Bitcoin (BTC) has been trading below $90,000 since March 7th and is struggling to regain its upward momentum as it changes market sentiment.

On the other hand, technical indicators such as the cloud and EMA line suggest that potential reversals are not off-table, but the trend is weakening.

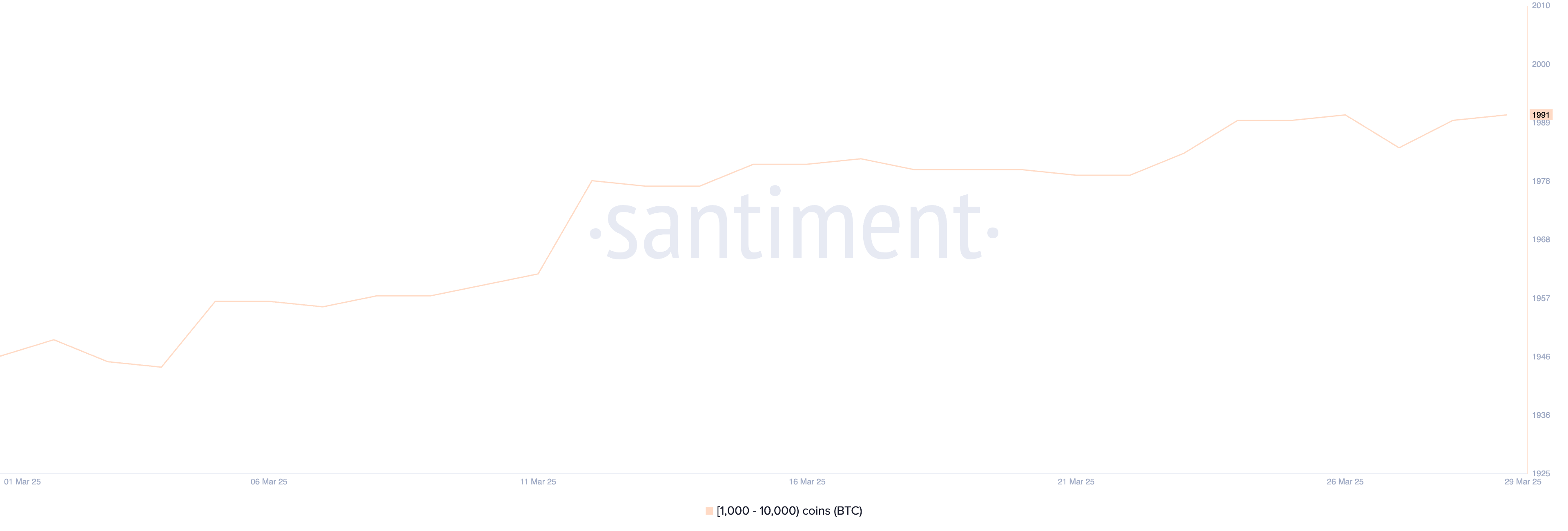

Bitcoin Zilla reached its highest level in over 3 months

The number of bitcoin jelly holding at least 1,000 btc has been steadily increasing in recent weeks. On March 22, there were 1,980 such addresses, and the number rose to 1,991.

The 11 change may seem modest at first glance, but this represents a meaningful rise in large accumulation, especially given the highest number of BTC whales recorded in more than three months.

Bitcoin jelly. Source: Santiment.

It is important to track Bitcoin Zilla as these large holders often have the power to influence price movements due to their position size. An increase in whale addresses could indicate increased trust between institutional investors and the wealthy.

If more whales accumulate rather than dispense, it often suggests bullish emotions and lower sales pressure.

With the current whale count reaching months’ highs, this could mean that key players are positioned ahead of the potential moves of Bitcoin’s price upwards.

