Bitcoin mining difficulty decreased by 11.16% to approximately 12.586 billion at the latest retargeting boundary around block 935,424.

This is the largest negative correction since the Chinese mining ban in 2021, the sixth consecutive downward revision target, and the 10th largest negative correction in Bitcoin history.

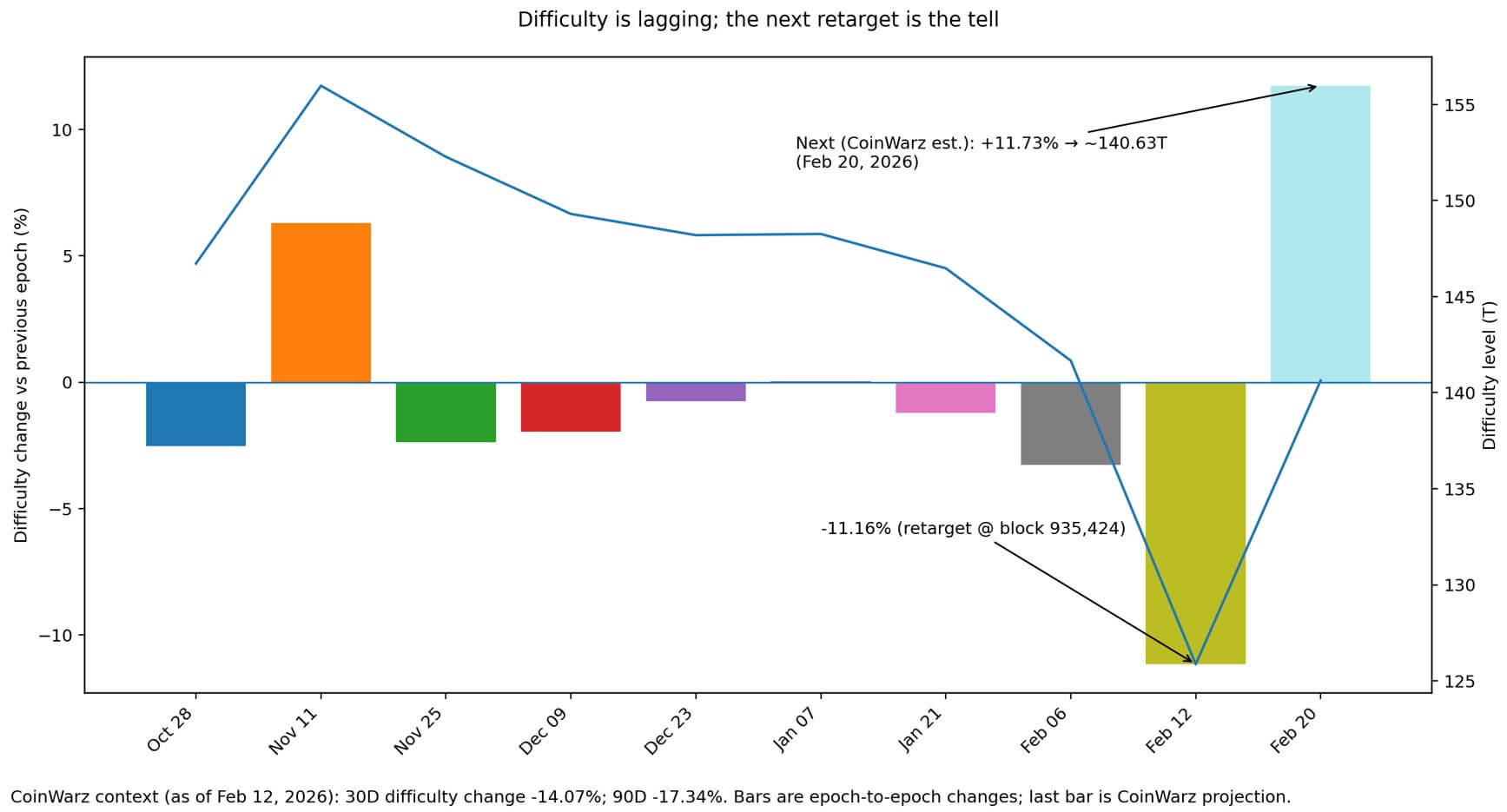

However, the difficulty adjustment is a lagging indicator, as it reflects what has happened over the past 2,016 blocks, rather than what is currently happening.

The real question is whether the machine that disappeared into the shadows will return, or whether this retargeting marks the beginning of a more serious shakeout of miners.

The most useful forward signals are the following adjustments: CoinWarz has already estimated a 12% pullback around February 20th, suggesting that the hashrate is recovering quickly.

This is a move more consistent with reductions in production activity and short-term economics than with a structural exodus of miners. If that recovery doesn’t materialize and the difficulty continues to decline, “surrender” becomes more than just a headline.

Three drivers, only one surrendered

A decrease in difficulty indicates that block times have become slower compared to the previous epoch, indicating a decrease in online hashrate.

