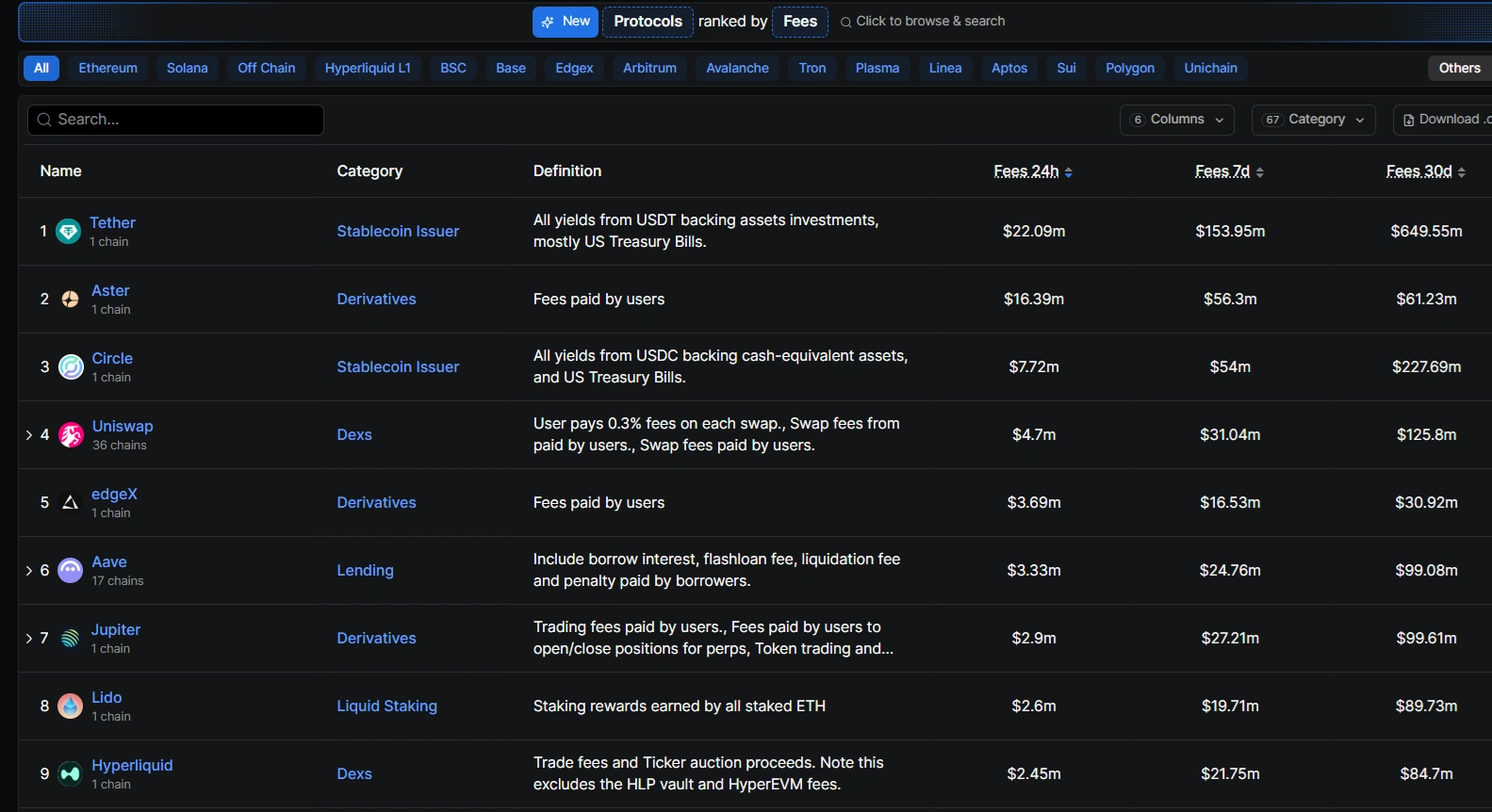

Since September 24th, Aster has outperformed Stablecoin Firm Circle in the amount of protocol revenue generated, breaking the recent double layer between USDC publishers and Tether.

Astor first overtook the circle with 24-hour revenues, becoming the second-largest protocol with daily revenue just behind Tether on September 24th.

Aster Dex tied together consecutive strong revenue generation days. Source: Defilama.

Aster stays in front of the circle

Aster is located in a competition with the recently launched Parp Dex against high lipids, growing very quickly, attracting the attention of traders and institutions.

On September 25th, Astor again surpassed the circle, bringing in $16.33 million, with the circle bringing in the usual $7 million. This pattern has continued ever since, with Astor’s revenues increasing with each passing previous mark, and the circle’s current status remains at around $7 million.

Through all this, Tether has maintained a million-dozen leads.

Aster Hot daily profits Streak highlights explosive growth, with the seven-day costing 2.6 times higher than rival Perp Dex hyperliquid. This powerful performance is driven by whale activities, Aster’s personal order book, broader defi adoption and strong support from former Vinance CEO Changpen Zao (CZ).

Astor has been set up as a challenger for high lipids and other existing DEX in the “Parps War,” and currently has broader meaning in the crypto revenue landscape.

For a long time, tethers and circles controlled the revenue sequence with stablecoin yields. However, Aster’s breakouts are likely to see that the Defi protocol is improving by acquiring trading fees, and could draw more liquidity and innovation from centralized players.

The tether remains number one

Stablecoin revenue comes from transaction fees, interest on loans and financial operations. So it’s no surprise that Tether, whose potential ratings have been linked to advantage in the Stablecoin market and interest from investors like SoftBank and Ark Invest, remains number one in the region.

Reporting it is still a private company, the crypto giant claims it is in talks to raise up to $20 billion in private deployments that could cherish the El Salvador-based company for around $500 billion.

One report claims that the company is seeking between $15 billion and $20 billion for about 3% of its shares, citing people familiar with the issue.

However, numbers are top-end targets, and ultimately the numbers are significantly lower and the company’s valuation may depend on the stakes offered.

Tether’s CEO Paolo Ardoino confirmed in X’s post that the company is actually evaluating funding from a selected group of well-known major investors, but it’s all kept quiet.

In August, the company tapped former White House crypto policy executive Bohines as its strategic advisor to promote expansion in the US.