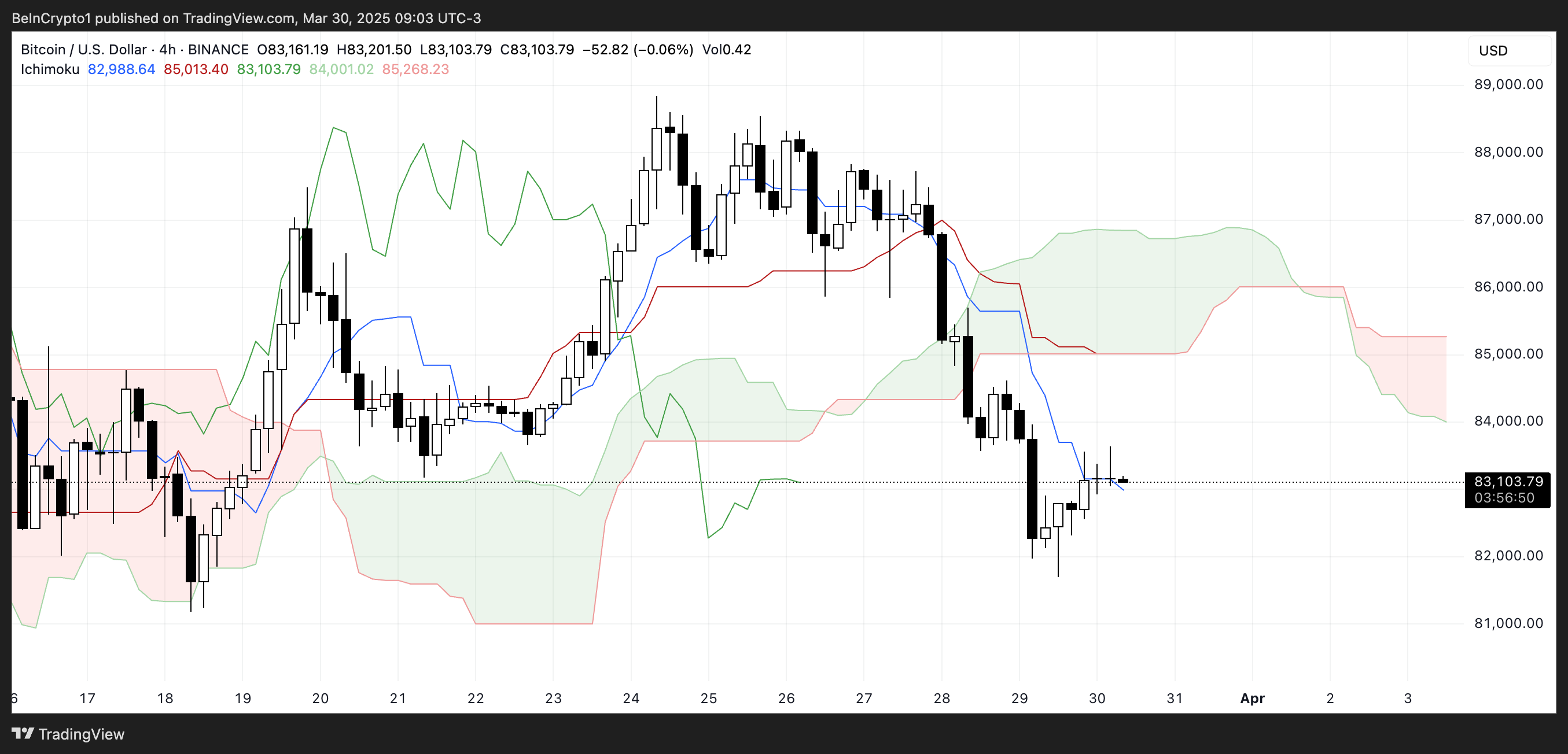

BTC Ichimoku Cloud shows future challenges

The one-sided cloud chart for Bitcoin shows that after a strong downward movement, the price is integrated just below the Kijunsen (red line).

The Tenkan-Sen (blue line) remains beneath Kijun-Sen, indicating short-term bearish momentum. Price action is about to stabilize, but has yet to show any critical changes in the trend.

The delayed span (green line) lies under both the price and the cloud, reinforcing the bearish outlook from a historical perspective.

btc icchimoku cloud. Source: TradingView.

The previous spider (cloud) is bearish, with a senkou span A (green cloud boundary) located below the senkou span B (red cloud boundary), and the cloud itself is projected downward.

This suggests resistance overhead and limited bullish momentum, unless prices can break through the cloud decisively.

However, the current thin structure of the cloud suggests possible vulnerabilities. If the buyer intervenes with strength, there could be a window of inversion.

But for now, the overall setup remains a general trend following table tennis principles, so we’re cautious.