But three different forces can take a hashrate offline, and they don’t all mean the same thing.

Mandatory business closures and power outages are temporary. Winter Storm Fern hit U.S. miners in early February, forcing grid-connected operations to shut down during peak demand.

Foundry’s pool hash reportedly decreased by approximately 60% at the peak of the disruption. If miners scale back operations during a power grid emergency, hashrate can disappear overnight, but can quickly come back when the weather improves.

Although these types of offline events may seem dramatic in terms of difficulty numbers, they are not indicative of financial hardship.

An economic-driven shutdown borders on capitulation.

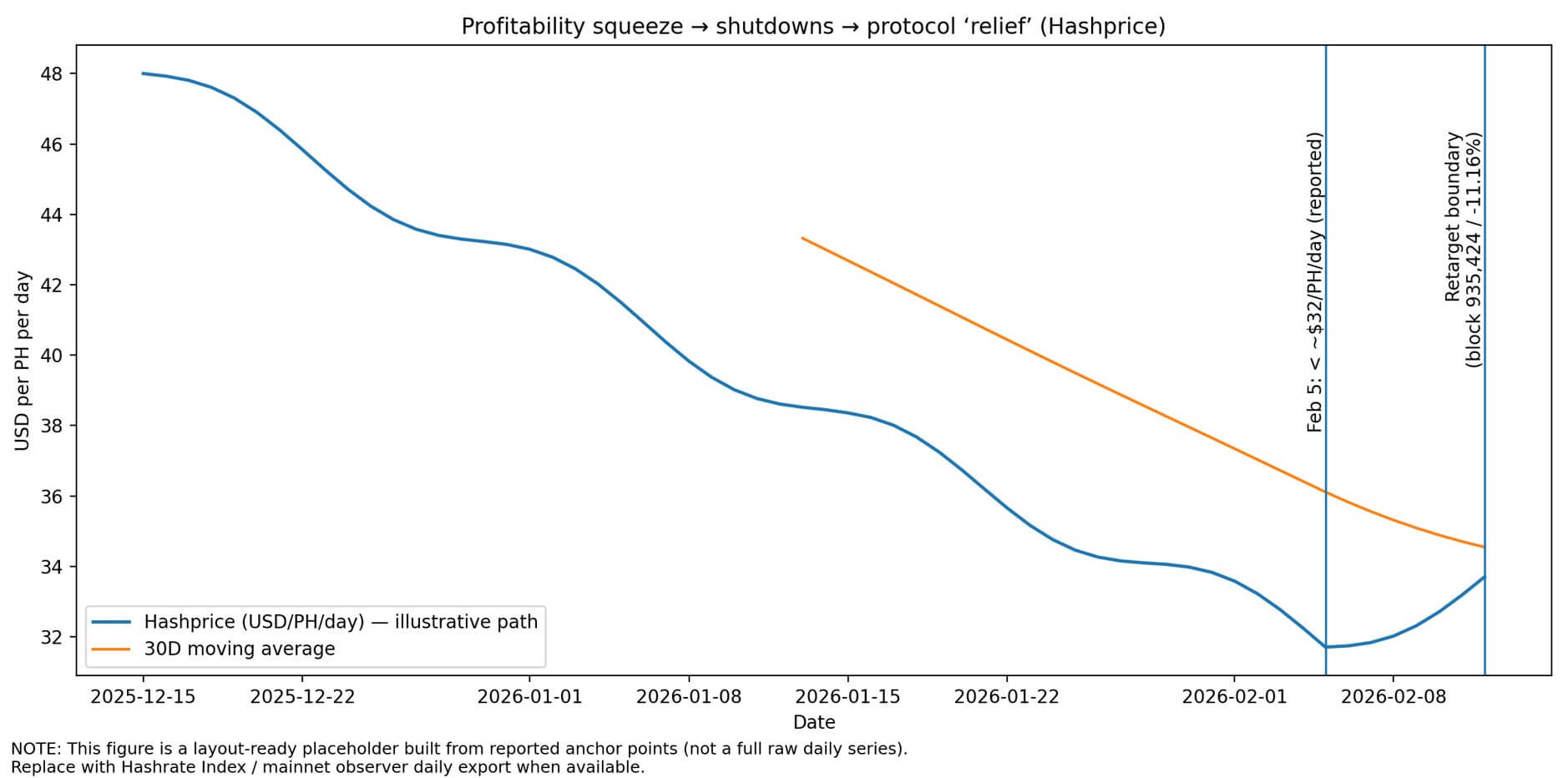

The revenue per unit of hashrate, known as the hash price, hit a record low in early February. TheEnergyMag reports that hash prices are below $32 per petahash per day, and Hashrate Index data shows real-time hash prices hovering in the low $30s.

When hash prices collapse, marginal fleets running older ASICs or paying higher power costs will be shut down. It could be surrender, but it could also be reasonable idling. Miners are waiting for difficulties to reset and profitability to improve before turning the machine back on.

