Binance leads prices across a variety of central exchanges in terms of trading activity metrics, while others like OKX and Gate are strengthening their position.

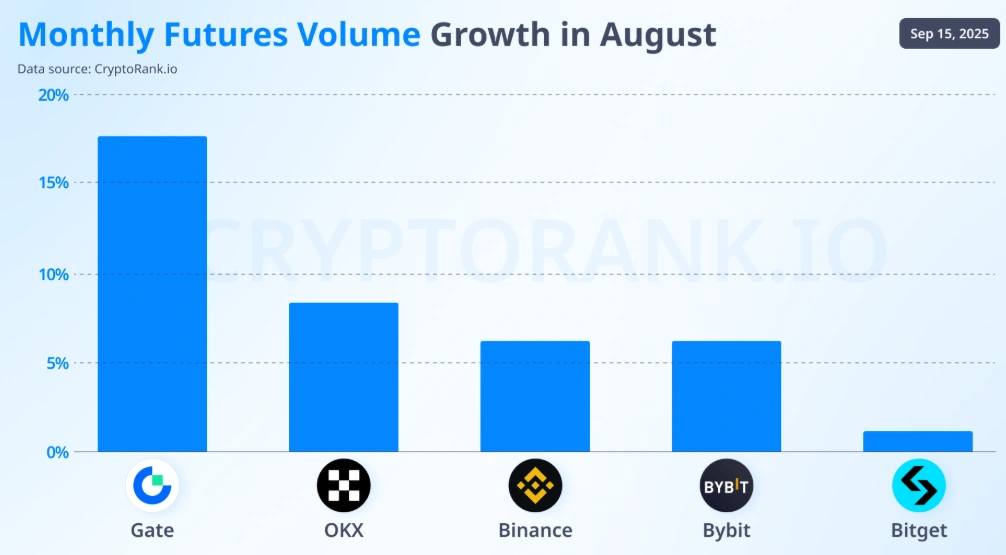

According to an August report, Gate has emerged as one of the most powerful upswing exchanges, taking on the second global position behind Binance in August, and Binance’s second global position.

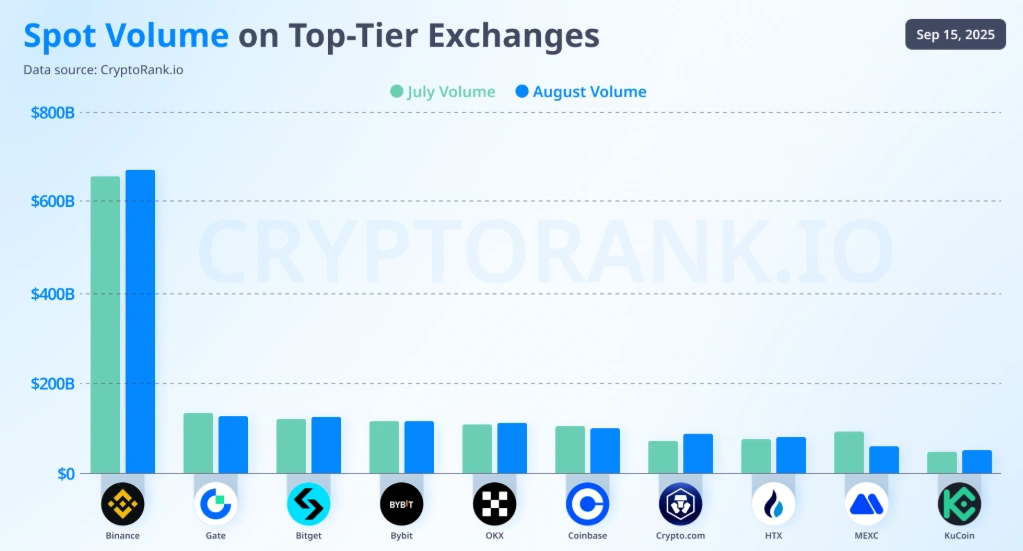

Binance maintains a lead in the spot volume. Source: Cryptorank

Binance also dominated the futures market in August, recording more than $3.25 trillion, while OKX was $1.26 trillion, with gates growing to $92.3 billion in the same month.

As far as trading volumes go, Binance remains the only exchange to consistently capture more than a third of its market share. His position as a leader in the exchange space continues in the face of regulatory pressures and extreme market volatility.

The gates were most acquired in terms of monthly futures volume. Source: Cryptorank

Binance is leading, but trading volume has declined completely

Compared to the 2024 frenzy, trading volumes were relatively restrained in early 2025, but we are looking forward to rebounds driven by institutional adoption before the end of the year.

In the second quarter, Bitcoin peaked at $83,000, at $111,900, closing the quarter at nearly $106,000, but most other assets witnessed limited recovery, and Altcoins experienced a sharp decline in liquidity.

Fortunately, the crypto market capitalization was recovered by the end of the second quarter, showing a quarterly increase of 28.2% after a strong first quarter revision. Analysts believe this recovery is attributed to an influx of ETF products and a Bitcoin rally.

Federal Reserve rate reductions and improved employment data also support sentiment. However, geopolitical tensions and slower global progress have affected stronger rebounds, while ongoing macro uncertainty and slower regulatory progress continue to weigh activities.

Careful investor sentiment played a major role in reducing the volume of trading across the exchange. That attention did not go away in the second quarter.

In the first quarter, spot trade volume was $51 billion per day, but fell to $40 billion in the second quarter. Spot trading totaled $3.63 trillion, down 21.7% from the first quarter’s $4.6 trillion, while derivative trading statistics fell 3.6% from the previous quarter to $20.2 trillion. The average daily trading of derivatives also fell from $233 billion to $226 billion.

Third quarter is at the tail end, but new market momentum, Bitcoin price recovery above $100,000, and increased tail-tails of the regulation show a marked recovery in centralized cryptocurrency spot trading volume compared to the modest levels observed in Q2.

Although there are a few days left before Q3 ends, the volume has already surpassed the total for the second quarter, showing an increase of around 19-25% per quarter if the current trend continues.

Exchanges are expanding their offerings

Over the past two months, major centralized exchanges have demonstrated a complete commitment to evolving into a complete ecosystem that can deliver far beyond spot and derivative trading services.

The platform deploys on-chain products, layer 2 networks and integrated wallets to ensure long-term relevance. Binance has expanded its tokenization partnership and has recently invested in interesting projects such as the Viral $Aster token through YZI Labs.

Meanwhile, OKX is also making progress in X-layer blockchain and multi-chain wallets.