.

Whales are usually considered “smart money,” and increasing numbers suggest an increase in confidence in the market’s upcoming outlook.

The growth rate of new whales has been slowing recently, but the fact that their numbers have reached a high signal for months that underlie their strength.

An institution or wealthy investor will position themselves ahead of potential bullish moves, add weight to Bitcoin’s current support level, and even stand on top if momentum continues.

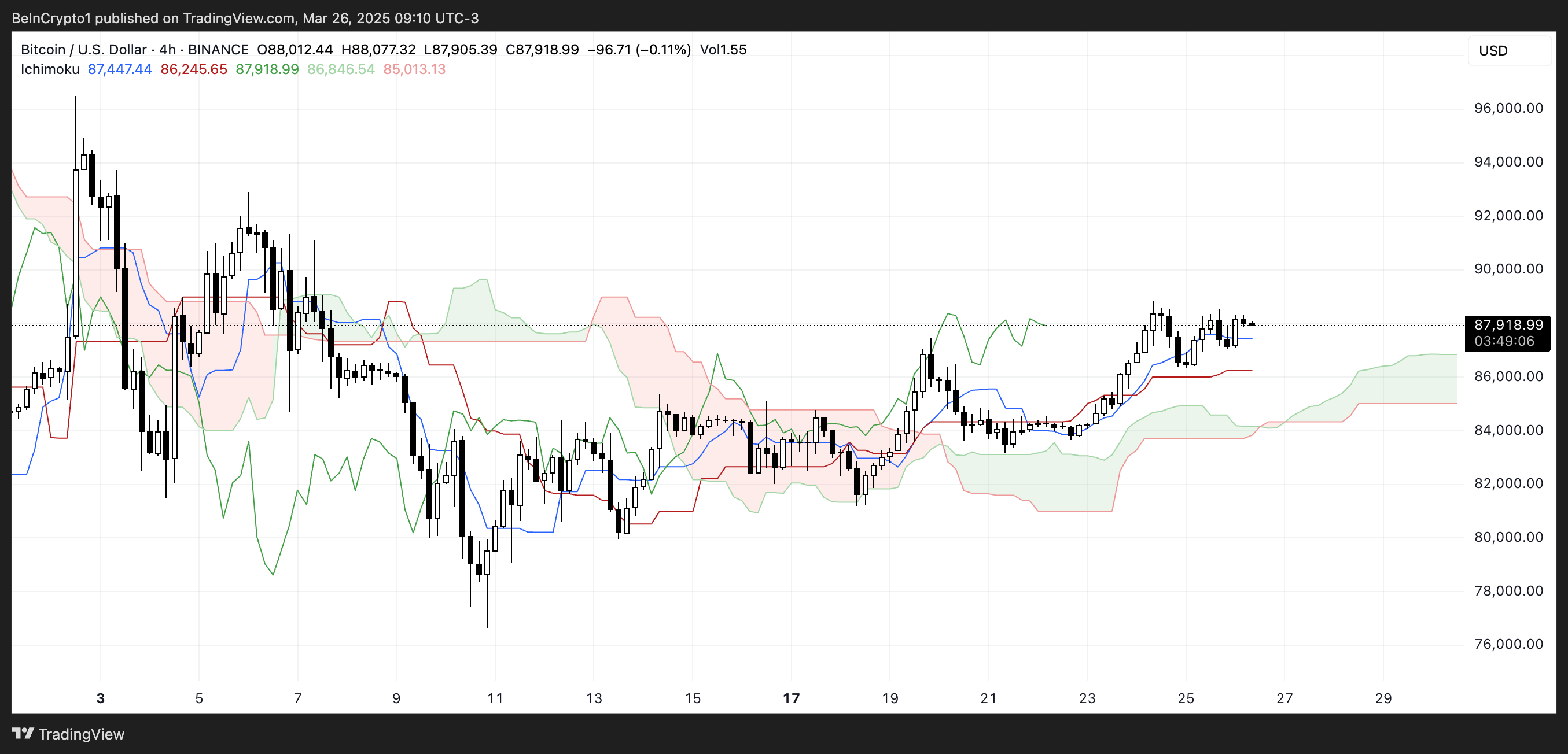

Bitcoin, Ichimoku, and Cloud draw good momentum

Bitcoin’s Ichimoku Cloud Chart shows a bullish structure, with the price action clearly above the clouds, the cloud itself turning green and moving forward.

Tenkan-Sen (blue) is above Kijun-Sen (Red), indicating that short-term bullish momentum is still playing. However, the two lines begin to flatten, suggesting the possibility of pause or integration.

btc icchimoku cloud. Source: TradingView.

The Future Cloud (Kumo) is broad and sloping upward, indicating the underlying support and strength of growth trends of solids. Furthermore, Chikou Span (Rugging Line) has far surpassed past price action, further confirming bullish sentiment.

There may be sideways in the short term, but the overall one-sided setup continues to support the Bulls, unless the failures under the cloud shift the outlook.

Will Bitcoin return to $100,000 in April?

Bitcoin’s EMA line is in line with potential golden crosses. This could indicate the onset of a fresh bullish phase. If this crossover occurs and the price of Bitcoin can beat the resistance at $88,807, it could trigger a move to $92,928.

With a strong continuation of the uptrend, Bitcoin could potentially send Bitcoin to test $96,503 and $99,472, which could potentially exceed $100,000 if momentum accelerates.

BTC price analysis. Source: TradingView.

On the other hand, if Bitcoin is not breaking beyond $88,807 and is facing a trend reversal, it could pull back to test support at $84,736. A break below that level could lead to further drawbacks towards $81,162.

If sales pressure continues, BTC could revisit $79,970 and $76,644, potentially below $80,000.