With cryptocurrency, analysts scratched their heads trying to identify the perpetrator behind the price action. Meanwhile, the institution simply took advantage of discounts.

The engine is loaded into BTC as BTC slips below $115k

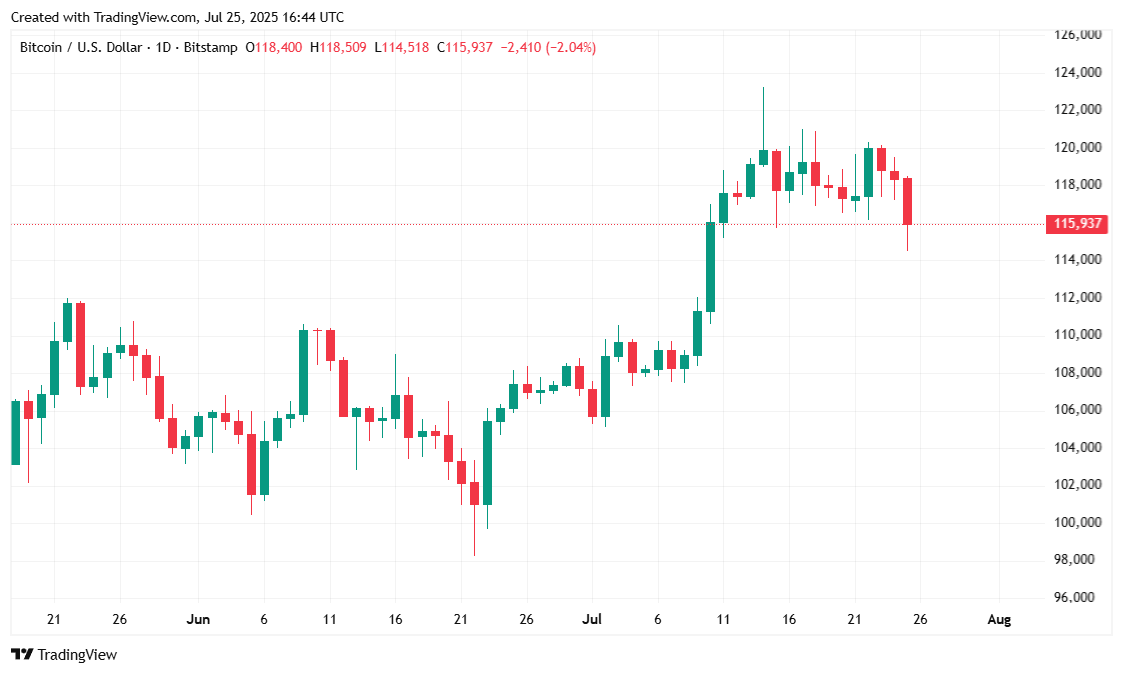

Bitcoin (BTC) is known for being unstable, but a 3% retreat on Friday was caught by many surprises. Digital assets traded within an unusually wide range, peaking at $119,535.45, immersed in $114,759.82 over the last 24 hours. Some lamented the volatility, but the agency went crypto shopping.

According to a press release released Friday, electric vehicle (EV) manufacturer Volcon, Inc. (NASDAQ: VLCN) purchased 3,183.37 BTC at an average purchase price of $117,697 per coin. The company says it launched its Bitcoin financial strategy last week.

(Volcon manufactures EVs such as this utility task vehicle (UTV), but recently adopted Bitcoin Treasury Strategy. / volcon.com)

“Our financial strategy reflects Bitcoin’s conviction as a durable long-term value and a strong Treasury reserve asset,” said Volcon co-CEO Ryan Lane. “As a continuing aggregator for BTC, we will leverage our team’s decades of hedge fund experience to implement creative ways to lower the effective purchase price of BTC.”

And it appears that Volcon is just starting out. The company said it would “want to buy additional BTC for $115,000, $116,000 and $117,000.”

Another company, The Smarter Web, a public British Web Design company, also announced its purchase of Bitcoin on Friday. According to a press release, the company began accepting Bitcoin payments in 2023 and implemented its official 10-year BTC acquisition strategy in April 2025. Smarter Web purchased 225 Bitcoin and currently holds a total of 1,825 BTC at the Ministry of Finance.

If BTC retreats are always rushed by institutions to “buy DIP” anytime, then as some have assumed, Bitcoin winter days may now be a thing of the past.

Market Metric Overview

Bitcoin was down 1.72% over seven days, down 115,890 at the time of reporting, down 2.74% over the past day. As mentioned above, the volatility was relatively high, with prices rising between $114,759.82 and $119,472.65.

(BTC Price/Trade View)

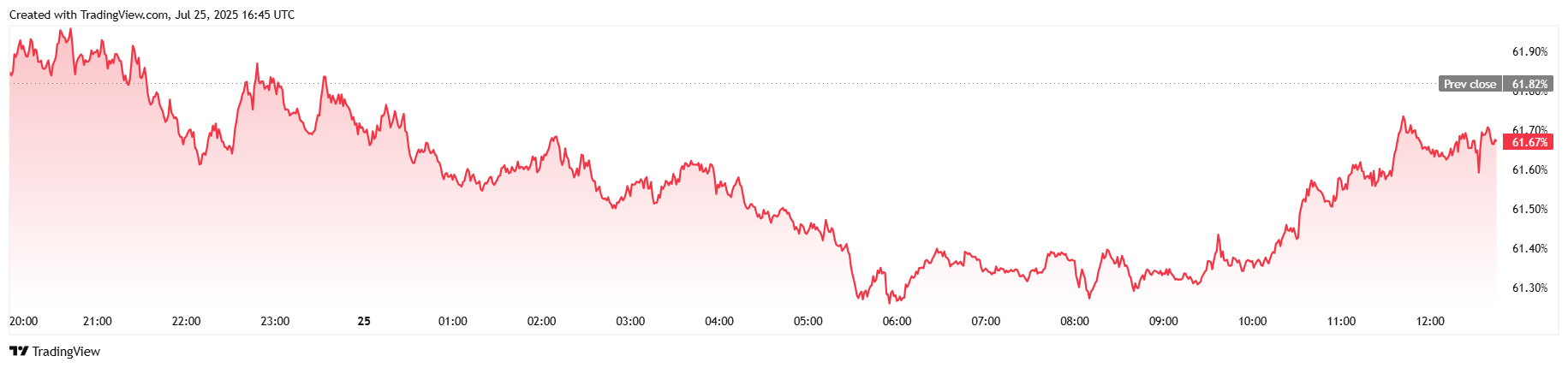

The 24-hour trading volume rose nearly 40% to $1024.2 billion, but Bitcoin’s market capitalization fell 2.65% to $2.3 trillion. The BTC advantage also fell by 0.21% to 61.67%.

(BTC dominance/trade view)

Total interest on Bitcoin futures increased by 3.86% per day to $875.5 billion, with the total daily Bitcoin liquidation totaling $16208 million. The long-positioned bull controlled that total and was wiped out by an adjustment of $14612 million, while the short-positioned bear was liquidated by $15.95 million.