- Bitcoin Miner’s revenue fell to $34 million, marking its lowest mark since April 2024.

- Whale behavior is mixed as small holders are sold and medium-sized wallets accumulate.

- The Bull flag indicates that breakouts above $109,000 could push Bitcoin to more than $146,000.

Bitcoin miners are constantly experiencing profits at the lowest. According to Cryptoquant, the miners generated just $34 million daily in June. This is the lowest level since April. This fall, trading fees will be reduced by 50% and Bitcoin prices will be reduced by 15%. The two metrics have a major impact on the profitability of the miners.

Bitcoin Miner saw the worst payday of the year.

Daily revenue fell to $34 million in June, the lowest since April.

Falling fees and Bitcoin prices are crushing margins. pic.twitter.com/txdn06cu1f

– cryptoquant.com (@cryptoquant_com) June 26, 2025

According to the chart provided by Cryptoquant, the revenue parameters are similar to those for July 2022. This sudden drop has raised concerns about the sustainability of the mining industry due to increased operating costs. Mining companies are forced to sell reserves or suspend operations to reduce losses.

A decline in profitability occurs when Bitcoin is difficult to crack $108,000 in resistance. While the network foundations remain strong, miners’ surrender could introduce short-term sales pressures if miners offload coins to cover costs.

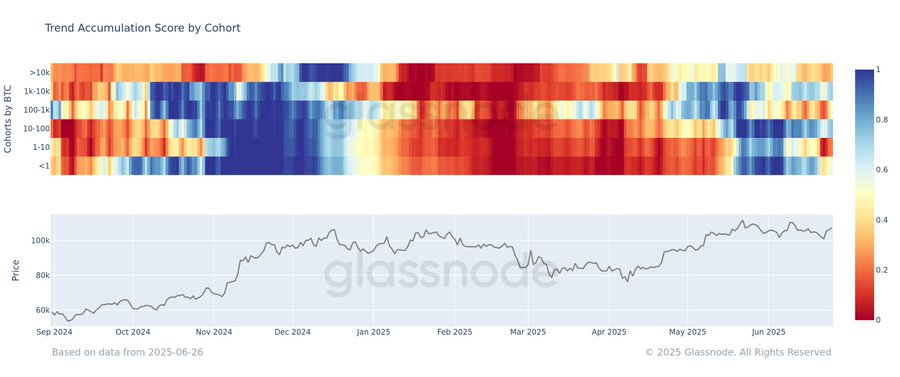

Mixed whale behavior suggests market uncertainty

GlassNode data shows images split between bitcoin holders. Small whales of 1-10 btc actively redistribute them, but larger investors with 10-100 btc BTC are beginning to accumulate them. This variance speaks to the contradictions in the whale approach.

Source: GlassNode

The accumulation trend score increased from 0.25 to 0.57, indicating that medium-sized investors are once again interested. However, without wider whale aggregation, the direction of prices remains uncertain in the near future.

