On-chain data shows that Bitcoin’s net unrealized profit and loss (NUPL) has fallen sharply recently. Here’s what this means for cryptocurrencies.

Bitcoin NUPL falls to 0.18 level

O-chain analysis company Glassnode talked about the latest developments in Bitcoin NUPL in a new post on X. NUPL is an index that compares the amount of unrealized gains and losses held by investors on Bitcoin. $BTC blockchain.

This metric works by looking at the transaction history of each token on the network and finding the last price involved in a transfer. If this previous sale price is higher than the current spot price of any coin, it is assumed that there is some net unrealized gain on that particular token. Similarly, a low cost base means the token is underwater.

The exact amount of profit/loss a coin holds is equal to the difference between the two prices. NUPL sums this value for each category and subtracts it to determine the final state of the network. Additionally, we divide the result by market capitalization to show how the net profit or loss among investors looks compared to the total valuation of the asset.

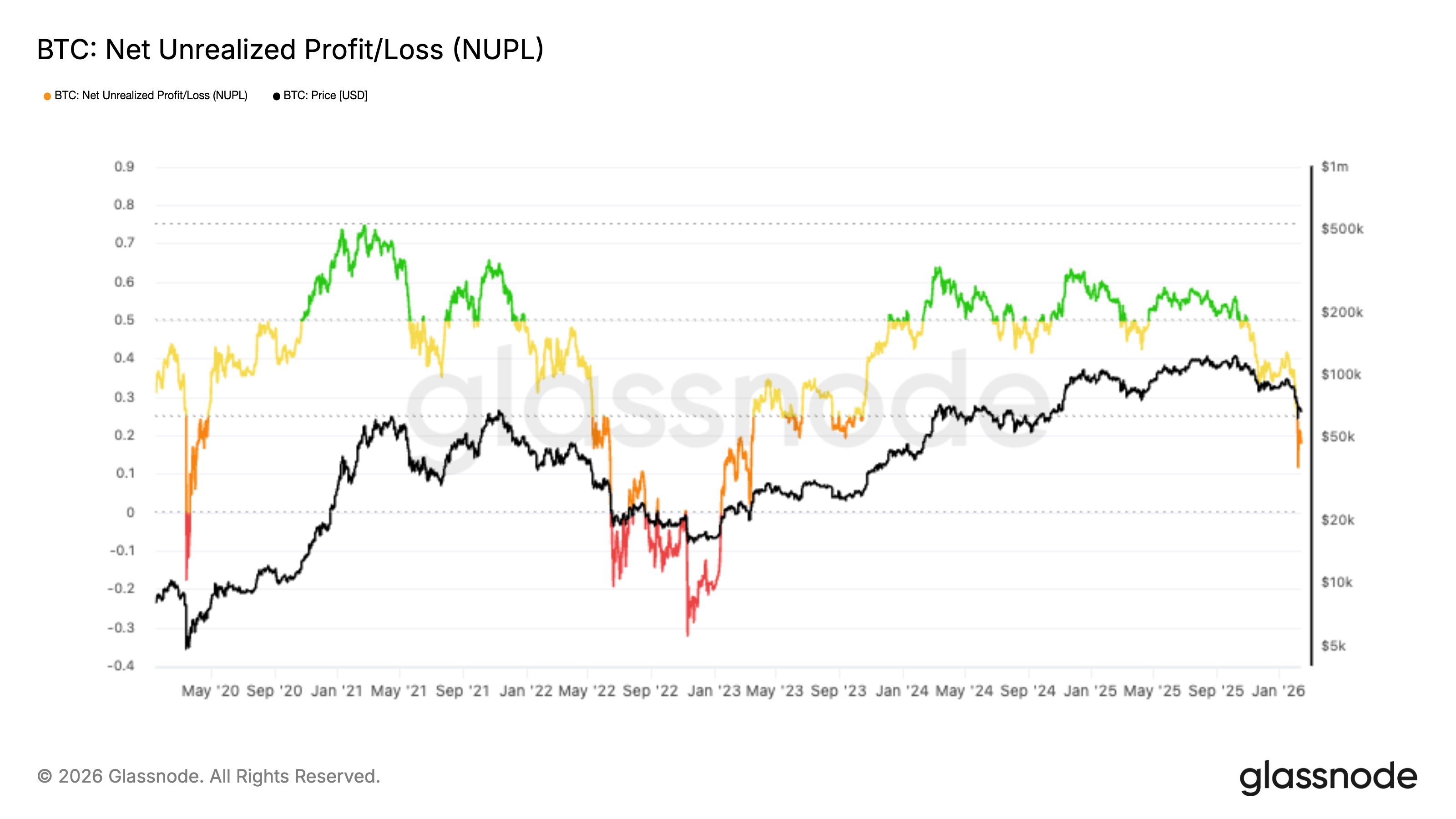

Here is a chart shared by Glassnode showing the trend of Bitcoin NUPL over the past few years.

As shown in the graph above, Bitcoin NUPL soared above the 0.5 level during the 2024 and 2025 bullish phases. This suggests that investors were sitting on a net profit of more than half of the cryptocurrency’s market capitalization.

These euphoric phases were followed by a price decline, with the indicator entering the 0.25-0.5 zone. $BTC Although the stock managed to recover from the first two drops, the recent decline has been a prolonged period of decline.

From the chart, we can see that this bearish action brought the cryptocurrency’s value to 0.18. This level indicates that profits are still dominant on the network, but much less so than before.

This level falls within the range defined by the analytics firm as relating to investors’ “hope/fear.” “This regime tends to be reactive, with rallies countering selling pressure and the downside potentially extending as confidence wanes,” the analysis firm explained.

The last time Bitcoin NUPL saw a significant decline in this region was during the 2022 bear market. At that time, the cryptocurrency finally passed through the zone and entered the extreme fear area below the zero level, which corresponds to a net loss held by the majority of investors.

It remains to be seen how long this cryptocurrency will remain in the region this time around, and which ones will follow next.

$BTC price

Bitcoin fell toward $65,000 on Thursday, but rebounded to $69,000 on Friday.

Featured image from Dall-E, chart from TradingView.com