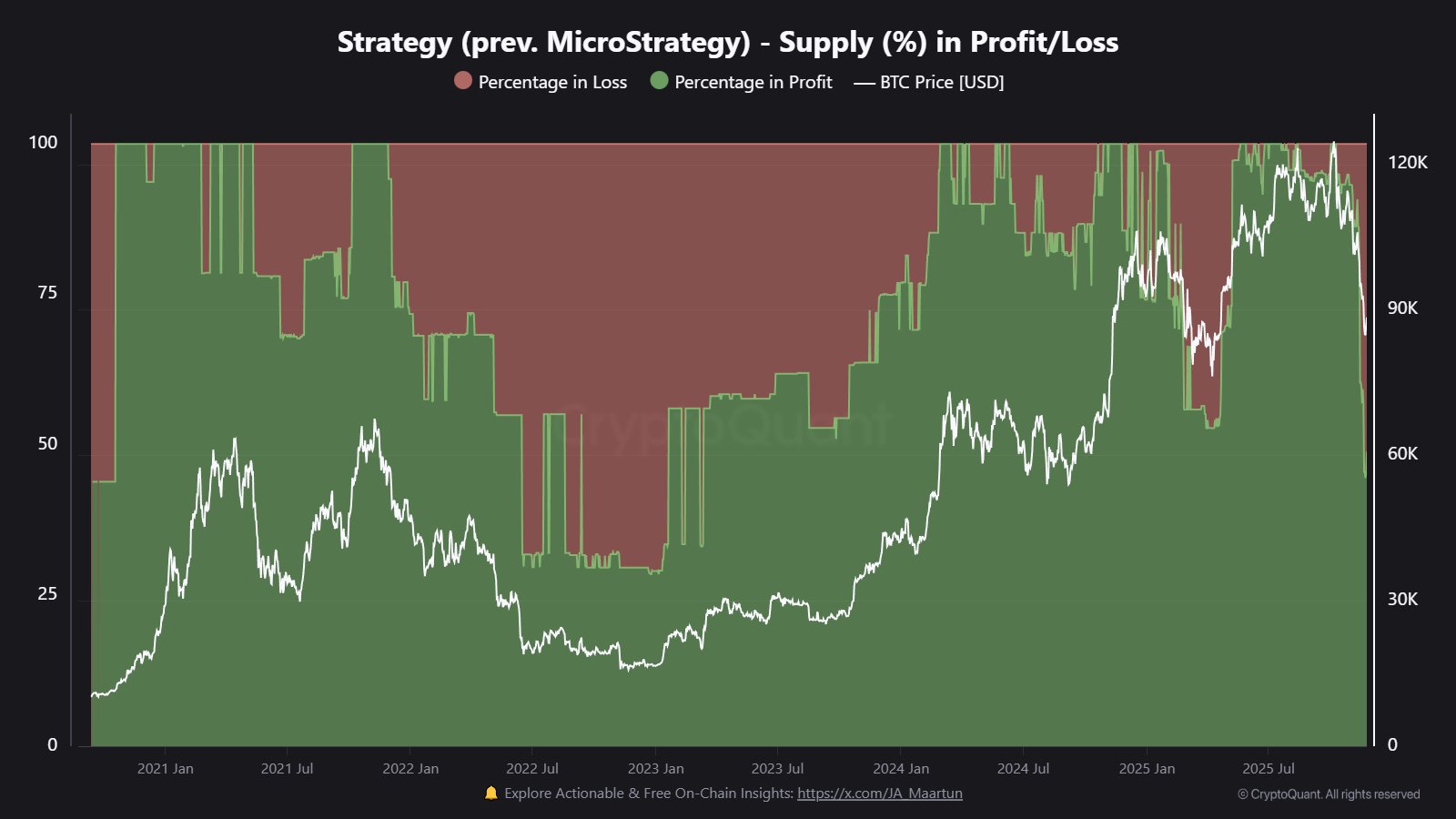

Strategies, a company that has built its entire identity around buying Bitcoin nonstop, stumbled upon exactly the numbers you didn’t want to see. According to CryptoQuant analysts, more than 51% of the company’s total Bitcoin assets were purchased at higher prices than current prices, and this type of statistic could completely change how the market views the company’s position.

At the moment, Strategy holds 649,870 BTC, making it the largest corporate pile in the world with an average cost of $74,430. That means the company is still profitable and Bitcoin is trading near $86,900. But averages aren’t the whole story here.

The question is where did you buy it? Many of Strategy’s coins were created during expensive periods in 2021, 2024, and early 2025. Back then, BTC was much higher than it is now. Especially since it’s 2025, more than half of the stash is now below the entry price.

All of this came to light after Bitcoin fell from over $120,000 to low $80,000 in a short period of time. This decline pulled BTC back into the zone where Strategy had most of its biggest buys.

Older coins purchased at deep cycle levels below $20,000 are still rising. The later rounds, the expensive ones, are not.

Stock angle adds more pressure

MSTR is trading near the lower end of the Bitcoin-based valuation band. Strategy has a market capitalization of about $49 billion, but the value of its Bitcoin holdings is about $56.4 billion. This means the stock is trading below its BTC value.

The 51% number doesn’t put Strategy in any danger, but it does show how much the company overpaid. It is clear that the success of Bitcoin is now tied to Bitcoin and that Bitcoin has reached a level where it has made the biggest purchase.