Bitcoin has fallen below the $70,000 level, a move that reflects increased selling pressure and growing uncertainty in the market. Breaking this psychological threshold intensifies volatility and short-term participants quickly react to the downside momentum. Analysts note that the current environment is defined less by macro headlines and more by internal market structures, particularly the behavior of long-term holders.

According to an insight shared by On-chain Mind, the price of Bitcoin alone rarely determines the bottom of the market. Rather, important signals tend to come from holder behavior, specifically whether long-term investors are starting to show signs of stress. Historically, these participants have been the least reactive cohort, often absorbing volatility rather than amplifying it through rapid selling.

However, the situation changes when long-term holders become exposed to widespread unrealized losses. This situation often coincides with the later stages of a bear market, when confidence weakens and broader capitulation becomes possible. Although this stage does not guarantee immediate reversal, it often indicates ongoing structural exhaustion.

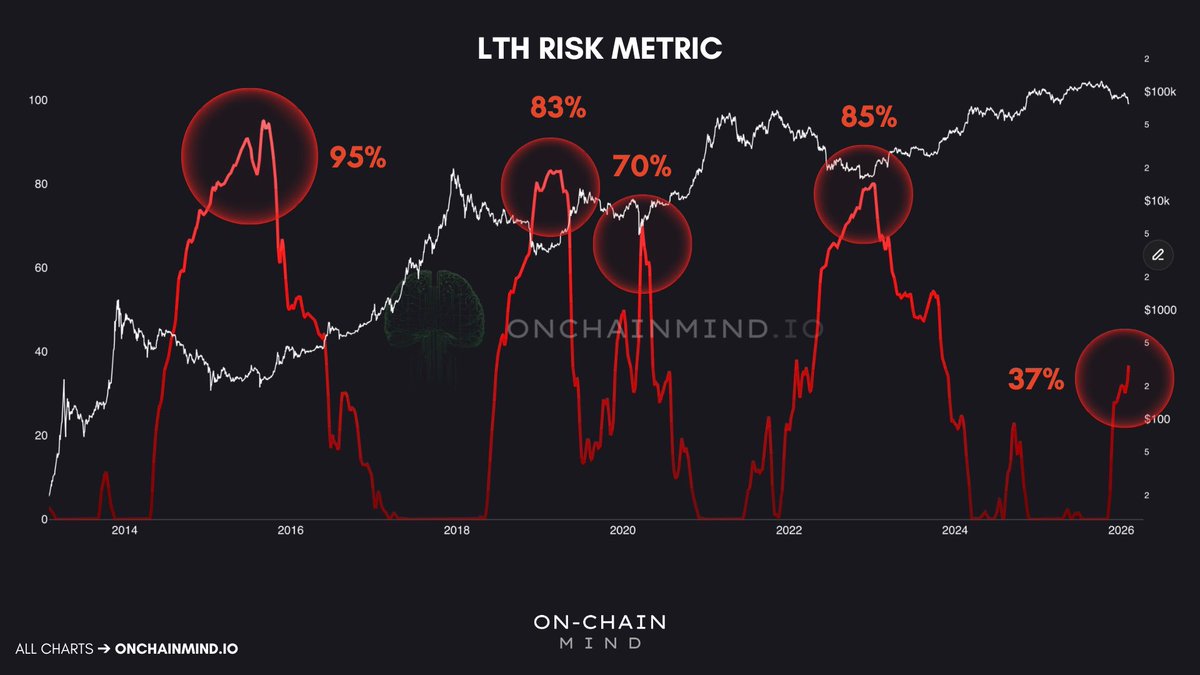

Onchain Mind further highlights that long-term holder risk has historically played a decisive role in identifying late bear market conditions. Previous cycles have seen a clear peak in this indicator. It was about 95% in 2015, about 83% in 2019, about 70% during the coronavirus crash, and about 85% during the 2022 recession. These spikes typically reflect widespread unrealized losses among long-term investors and indicate severe structural stress across the network.

Historically, when this indicator exceeds the 55-60% range, the bottoming process tends to accelerate. At these levels, even most patient holders begin to experience meaningful pressure, often coinciding with the final stage of surrender. This does not necessarily indicate an exact price low, but often precedes stabilization and eventual recovery.

However, this indicator is now at a level close to 37%, well below the previous capitulation threshold. This suggests that while market stress is evident, conditions may not yet reflect the full-blown depletion that typically accompanies the bottom of an endurance cycle. If the pattern of decreasing peaks continues, a move towards the 70% area indicates that even strong hands are under a lot of pressure. This has historically been a prerequisite for more structural and persistent market lows.

Bitcoin’s weekly structure shows a clear deterioration in momentum after a rejection from the $120,000-$125,000 area, with the price currently trading near the $69,000 zone. The latest breakdown has brought Bitcoin decisively below the 50-week moving average (blue) and 100-week moving average (green) levels that served as dynamic support throughout the previous uptrend. The loss of both signals signals a transition from a corrective pullback to a more structural downtrend phase.

The 200-week moving average (red) remains well below current prices, suggesting that the broader macro trend has not yet entered deep bear market territory. However, the speed of the decline and the expansion of bearish candlesticks indicate aggressive dispersion rather than orderly consolidation. The surge in volume accompanying the recent downside price movement strengthens the interpretation of forced sales and liquidation activity.

From a technical perspective, the $70,000 area has transitioned from support to resistance after the break. Failure to recover this level quickly increases the likelihood of further downside exploration, potentially towards the sub-$60,000 regional historical demand zone. Conversely, if sales volumes decline and stabilize beyond this region, it could indicate seller exhaustion.

Featured image from ChatGPT, chart from TradingView.com

editing process for is focused on providing thoroughly researched, accurate, and unbiased content. We adhere to strict sourcing standards, and each page is carefully reviewed by our team of top technology experts and experienced editors. This process ensures the integrity, relevance, and value of your content to your readers.