The derivatives market has absorbed a week of decline in Bitcoin prices without the kind of leverage reduction that usually marks stress.

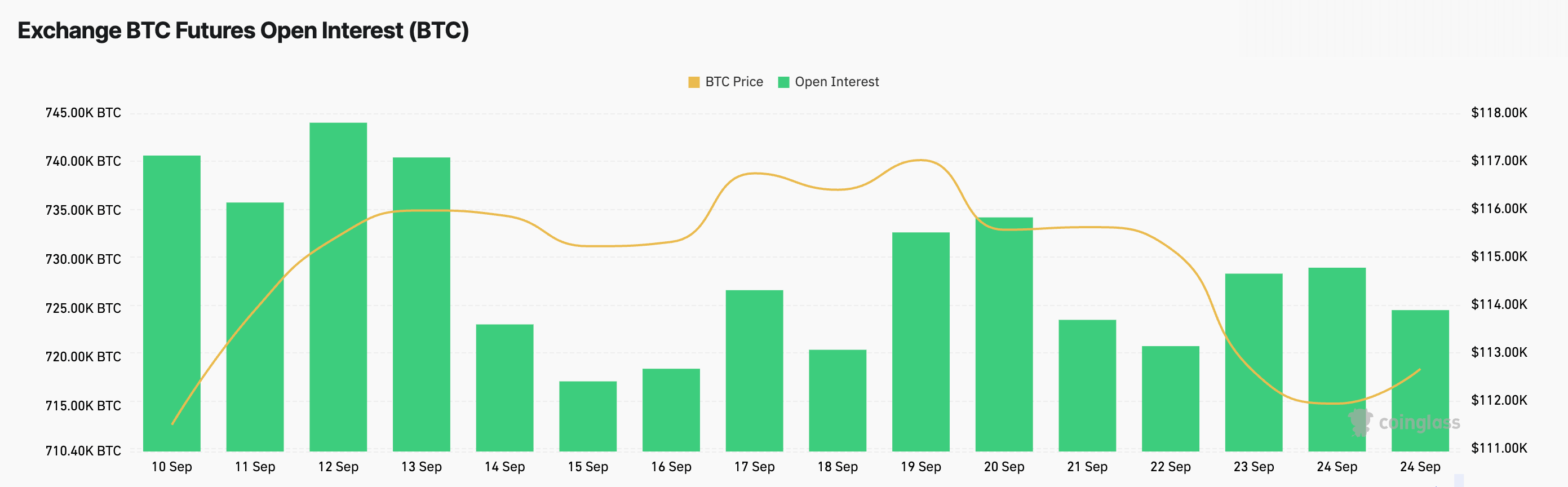

Open interest in futures in BTC terms was higher, with the conceptual concept tracking 3.36% slides at the spot, and optional interest increased for two consecutive days of decline. The setup looks more like a re-regulation or hedge than a derevalization.

Futures positioning retained its position despite a $3,910 pullback from $116,403 on September 18th to $112,493 on September 24th.

