Australia-based Propunk Biopharma announced it has secured $100 million from a crypto-focused family office to launch a crypto treasury. The company’s CEO described the move as “transformational” as the company’s cancer treatment products enter human trials next year.

The private placement is structured through convertible preferred stock and provides Propanc with an initial investment of $1 million and up to $99 million in additional funding over the next 12 months from Hexstone Capital, a family office that invests in multiple crypto treasury companies.

The cancer treatment biotechnology company said the proceeds will be used to build a digital asset vault and accelerate the development of its lead cancer treatment, PRP, with a goal of starting first-in-human clinical trials in the second half of 2026.

Propanc CEO James Nathanielsz said the crypto treasury will support the company’s “transformation phase” by strengthening its balance sheet and evolving its proenzyme-based oncology platform.

“Based on the mechanism of action of proenzyme therapy, it can be targeted not only to patients suffering from metastatic cancer caused by solid tumors, but also to several chronic diseases.”

Propanc hasn’t disclosed which digital assets it plans to purchase for its crypto assets, but Hexstone’s customers have invested in everything from Bitcoin (BTC), Ether (ETH), Solana (SOL), Injective (INJ), and even lesser-known cryptocurrencies.

Biotech companies adopting crypto strategies

Propanc joins Sonnet BioTherapeutics, Sharps Technology and other biotech companies that have turned to cryptocurrencies to reignite investor interest.

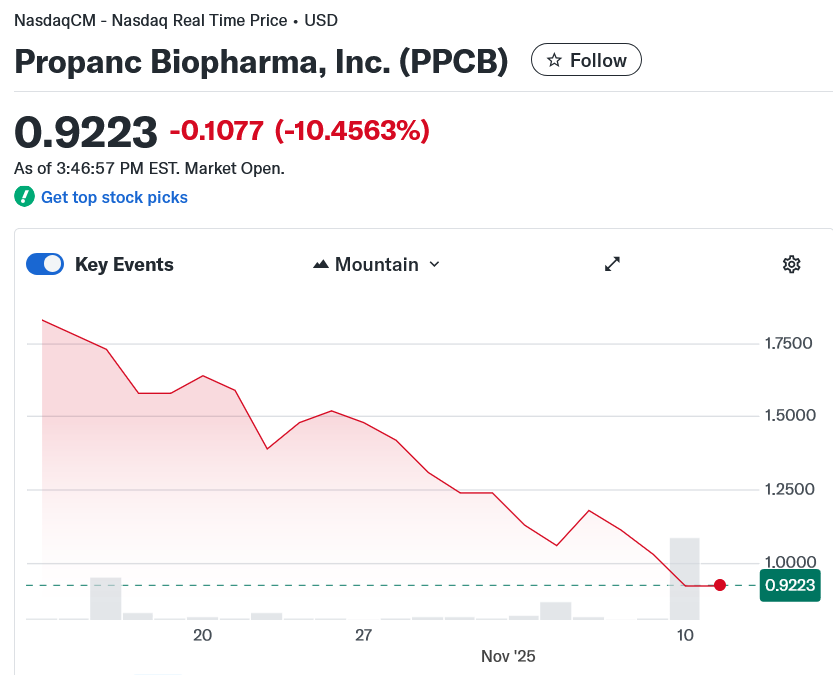

But propane’s move was not well-received by investors, with PPCB shares plummeting 10.5% on the Nasdaq market on Monday, according to Yahoo Finance data.

PPCB stock is currently down 46.7% from last month. sauce: Yahoo Finance

Cryptocurrency strategy hasn’t been going well lately.

Bitcoin treasury holding companies have lost some of their luster over the past few months as more companies enter the space.

Related: “The most hated bull run ever?” 5 things to know about Bitcoin this week

Even Strategy, the largest corporate Bitcoin holder, has seen its market capitalization fall by more than 43%, from $122.1 billion in July to $69.1 billion now.

Metaplanet, one of the best-performing stocks on the Tokyo Stock Exchange to start the year, was hit even harder, falling about 55% since late June, and other Bitcoin treasury companies had to sell some of their Bitcoin holdings to pay outstanding debts.

magazine: Bitcoin OG Kyle Chasse is one shot away from being permanently banned from YouTube