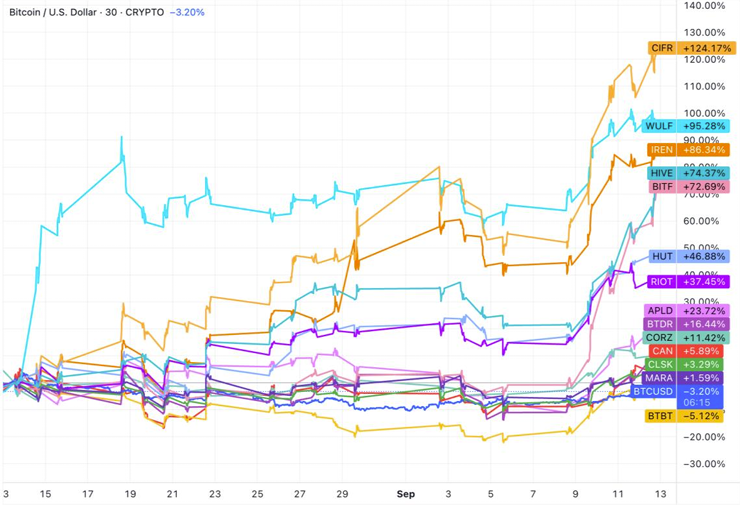

Bitcoin mining stocks extended their recovery in September, surpassing Bitcoin and increasing hardware payout period despite the pressures of industry economics.

Stocks in Cipher Mining (CIFR), Terawulf (Wulf), Iris Energy (Iren), Hive Digital Technologies (Hive) and BitFarms (BITF) have skyrocketed from 73% to 124% over the past month, according to Miner Mag’s latest industry update. In contrast, Bitcoin (BTC) slid over 3% over the same period.

Some Bitcoin mining stocks trade annually or at their highest ever highs. Source: Minor magazine

Mining stock gatherings occur despite continuous pressure on industry fundamentals. The next difficulty adjustment for the Bitcoin Network is projected to rise by an additional 4.1%. This “marks the first epoch with an average hashrate on top of the Zetahashmark,” Miner Mag reported.

One Zetahash milestone first reached in September, based on Bitcoin’s 14-day moving average hash rate. But the results did little to ease the profitability tension.

Hashpris remained below the Petahash, which was pressured by rising network activity, of less than $55 per second, but its trading fees slid at less than 0.8% of its monthly fee.

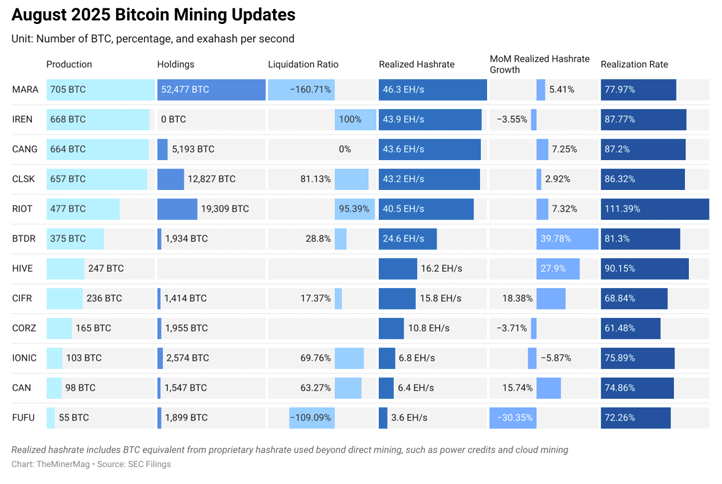

Bitcoin mining update for August 2025. Source: Minor Mug

Still, investors will reward miners who pursue GPUs and AI pivots, Miner Mag said. Hive Digital accelerates its transition to AI data center infrastructure, Iris Energy is growing with Blackwell GPUs, and Terawulf has drawn momentum from its high-performance computing partnership with Google.

Related: Bitcoin Network Mining Difficulties Rises to the Highest of All Time

Bitcoin miners continue to accumulate

In the face of tougher profit margins, rising costs and increasing competition, Bitcoin miners are increasingly relying on diversifying strategies.

Beyond the pivot of resources to AI and high-performance computing, many miners embrace financial strategies and retain more mined Bitcoin in anticipation of future price surges.

Cointelegraph reported on this trend in January, highlighting a significant change in miner accumulation as companies hold a larger share of production until 2024.

“In 2024, there was a significant change among Bitcoin miners, and we chose to retain the majority of the mined Bitcoin or refrain from selling it entirely,” Digital Mining Solutions and BitcoinminingStock.io wrote in a January report.

Miners appear to double the strategy in September, with GlassNode data showing wallet balance rising for three consecutive weeks. On September 9th, net inflow peaked at 573 BTC. This is the largest daily increase since October 2023.

https://www.youtube.com/watch?v=3_b-7ctsvhy

magazine: Bitcoin’s long-term security budget issues: an imminent crisis or FUD?