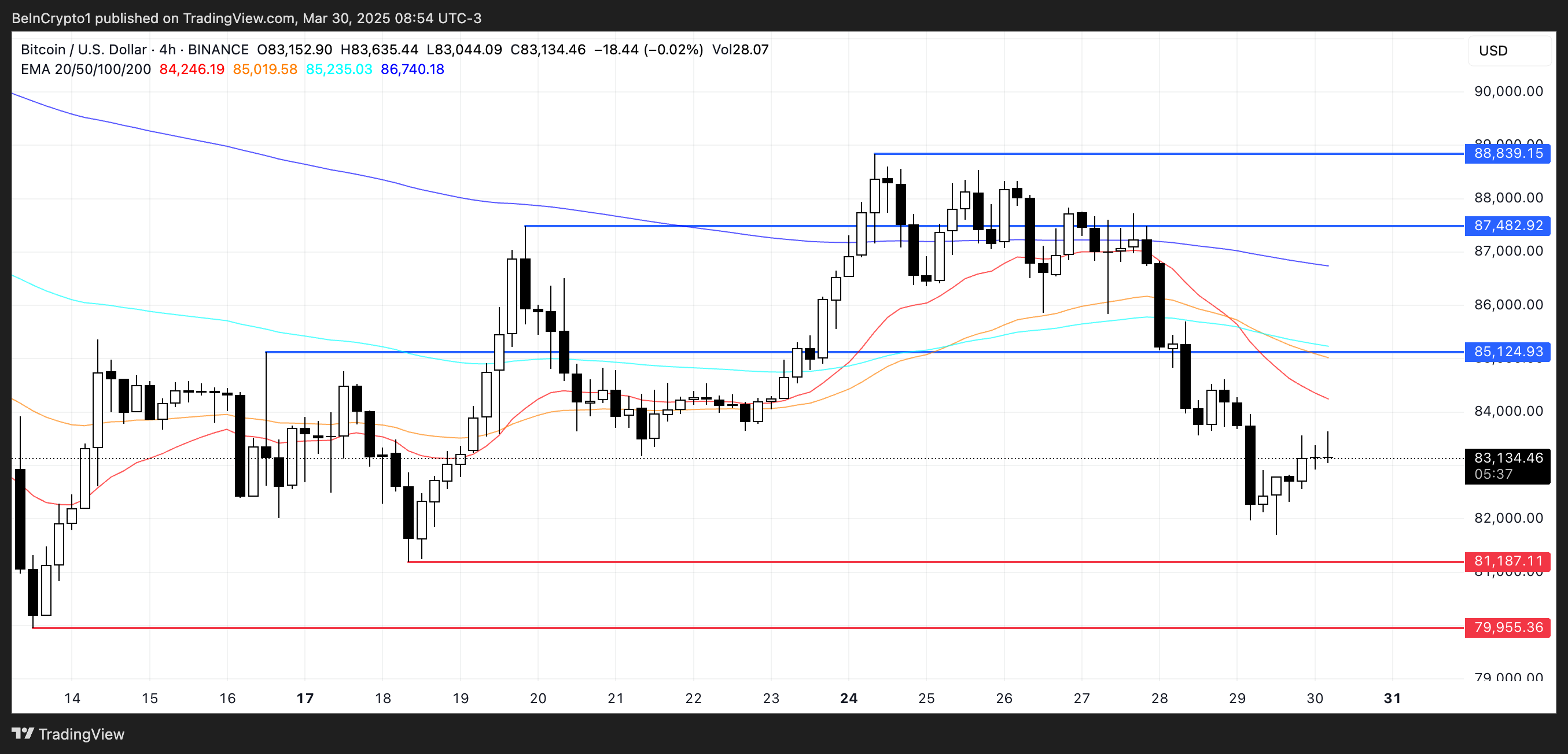

Can Bitcoin test $88,000 immediately?

Bitcoin’s EMA line continues to show a downward trend, with the short-term moving averages below the long-term ones. This alignment suggests that bearish momentum remains dominant for now.

However, if buyers can regain control and establish an uptrend, Bitcoin prices could rise towards the next major resistance level.

The first challenge is resistance of nearly $85,124. If it breaks, this could pave the way to $87,482 and potentially $88,839, assuming that bullish momentum will be strengthened and maintained.

BTC price analysis. Source: TradingView.

Conversely, failing to build upward momentum strengthens the current bearish structure.

In that case, Bitcoin could revisit a support level of around $81,187.

This breakdown below points could further examine the downtrend and reduce the price to $79,955.