Bitcoin’s momentum is stuck as key investors reduce exposure and institutional inflows shrink. With billions of whales selling and careful corporate shopping, the asset faces a critical $110,000 test.

summary

- The whales have dumped over 100,000 BTC in recent weeks, their biggest sale since 2022, increasing downward pressure on prices.

- Institutions’ BTC purchases have slowed, with strategy’s monthly purchases plummeting from 134,000 in November 2024 to just 3,700 in August.

- Bitcoin has been integrated between $110,000 and $115,000, with a low trend signal.

Bitcoin (BTC) is facing pressure around the $110,000 mark, indicating a sharp decline in whale accumulation and a weakening of institutional demand.

Bitcoin Zilla’s sale reaches its highest level since 2022

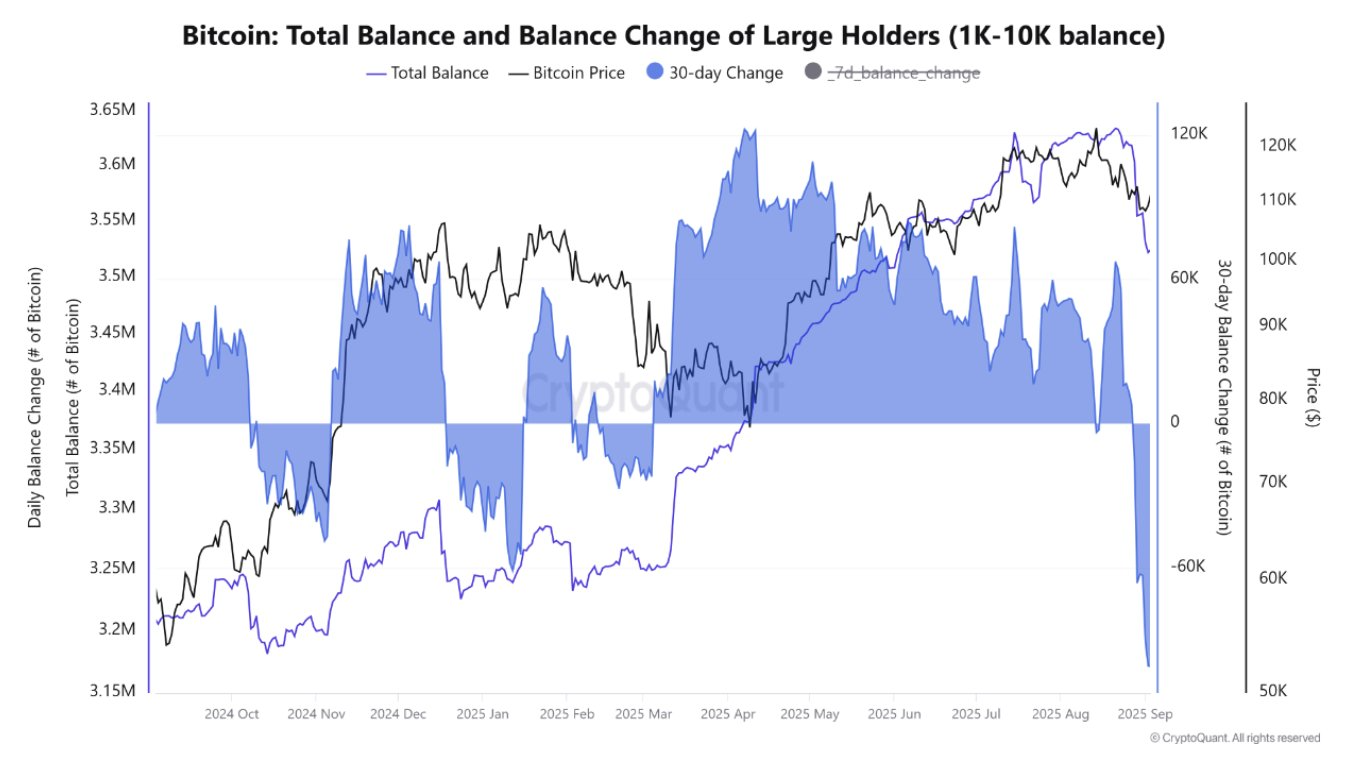

According to crypto analyst Caueconomy, the Bitcoin market has experienced the biggest wave of whale selling since 2022. In the last 30 days alone, whale reserves have fallen by more than 100,000 btc, equivalent to about $11.1 billion at current prices.

Bitcoin Whale Holdings | Source: Cryptoquant

“This sales pressure is punishing the price structure in the short term, ultimately pushing prices to under $108,000,” CaueConomy said.

These large holders appear to be reducing exposure amid increasing market uncertainty. CaueConomy also said the current whale portfolio is still declining, and it could continue to weigh Bitcoin in the coming weeks.

You might like it too: Bitcoin, altcoin rises as cooling labor markets cannot scare trade of risk

In addition to concerns, another analyst, Martun, revealed on Monday that the long-term holder, one of the largest 241,000 BTC since early 2025, offloaded 241,000 BTC. The size of this sale suggests that even veteran holders are beginning to lock in profits or reduce risk exposure.

Despite record holdings, institutional activities are cooled

Another trend has also been developed to reduce institutional interest. Currently, Bitcoin’s finances hold a record 840,000 BTC in 2025, but growth rates are falling sharply. According to Cryptoquant, Strategy, the largest owner with 637,000 BTC, saw a decline in monthly purchases, which amounted to 134,000 BTC in November 2024 and just 3,700 BTC in August 2025.

Bitcoin purchases by other companies also slowed down during this period, reaching 14,800 BTC, well below the peak of 66,000 BTC this year. The number of transactions is still high, but the size of those purchases has been reduced. The average transaction size for the strategy fell to 1,200 BTC, while others averaged 343 BTC, a decrease of 86% from the early 2025 levels.

This trend suggests attention and possibly liquidity constraints. The institution remains active, but is hesitant to current market conditions despite fewer purchases per transaction and the highest headline holdings ever.

Price Action Signal Range Binding Transactions When Bulls Lose Steam

Bitcoin trades at $111,134 at press time for each crypto.news market data. The Crypto Market giant is over 10% from an all-time high of $124,128, and stays in the $110,000 to $115,000 range. In the meantime, technical indicators are giving neutral signals. The ADX (mean directional index) is 16.10, indicating a weaker direction along the current lateral movement.

BTC Price Chart | Source: crypto.news

BTC must overcome $115,000 to continue its bullish trend with a potential target of $120,000 or $125,000. Conversely, if you fall below $110,000, you can increase your BTC to $105,000 again.

You might like it too: Bitcoin Bull Michael Saylor makes his debut with the Bloomberg Billionaire Index