Bitcoin price weekly outlook

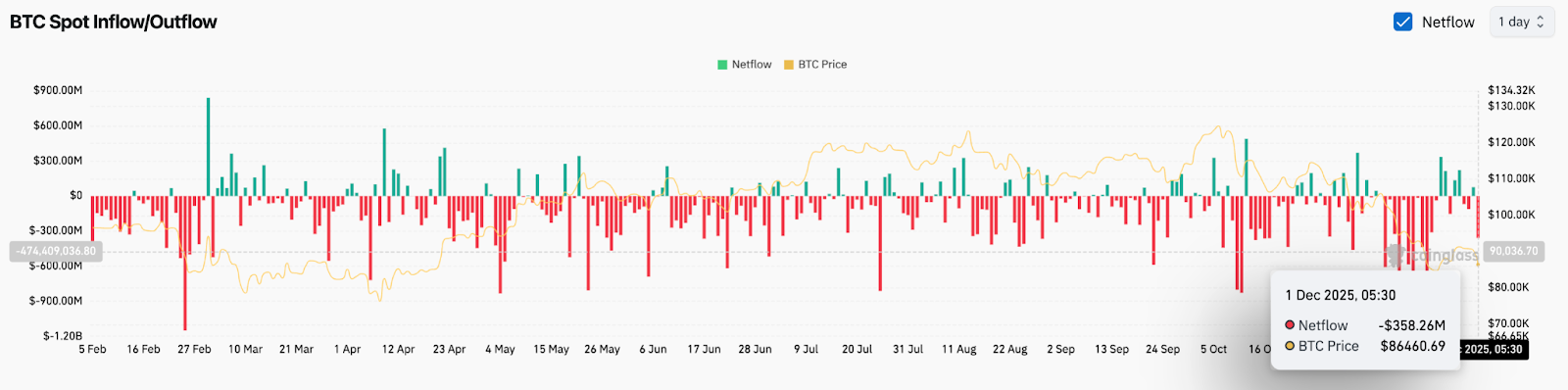

Last week was a bit of a roller coaster, with the bears pushing the price down to the $84,000 support level at the beginning of the week, but the bulls stepping in and pushing the price to the $94,000 resistance level. From there, the price fell again to just below $88,000 on Sunday morning, before rebounding slightly to end the week at $90,429. This week, Bitcoin bulls will look to Wednesday’s FOMC meeting for a long-awaited interest rate cut to foster a better investment environment for Bitcoin and other assets. If the bulls want to move the market in their favor, a break above $94,000 will be key this week.

Current major support and resistance levels

Bitcoin ended the week on a doge candlestick on Sunday, showing indecision among buyers and sellers. The short-term outlook is slightly in favor of the bulls, who are trying to overcome the $94,000 resistance level. If this level is established as support, we will focus on $101,000 as the next major resistance level, with sellers likely to start losing momentum above $96,000. Above $101,000, we will focus on the resistance zone at $104,000 and between $107,000 and $110,000. Above $100,000, the resistance becomes very thick.

Turning to the support level, the bulls would want $87,200 to remain the daily close to avoid further testing of the support level below $84,000. Touching another $84,000 weakens it and makes it less likely to stay in place as a floor. There is a support zone between $72,000 and $68,000 that will push the price below this. Below $68,000, the price may decline some, but it will sustain the 0.618 Fibonacci retracement at $57,700. However, even if this level does arrive, it is unlikely to be tested for at least a few weeks.

This week’s outlook

Short-term momentum has given the bulls a slight advantage early this week. The Relative Strength Index (RSI) on the daily chart shows some positive development, creating higher highs from the 13 SMA support. This week, bulls will hope that the 13 SMA will continue to act as support and help push the RSI above 60 and into bullish territory. As long as the bulls can maintain above support levels heading into Wednesday’s FOMC meeting, they have a chance to challenge higher levels with rate cuts. If no rate cut is announced at the FOMC meeting and everyone is surprised, the $84,000 support is expected to fail.

Market atmosphere: Very Bearish – The bulls have managed to see a small rally here over the past two weeks, but price action has been lackluster and the situation remains in favor of the bears.

coming weeks

The bearish cross on the monthly MACD oscillator will continue to weigh on prices throughout December, and likely into January, unless there is a significant price increase to offset it. Bitcoin price continues to rise heading into this week and needs to maintain a close above its 100-week simple moving average (SMA) at $84,700. Even if the bulls manage to maintain momentum over the next few weeks, there is significant resistance above $110,000, and it is very likely that the price will pull back from that level (or below) on the weekly chart. Doing so would provide a convincing low on the weekly chart and give bears new confidence that the long-term upside is sustained.

Terminology guide:

Bulls/Bulls: Buyers and investors who expect prices to rise.

Bearish/bearish: Sellers and investors who expect prices to fall.

Support or support level: The level at which the price of an asset should be maintained, at least initially. The more you touch the support, the more likely it will weaken and the price will not be able to sustain itself.

Resistance or resistance level: Opposite of support. A level where the price is likely to be rejected, at least initially. The more times you touch the resistor, the weaker it becomes and the more likely it is that you won’t be able to keep the price down.

SMA: Simple moving average. Average price based on the closing price for the specified period. For RSI, it is the average strength index value over a specified period.

Fibonacci retracements and extensions: The ratio is based on what is known as the golden mean, a universal ratio that relates to cycles of growth and decline in nature. The golden ratio is based on the constants Phi (1.618) and Phi (0.618).

Oscillator: A technical indicator that changes over time but typically stays within a range between set levels. Therefore, they fluctuate between low levels (usually representing oversold conditions) and high levels (usually representing overbought conditions). EG, relative strength index (RSI) and moving average convergence divergence (MACD).

RSI oscillator: The relative strength index is a momentum oscillator that varies between 0 and 100. Measures changes in price velocity and speed of price movement. An RSI above 70 is considered overbought. An RSI below 30 is considered oversold.

MACD Oscillator: Moving Average Convergence Divergence is a momentum oscillator that subtracts the difference between two moving averages to indicate trend and momentum.

This article, Bitcoin Bullseye’s $94,000 Breakout Ahead of Important FOMC Rate Cut Decision, originally appeared on Bitcoin Magazine and was written by Ethan Greene – Feral Analysis and Juan Galt.