Crypto Market is hindering significant movements as more than $3 billion in Bitcoin and Ethereum options expire today.

With substantial contracts and the biggest issues identified, how do these expired options affect market volatility?

Crypto sells Brace as its $3 billion option expires

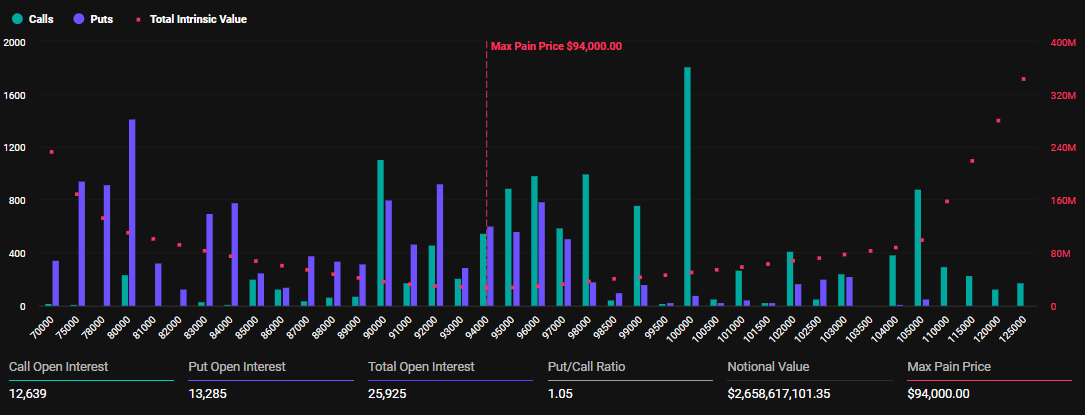

According to Deribit data, there are currently approximately $2.65 billion in Bitcoin options. The biggest problem with these options is $94,000, with a put-to-call ratio of 1.05.

The expiration date includes 25,925 contracts, slightly less than last week’s 26,949 contracts.

Bitcoin options expired. Source: Deribit

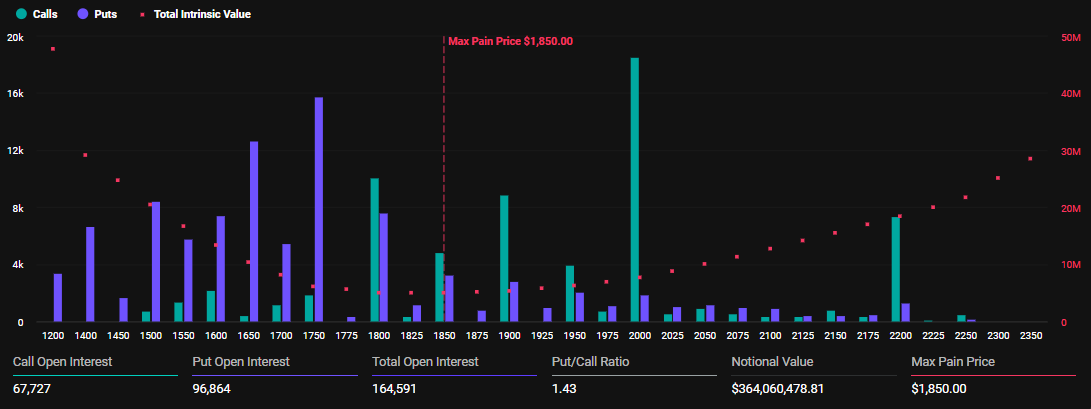

Ethereum is also seeing the expiration of its 164,591 contract. That’s lower than last week’s public interest rate of 184,296. The expected value for these expired contracts is $364.06 million. The biggest problem with these contracts is $1,850 with a put-to-call ratio of 1.43.

Ethereum option expires. Source: Deribit

Greek analysts as Bitcoin and Ethereum sales exceed purchase calls.

“This group appears bearish because traders are positioned for potential drawback movements,” writes Greeks.Live.

For Bitcoin, this sentiment is more evident by the maximum pain level, well below the current price of $102,570. Based on the theory of maximum pain, prices tend to attract these strike prices as options close to expiration dates.

Based on this, analysts at Greeks.live note that some traders are looking at price levels of $93,0000 to $99,000 for Bitcoin. They also cite the lack of enthusiasm for BTC’s forays past the $100,000 milestone.

“The market is called boring chops and is trying to capitalize the collapse of time while maintaining downside exposure,” the analyst added.

Positioning distortion is bearish, with the biggest pain below the price

On the other hand, for both Bitcoin and Ethereum, there are more put options (bearish bets) than the call option, as there are more than one Put-to-Call ratio. More traders bet that prices will go down.

The histogram in the image above checks this. BTC’s open interest chart shows a significant concentration of options contracts, particularly at strike prices below the current BTC price of $102,570, between the price of around $93,000, which is about $100,000.

This clustering of options contracts on low strikes indicates that traders are positioning for potential price drops.

It comes amidst a volatile weekend expectation that could threaten the benefits of Bitcoin. As reported by Beincrypto, envoys from China and the US will meet in Switzerland over the weekend for trade negotiations.

However, concerns remain due to the risk of a collapse of the customs talks. The meeting marks the first official trade talks as President Trump escalated tariffs on China’s imports to 145%.

But Treasury Secretary Scott Bescent has made it clear that the United States is not trying to separate. Meanwhile, in a announcement Thursday, the Chinese embassy in Washington said it would not allow attempts to pressure or force China.

China is committed to protecting legitimate interests and supporting international fairness and justice. The general sentiment is that Beijing is deeply skeptical of our intentions.

“If the United States fails to correct false, unilateral tariff measures in potential dialogues and consultations, it will demonstrate a complete lack of integrity and further undermine mutual trust.

With neither side offering concrete concessions before the meeting, crypto traders fear that the summit could end in another diplomatic stalemate.

Against this background, escalation tips can act as volatility catalysts and derail the possibility of Bitcoin’s upside down. Meanwhile, positive developments at the conference could provide a tailwind for Bitcoin, as did Trump when he announced a massive deal with the UK.

“Donald Trump has just dropped a massive new trade deal with the UK. He’s his first since rolling out global tariffs. The market is exploding. Bitcoin was the first to shoot over $100,000 for the first time since February,” the user observed on X (Twitter).