The options business appears to be the “pharmaceutical sector” of the crypto market, showing solid activity across both bull and bear market trends.

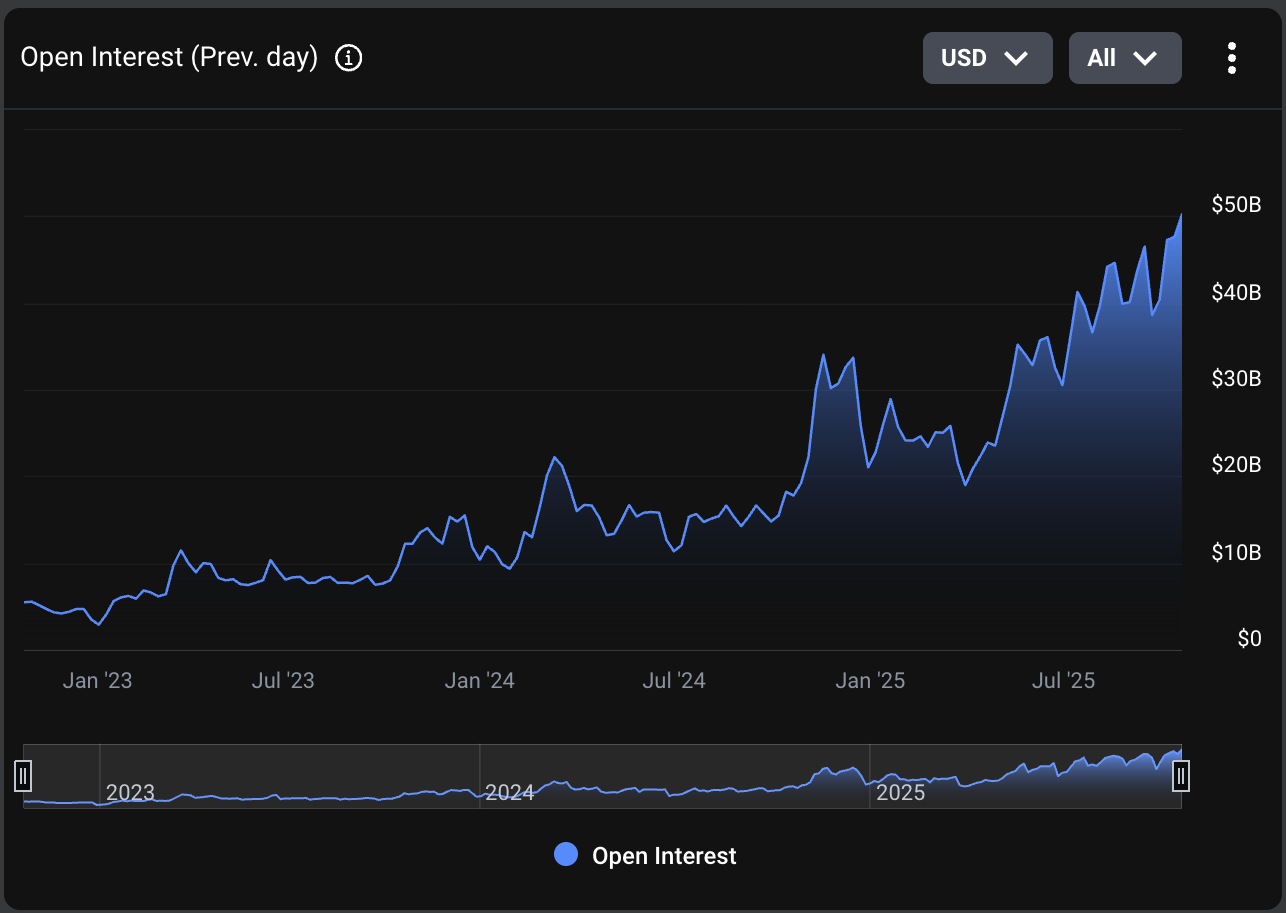

Let’s take Bitcoin listed on Deribit as an example. BTC$109,484.74 The options market continues to be active despite, or perhaps because of, recent bearish price movements. On Thursday, the number of active BTC contracts on the platform increased to an all-time high of 453,820 contracts, each representing 1 BTC. Notional open interest, which measures the dollar value of active contracts, also hit a record high of $50.27 billion, according to data source Deribit Metrics.

“Despite continued price pressure and the recent decline in the spot price of BTC, Deribit’s BTC options open interest has surged to an all-time high of approximately USD 50 billion in nominal terms, which is a record in both contract count and dollar terms, confirming continued and expanding market participation,” Deribit CEO Luke Strigers told CoinDesk.

Year-to-date, open interest in the contract terms has more than doubled, showing resilience as BTC fell from $110,000 to $75,000 earlier this year and rose to lifetime highs of over $126,000 earlier this month. Since then, the price has plummeted to $108,000.

