Bitcoin (BTC) mining difficulty is a metric that tracks the relative challenge of adding new blocks to the ledger, climbing to a new all-time high of 142.3 trillion on Friday.

Mining difficulties hit consecutive all-time highs in August and September, driven by a newly deployed influx of computing power over the past few weeks.

Bitcoin’s hash rate, the average total computing power that secures decentralized currency protocols, hit an all-time high of over 1.1 trillion per second on Friday, according to Cryptoquant.

The increasing difficulty of mining and the constant need for energy-hungry, high-performance computing power to protect networks make it difficult for individual miners and businesses to compete, raising concerns that Bitcoin mining is becoming increasingly centralized.

The difficulty of the Bitcoin Network was a new all-time hit in September. sauce: Encryption

Related: Bitcoin mining stocks outperform BTC as investors bet on AI pivots

Publicly available businesses face heat from government and energy infrastructure providers

Even small miners and public companies face increasing competition from governments with access to free energy resources, allowing energy infrastructure providers to vertically integrate Bitcoin mining into their business operations.

Some governments are already mining Bitcoin or are exploring mining with excess or runoff energy, including Bhutan, Pakistan and El Salvador.

In May, the Pakistani government announced plans to allocate 2,000 megawatts (MW) of surplus energy to Bitcoin mining as part of a country’s regulatory pivot that accepts cryptocurrency and digital assets.

The US Texas energy provider has integrated Bitcoin mining into infrastructure to balance the electrical loads in collaboration with the Texas Energy Reliability Council (ERCOT).

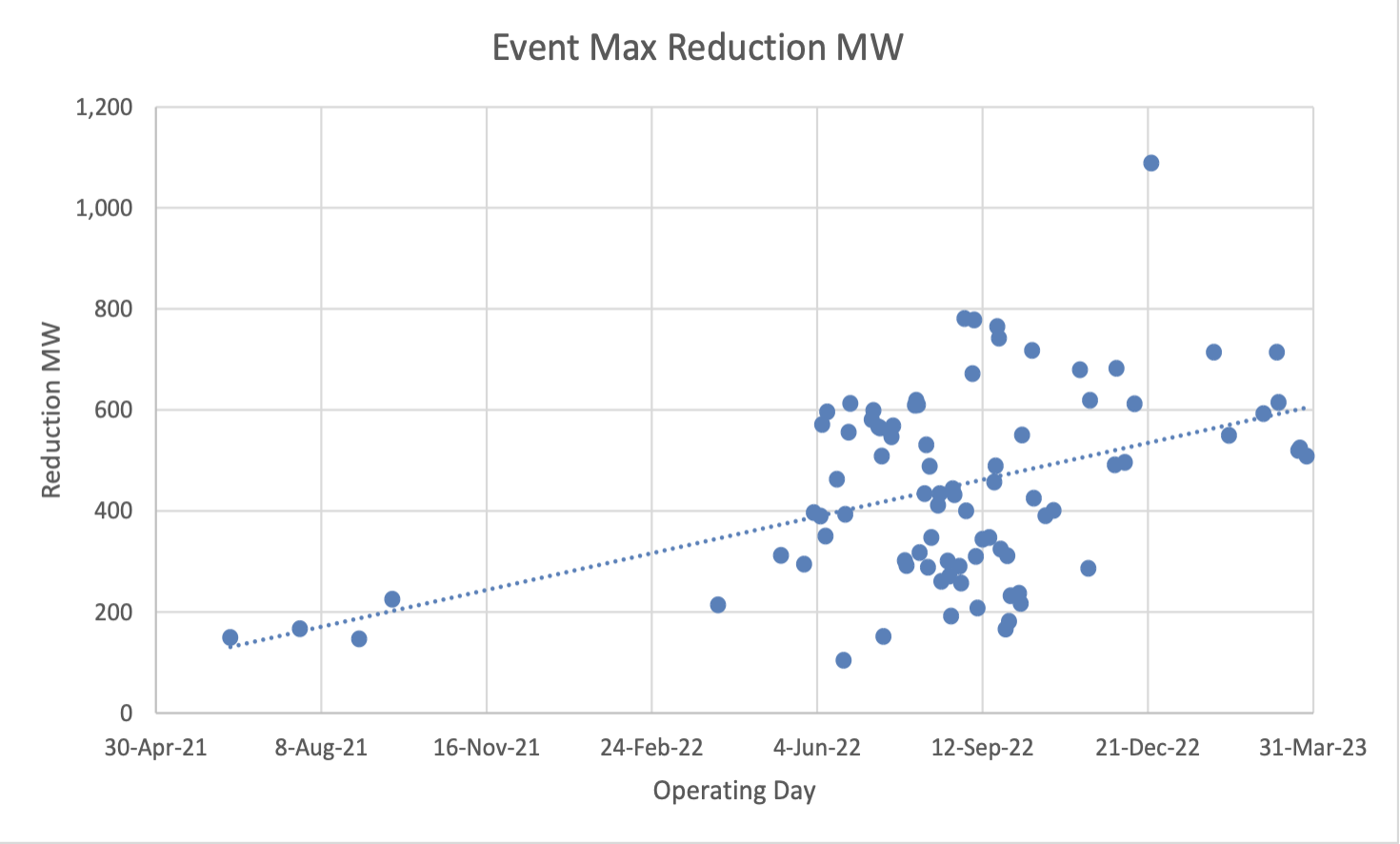

A chart showing a decline in energy usage by Cryptominers in Texas during peak demand between 2021 and 2023. Source: ERCOT

Electric grids can suffer from energy shortages to meet consumer needs during peak demand, or energy shortages to meet surplus energy during periods of low consumer demand.

Texas energy companies leverage Bitcoin mining as a controllable load resource that balances these electrical mismatches, consuming excess energy during periods of low demand and turning off mining rigs at peak consumer demand.

This creates a greater competitive advantage over publicly traded mining companies that have to make profits and pay for these power providers without worrying about the fluctuating costs of energy.

magazine: 7 Reasons Why Bitcoin Mining is a Worst Business Ideas