Gold’s momentum has reached unprecedented levels, raising questions about what’s next for not only the precious metal but also the crypto market, especially Bitcoin (BTC).

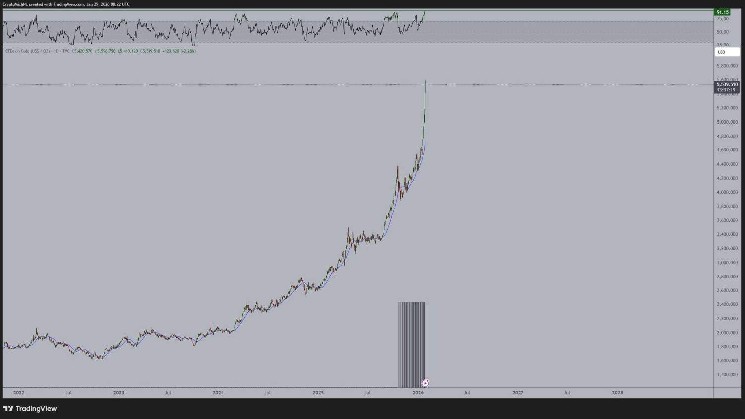

That is, the price of gold currently has a Relative Strength Index (RSI) above 91, a level that has only been reached once in history, in December 1979, just before a prolonged period of decline.

A similar thing happened in August 2020, when gold soared to record highs again, just before Bitcoin rose, consolidating almost six-fold in the ensuing cycle.

Naturally, historical similarities have investors wondering if gold is once again nearing a consolidation phase, potentially setting the stage for a new rise in digital gold.

According to Michael van de Poppe, a macro market expert and crypto trading analyst, the current settings for gold are historically extreme and could have an impact on Bitcoin.

“Gold’s RSI has only exceeded 91 once, in 1979. It has now exceeded it in August 2020, which has been followed by a consolidation in gold and a 5-6x increase in Bitcoin.” Van de Poppe said.

Gold rises to record high

Gold’s ongoing rally is largely a result of escalating geopolitical tensions and a weaker US dollar, with markets reacting to US President Donald Trump’s renewed threat of military action against Iran.

In fact, on Thursday, bullion topped $5,500 an ounce, up more than 20% since the beginning of the year. By comparison, precious metals soared a total of 64% last year, thanks to the new administration’s overhaul of global trade relations and international institutions.

Gold’s strong performance is also supported by waning confidence in other traditional safe-haven assets, particularly government bonds, as investors grow increasingly concerned about the size of public debt across major developed economies, including the United States.

Meanwhile, the Federal Reserve kept interest rates unchanged on Wednesday, January 28, keeping the benchmark policy rate in the range of 3.5% to 3.75%. Fed Chairman Jerome Powell said at a news conference after the decision that the Fed would consider cutting interest rates if inflation showed clearer signs of easing.

Bitcoin’s trajectory is unclear

As for cryptocurrencies, the fate of Bitcoin remains unclear. The market is currently weighing weakening technical signals against the possibility of new institutional demand.

Therefore, regulatory catalysts are in the spotlight, as upcoming debates over U.S. cryptocurrency laws and the possible outline of a U.S. strategic Bitcoin reserve could either free up new institutional capital or increase uncertainty.

However, whale accumulation provides support. Large holders are buying en masse, tightening the supply of liquid in the process. Historically, such activity has tended to precede periods of increased volatility.

Overall, the market appears to be in a waiting phase, with investors closely monitoring new policy developments that could tip the balance towards the next big move in a situation characterized by extreme gold momentum and changing macroeconomic conditions.

Featured image via Shutterstock