As gold continues to set new history highs (ATH) – trading At the time of writing, $3,333 per ounce – Bitcoin (BTC) is seeing a more modest price action, consolidating in the $80,000 range. However, analysts suggest that top digital assets could soon reflect Gold’s recent momentum.

Are you set to follow the momentum of gold?

recently post In X, Crypto Trading account Cryptollica suggested that BTC may be poised to replicate the historical price movements of gold seen over the past few months. The account shared the following chart, highlighting the impressive similarities between gold and BTC price action.

The chart shows that both gold and BTC formed a macro bottom in early 2023 and were rejected at the top of the range in early 2024.

According to Cryptollica, BTC currently appears to be escaped from the linked wedge pattern. Currently, Bitcoin’s As is $108,786, recorded in January this year.

BTC could also benefit from some positive macroeconomic trends. For example, the global M2 money supply is increase Development in 2025 that normally supports risk-on assets such as Bitcoin.

BTC maturation as a safe haven

Beyond technical chart patterns, BTC demonstrates something amazing Resilience amidst the escalation of uncertainty due to global tariffs. According to the latest The Week On-Chain report, both Gold and BTC worked well during the ongoing tariff war. Report Note:

Amid this confusion, the performance of the hard assets remains very impressive. Gold has reached a new $3,300 ATH, and continues to surge even higher as investors flee to traditional safe haven assets. Bitcoin initially sold to $75,000 along with risky assets, but then recovered this week’s profits and has now become flat since this burst of volatility.

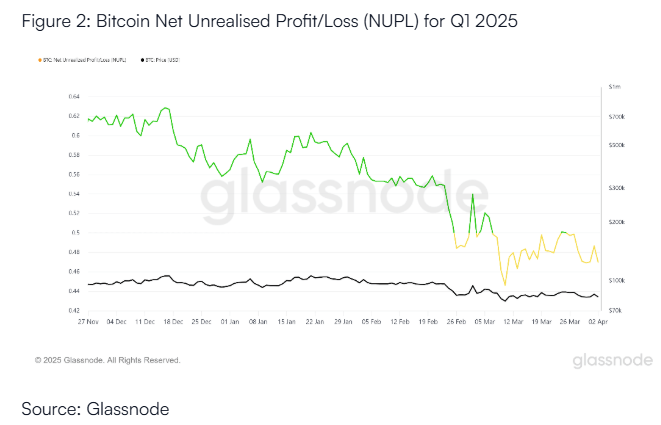

The report also states that BTC has recently experienced the largest price correction of 2023-25 cycles, experiencing a -33% drawdown from the ATH earlier this year. However, this correction remains relatively modest compared to what has been seen in previous market cycles.

The following chart shows the revised drawdowns for BTC Bull Market since 2011. As shown, the recent -33% revision is the shallowest of the past cycle, with the deepest in the bull market in 2012-14 at -72%.

BTC continues to show signs of maturity as a reliable asset in times of geopolitical uncertainty, but institutional investors appear To make a profit. This is evidenced by a recent spill from Bitcoin Exchange-Traded Funds (ETFs). At the time of pressing, BTC has been trading at $84,694, up 0.7% over the past 24 hours.

Featured images from Unsplash, X, GlassNode, and TradingView.com charts