Bitcoin prices are compressed into a tight triangular structure, marking a key decision point as the convergence of support and resistance signals impending increased volatility in the short term.

summary

- Triangle compression signals impending breakout, approaching volatility expansion

- Rising lows indicate growing demand and support a bullish resolution

- If the breakout is confirmed on volume, resistance at $76,700 will be the primary target.

Bitcoin ($BTC) The price trend has entered a constructive consolidation phase, forming a clear triangular pattern that reflects the expansion of the market equilibrium. After the recent volatility, the price has entered a period of compression and dynamic support and resistance continues to shrink. This action often precedes a larger directional move, as markets rarely remain compressed for long periods of time.

The triangle formation typically represents the balance between buyers and sellers before a definitive breakout occurs. In the case of Bitcoin, this means that the price remains within the structure and a breakout has not yet been confirmed. However, as prices approach the apex of the triangle, the potential for increased volatility increases significantly.

The market is now nearing a macro decision point where momentum has returned and is likely to determine Bitcoin’s next trend phase.

Important technical points for Bitcoin price

- Bitcoin trading within a clear triangle formationsignal compression

- Apex zone is approachingincreases the probability of breakout

- High timeframe resistance at $76,700 serves as an upside target.if a bullish break occurs

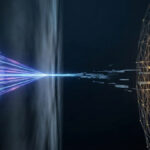

BTCUSDT (2H) chart, source: TradingView

The current triangle formation is defined by the convergence of dynamic support and resistance that closely match the value area low and value area high. Rejection from resistance and protection from support gradually tightened the price movement, reducing volatility and forming a classic apex structure.

This formation indicates that neither buyers nor sellers currently control the market. Instead, participants wait for confirmation of direction, increasing liquidity for both parties. As compression increases, even modest momentum can cause a sharp expansion if price breaks out of the pattern.

The important thing is that Bitcoin has not yet broken out. Until a confirmed move occurs, the price will be consolidating rather than trend continuing.

Rising lows suggest constructive momentum

One notable feature within the triangle is the development of higher lows that form near the low area. These rising lows indicate that buyers are intervening early on each pullback, gradually putting upward pressure on the price.

While this does not guarantee a bullish breakout, it does suggest constructive potential demand. Markets that form further lows during consolidation often tend to resolve to the upside, especially if support continues to hold consistently.

This behavior reflects accumulation rather than distribution, increasing the likelihood of a bullish expansion once the triangle resolves.

You may also like: Sentient Foundation was launched as a global non-profit organization to ensure AGI remains open source and aligned with humanity.

The apex zone becomes the market decision-making point

The vertices of the triangle represent the most important areas of the current structure. When prices reach this contraction zone, the market has to make a decision. Breakouts from triangle patterns often occur near the top, as the price has little room left to consolidate.

However, direction alone is not enough. Volume confirmation is required. A breakout with increased volume will prove that market participants will return, greatly increasing the likelihood of sustained follow-through.

If the volume does not expand, the breakout risks becoming a false move and quickly reverting back to the range.

Upside scenario targets resistance at $76,700

If Bitcoin sees strong volume confirmation and breaks above, attention will shift to the resistance on the higher timeframe near $76,700. This level represents a key technical objective and is consistent with previous supply areas within the broader trading structure.

A successful breakout would mark the end of the consolidation phase and the beginning of a new expansion leg, potentially attracting momentum traders and new market participants.

What to expect from future price trends

From a technical, price volatility, and market structure perspective, Bitcoin is approaching a macro decision point. Triangular formation indicates compression, and compression most often leads to expansion.

In the immediate short term, traders should expect volatility to increase as price interacts with the apex zone. A confirmed breakout supported by increased volume would determine the next big move.

Higher lows support a bullish resolution, but confirmation remains important. Bitcoin will continue to fall until a breakout occurs, but technical evidence suggests that a significant move is quickly approaching.

The upcoming sessions are likely to define Bitcoin’s next directional trend as the market braces for impending increased volatility.

read more: Phemex launches AI native revolution, signs of full-scale AI transformation