The protocol rewards that patience. When the cut difficulty reaches 11.16%, the expected Bitcoins earned per unit hash increases by approximately 12.6% until the hashrate returns, creating a brief honeymoon of profitability for survivors.

The structural changes represent a slow-burning surrender. Some miners are increasingly treating Bitcoin mining as an optional workload, with AI and high-performance computing datacenter axes emerging alongside miner stress coverage.

If companies are reallocating capital from ASICs to data centers, hashrate that goes offline may not come back, at least not right away. It’s a different kind of capitulation, a strategic retreat.

Surrender Checklist: What to Look for

Two-digit negative retargeting can have completely different meanings depending on subsequent events. Treat it like a diagnostic test, not a verdict.

The behavior of the protocol and hashrate indicates whether the machine is coming back or not. The hashrate rebound speed is the clearest signal. A rapid snapback within hours or days indicates suppression, while a slow grind indicates deeper stress.

The next retargeting projection is a proxy. CoinWarz’s 12% rebound prediction means the hash is already coming back. If this prediction holds true, then the decrease in difficulty is due to a temporary delay in offline capacity.

Difficulty paths across multiple epochs are also important. One big price drop followed by a rebound is not capitulation. Multiple consecutive cuts define a stress regime.

Cumulative difficulty has already dropped by two orders of magnitude over the past 30-90 days. This means that this retargeting was not the first sign of trouble, just the loudest one.

Changes in pool concentration can reveal real-world capacity reallocation. If a large pool loses market share structurally rather than temporarily, it is an indication that the mining infrastructure will change hands or be taken offline permanently.

In that context, the Foundry’s disruption during the storm is noteworthy.

Minor economics explains why machines stop in the first place. Hash price and “pain threshold” are the central metrics.

Record or near-record lows are when marginal rigs go dark. The drawdown in Bitcoin price relative to difficulty creates a squeeze. If the price drops faster than the difficulty resets, the stress will spike.

This is the macro relationship of why this is happening now. Fee support, which is the percentage of block rewards derived from transaction fees rather than subsidies, is also important.

If fees do not reduce subsidies, miners will live or die on price and efficiency. Hash price stress is amplified in a low price environment.

It is usually balance sheet stress that shows true capitulation.

Miner selling pressure, such as a spike in flows from miners to exchanges or a drawdown of reserves, is a sign of forced liquidation.

Financing actions for public miners, including emergency debt and equity capital increases, asset sales and restructuring language, also warn of distress.

Pricing in the ASIC secondary market is also different, with steep declines in used ASIC prices suggesting forced liquidation, while stable pricing suggests temporary offline capability rather than bankruptcy.

weather, economy, structure

Weather whiplash is a temporary case. Due to functional limitations and outages, the hashrate will be taken offline and the difficulty level will decrease, but the hashrate will quickly return once the situation normalizes.

In this scenario, the next retarget will flip positive, exactly as CoinWarz predicts. This scenario means that the difficulty reduction was mostly working.

The network adjusts, increasing profitability for users who remained online and returning offline capacity.

Economic reconstruction is a classic surrender. Hashprice remains depressed, Bitcoin prices remain depressed, and the old fleet remains offline because it makes no sense to operate at a loss.

We see repeated negative corrections over multiple epochs, increasing miner sales and decreasing ASIC resale prices.

This creates short-term selling pressure risk and long-term industry consolidation as weaker players exit and stronger players acquire distressed assets.

Structural reset is the path to data center reallocation. Some companies treat mining as interruptible and reallocate capital to AI and high-performance computing. Hashrate becomes seasonally and price dependent, difficulty adjustments become more erratic and more volatile.

Bitcoin’s security budget is increasingly tied to broader computing and energy markets. This is not a crisis, but it does change the dynamics of how hashrate reacts to price.

What the rebound says

The following retargeting will most clearly test which scenario is playing out. As predicted by CoinWarz, if the hashrate recovers quickly and the difficulty level recovers, the “surrender” narrative will disappear.

While this decline was real, it reflected temporary disruptions such as weather, short-term economic conditions, and reasonable idling.

Miners who stayed online captured a honeymoon of profitability, difficulty reset to match the returned hashrate, and the network moved forward.

The stress will only deepen further if the rebound does not materialize, but that is unlikely. But if the difficulty drops in a few more epochs, it means the offline hash rate won’t come back anytime soon, either because the economics don’t support it or because capital has moved elsewhere.

If that happens, we can expect balance sheet stress signals to start flashing, such as higher selling prices, funding scrambles, and ASIC liquidations.

The reduction in difficulty itself is backwards.

Over the past two weeks, we have seen a significant portion of our hashing power taken offline for financial and operational reasons.

What matters now is whether those machines come back, and the answer will appear in next week’s data.

The protocol doesn’t care about the narrative, it just adjusts to the hashrate it sees.

Whether this retargeting was temporary or the beginning of an exodus of miners depends on what happens next, not what has already happened.