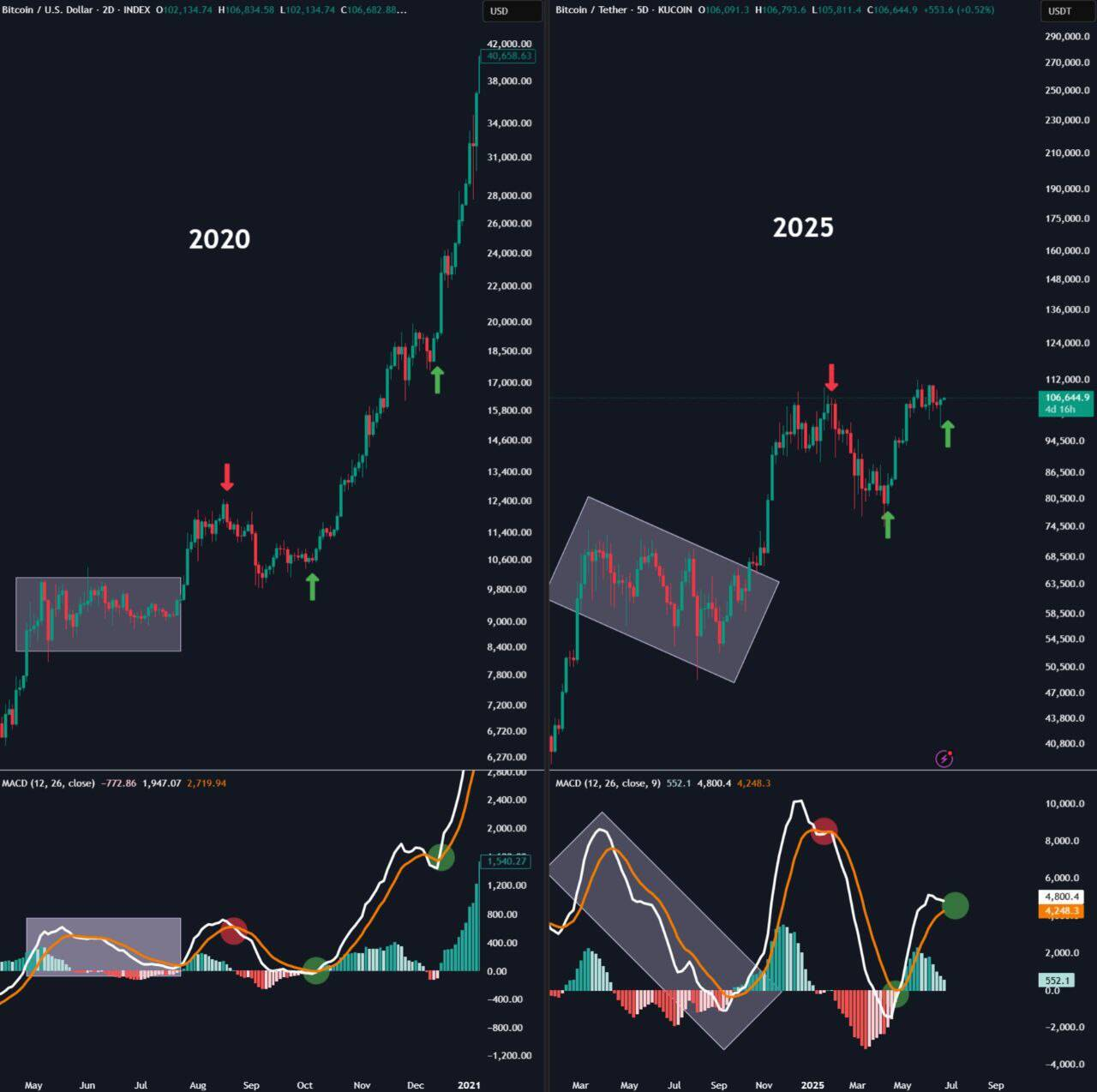

Bitcoin was structurally bullish despite the whale signal, which is the opposite of the stress of miners, according to analysts. The integration between $102,000 and $108,000 created the Bull Flag. This is a technical formation that leads to great breakouts.

Market analyst Cas Abbe said in a post on X that there is a possible breakout like the 2020 cycle. He compares the two periods and shows the major rally patterns of MACD’s crossover, range breakout, and the last rally that Bitcoin has made.

Source: x

Abbè is targeting a move from $150,000 to $180,000 before a blow-off top towards the second half of the cycle. He dismisses the supercycle claim and reminds everyone once again that Bitcoin is still in its normal four-year cycle. His position has always been in the market, so after creating a new best, he strengthens his expectations in a deep set-off.

If the MACD indicators maintain bullish momentum, Bitcoin could rise from 50% to 80% by October. This projection is consistent with Abbè’s side-by-side chart analysis comparing patterns from 2020 and 2025. Both periods share almost the same setup and weight the prediction.