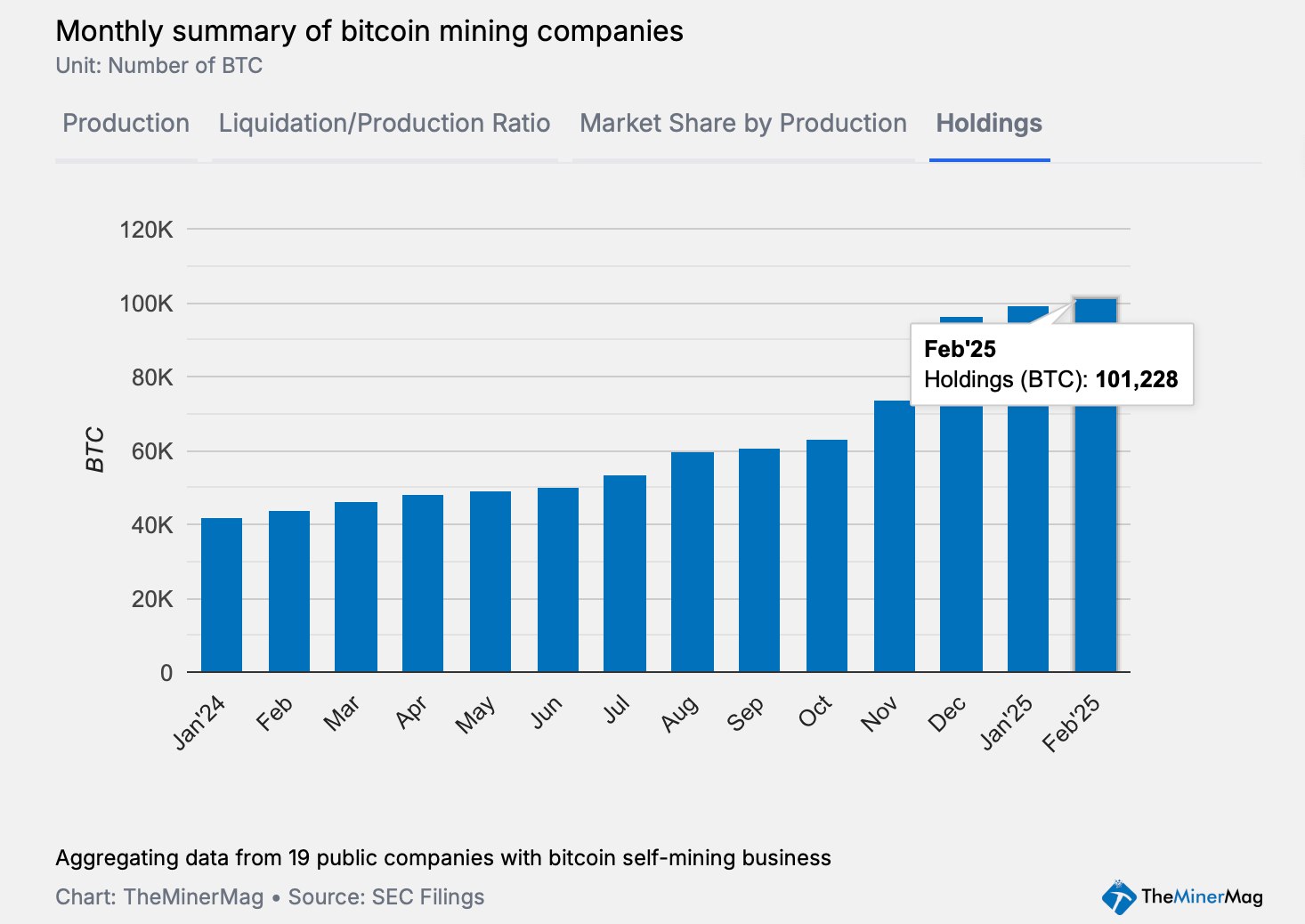

According to a recent report, Bitcoin mining companies currently own more than 100,000 BTC in their accounts, as they are operating or trading personally in the stock market. But there’s a catch. These companies have brought in $4.6 billion in debt.

Bitcoin Miner walks the debt tightrope with 100KBTC

Last Friday, all 10 major Bitcoin mining companies were listed and applied digital, which stole the spotlight thanks to a jump of 11.46%. Additionally, Theminermag.com, the Blocksbridge consulting news, data and research platform, released a report this week on the current status of Bitcoin Miners.

The analysis highlights that of the 14 companies spanning the private and public sectors, all closed in February at a total of 101,000 BTC. Companies like Cango, Core Scientific, Hut 8, Riot, Cleanspark and Mara have all faced double-digit declines since January, according to the findings from Theminermag.com.

Source: Theminermag.com

This collective BTC stash currently holds a value of $85.1 billion based on current exchange rates. Meanwhile, the report also reveals that the published Bitcoin Miner has acquired a $4.6 billion debt loan.

“Bitcoin’s hashpris (one revenue per unit of computing power) has led to a decline of $50/ph/s and reaching $45/s during the recent market slump. It will be interesting to see how these dynamics change, especially for companies that line up equipment.”

Bitcoin hash pris? Think of it as estimated daily revenue that miners can pocket from one petahash per second of SHA256 hash power. It flashed forward until March 15th, 2025, and the Hashpris clocked in at $47.85 per PH/s. Since February 15th, Hashpris has slided its last 11.84% 30 days.