BTC options open interest. (Delibit)

Their inelasticity to price changes can be explained by the fact that options serve multiple strategic purposes beyond simple directional bets, allowing traders to bet on volatility and time. This facilitates effective management of broad market exposures.

A call option gives the holder the right, but not the obligation, to buy the underlying asset at a specified price at a later date. A put option provides the right to sell.

active downside hedge

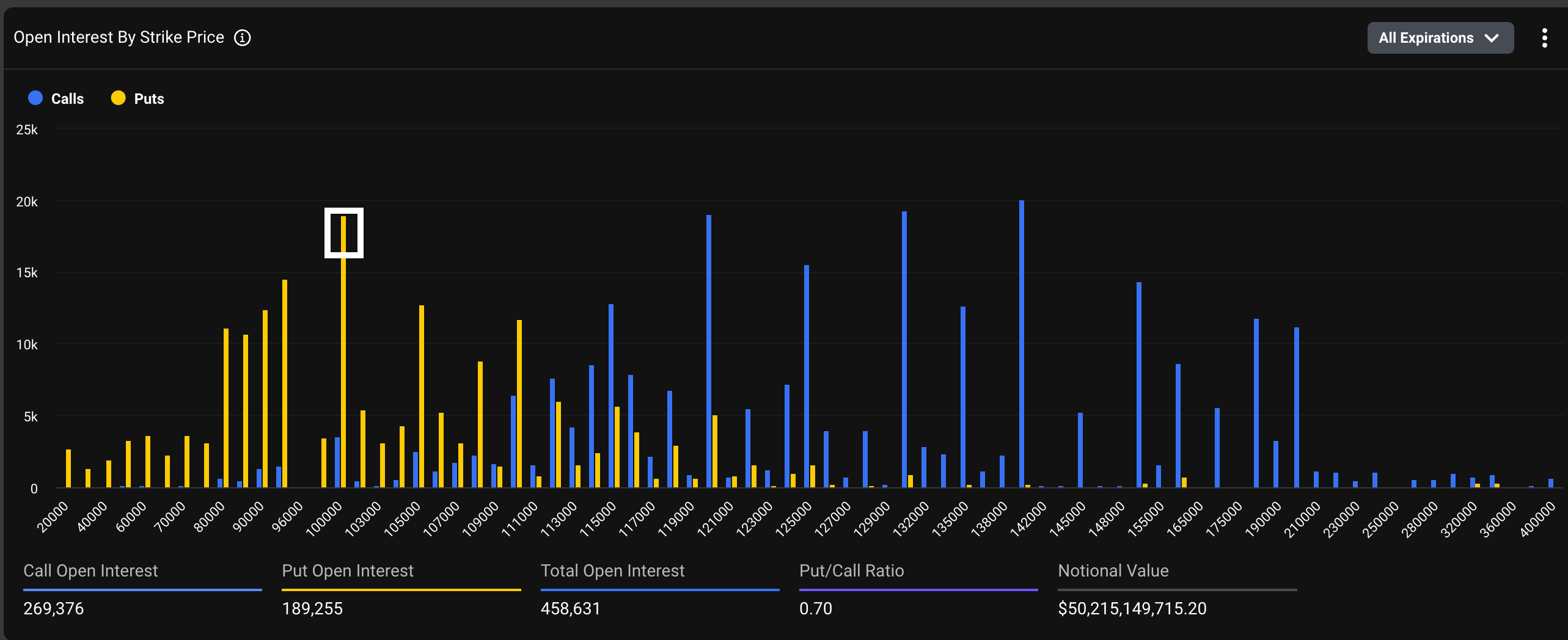

The latest record high in BTC open interest is marked by the growing popularity of put options, which offer protection against bearish trends.

This is evidenced by the $100,000 strike put, which has a nominal open interest of $2 billion, making it almost as popular as the $120,000 and $140,000 strike calls. A $100,000 put represents a bet that the spot price of BTC will fall below that level.

“Unlike previous records, this new OI milestone is characterized by a significant concentration of put interest around the 100,000 strike, highlighting aggressive downside hedging by market participants. With this single strike, Deribit shows more than 19,000 contracts open, representing more than US$2 billion in notional value,” Streiss said.

Distribution of BTC options open interest. (Delibit)

He explained that although the relative richness of puts has receded in recent days as some traders chase out-of-the-money calls with high strike prices, they continue to trade at a premium to calls.

“Despite the prevailing bearish positioning, the past 24 hours have also revealed new signs of optimism. Put OI has increased with a major downside strike, while significant call activity has built around 120,000 and above, suggesting traders are positioning for potential upside volatility or gamma exposure,” Streiss noted.