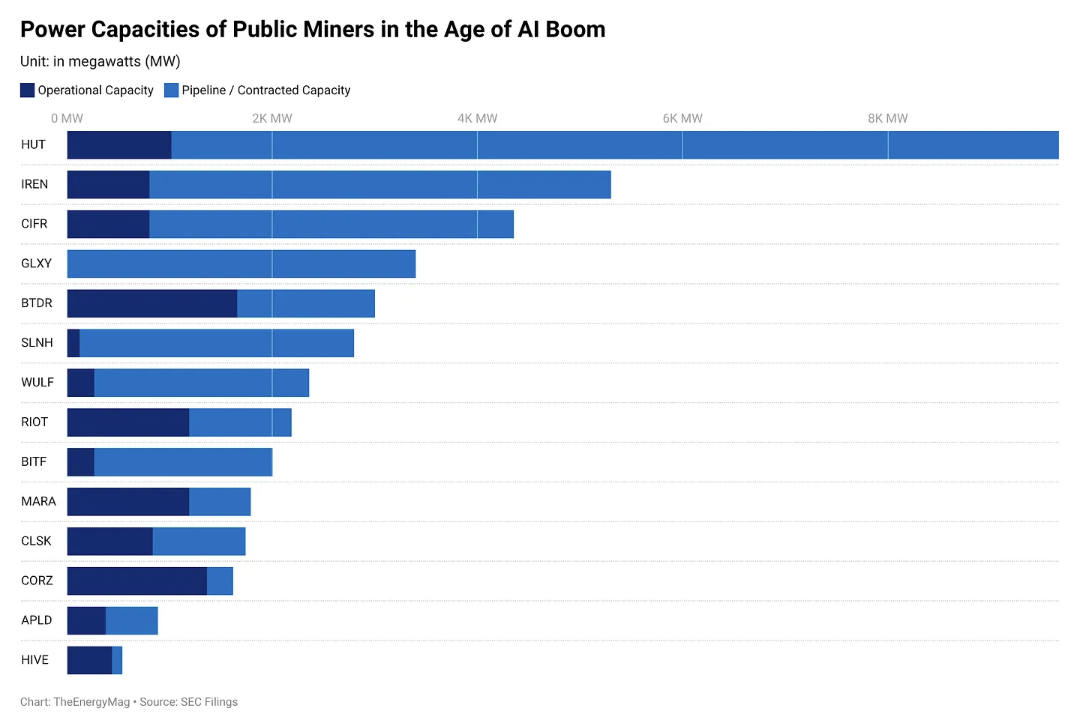

Public Bitcoin miners are planning about 30 gigawatts of new power capacity aimed at artificial intelligence workloads as they race to supplement shrinking mining margins and reposition for the next growth cycle. This is nearly three times the 11 gigawatts currently available online.

The results, compiled by TheEnergyMag for 14 publicly traded Bitcoin (BTC) miners, highlight how aggressively the industry is pivoting away from traditional hashing power as hash prices continue to slump.

By design, the planned expansion amounts to what TheEnergyMag described as “the power infrastructure equivalent of a small country.” In reality, much of the 30 GW is sitting in development pipelines, interconnection queues, or early-stage plans rather than in operational facilities.

Current and proposed power capacity of public Bitcoin miners. sauce: energy mug

The widening gap suggests the competition is shifting from ASIC efficiency to securing power, financing, and on-time delivery of data centers.

“This is a megawatt arms race for the AI boom,” TheEnergyMag said, adding that monetization will ultimately depend on whether demand for AI is strong enough to justify the scale of investment.

Related: The real “supercycle” is not cryptocurrencies, but AI infrastructure: Analyst

AI pivot brings early revenue growth for some miners

The move to artificial intelligence infrastructure reflects an increasingly hybrid strategy among existing Bitcoin miners, with some already reporting significant revenue contributions from AI and high-performance computing (HPC) workloads.

One example is HIVE Digital. The company recently posted record quarterly revenue, driven in part by its AI and HPC business lines. The company reported fourth-quarter revenue of $93.1 million, up 219% year-over-year, despite the decline in Bitcoin prices during the same period.

Investors are also becoming more sensitive to this change. Earlier this week, Starboard Value published a proposal to Riot Platforms’ management to accelerate the miner’s expansion into HPC and AI data centers.

The diversification efforts come as mining profits have taken a hit as block rewards have been cut since the 2024 Bitcoin halving, squeezing margins across the industry.

The situation has gotten even tougher since the fourth quarter, when strong selling pressure sent Bitcoin down from its all-time high of over $126,000. Prices briefly fell below $60,000 before finally stabilizing in February.

Despite these headwinds, U.S.-based mining companies showed resilience early in the year, with production rebounding after severe winter storms temporarily disrupted operations.

sauce: Julian Moreno

Related: Paradigm reframes Bitcoin mining as a grid asset rather than an energy consumption