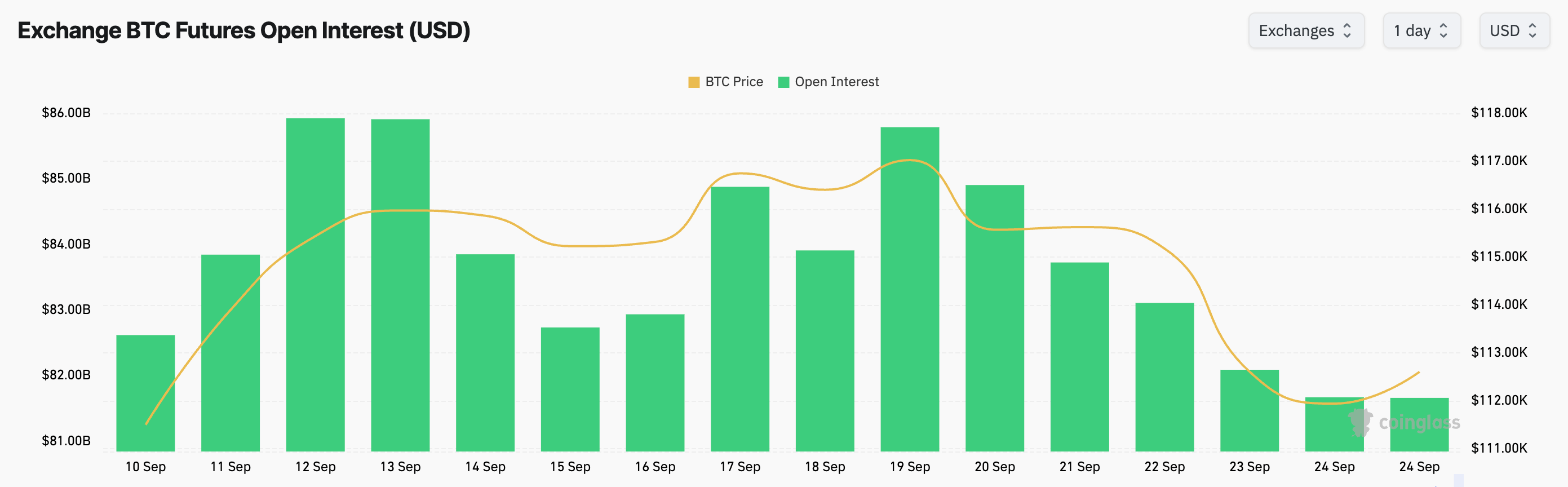

Valued in the dollar, the same position slipped from $839.1 billion to $815.8 billion, down 2.78%, reflecting the direct drag of the lower spot.

The pattern is consistent

The dollar concept reached $857.9 billion on September 19th, relaxed the following day, falling gradually until the end of September 24th. This has kept the market’s exposure, but marked it lower, and is a sign of a re-rick rather than a reduction in forced positions.

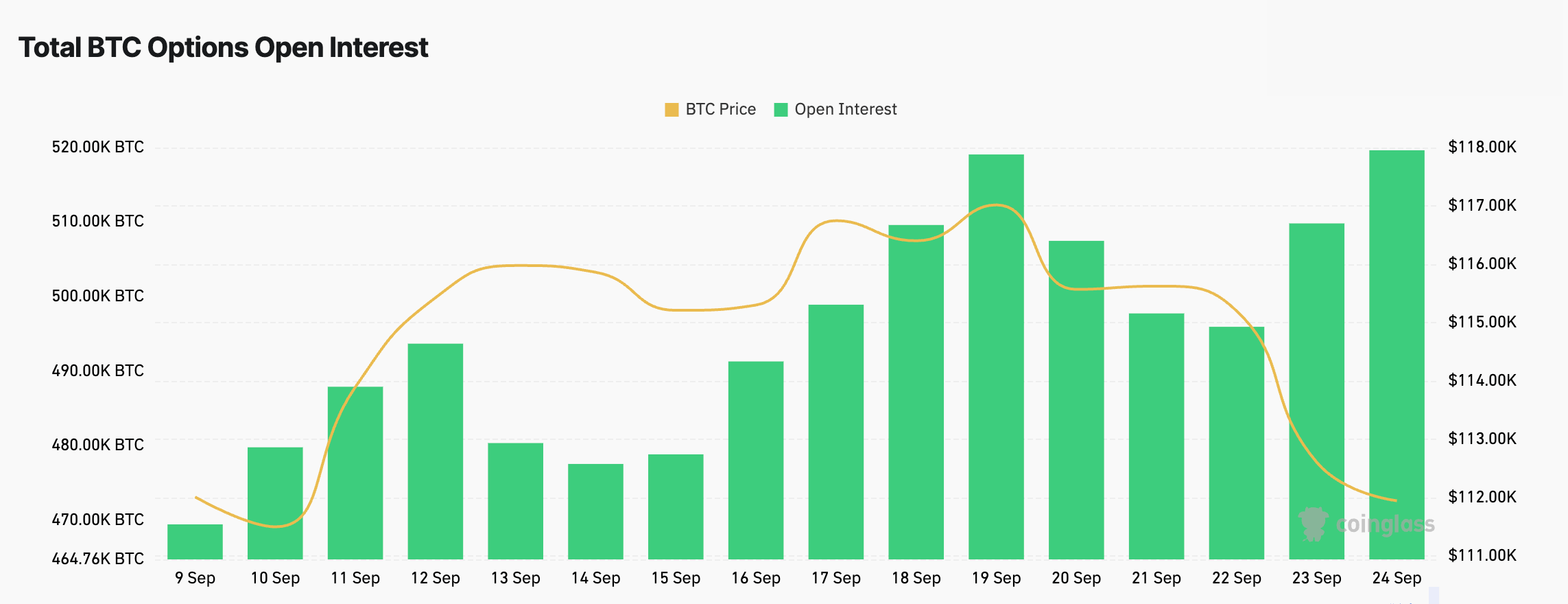

Option oi was classified as September 22 at 495,960 BTC and reversed with two sharp increases: +13,870 BTC on September 23 and +9,810 BTC on September 24.

These timings followed after soaking the spot at a low $112,000 pointing to hedging and structured flows rather than speculative pursuits. Dealer gamma exposures could change negatively on September 23rd. In other words, the demand for progressive options may have increased downside stickiness while reducing the scope of clean-up side breaks.

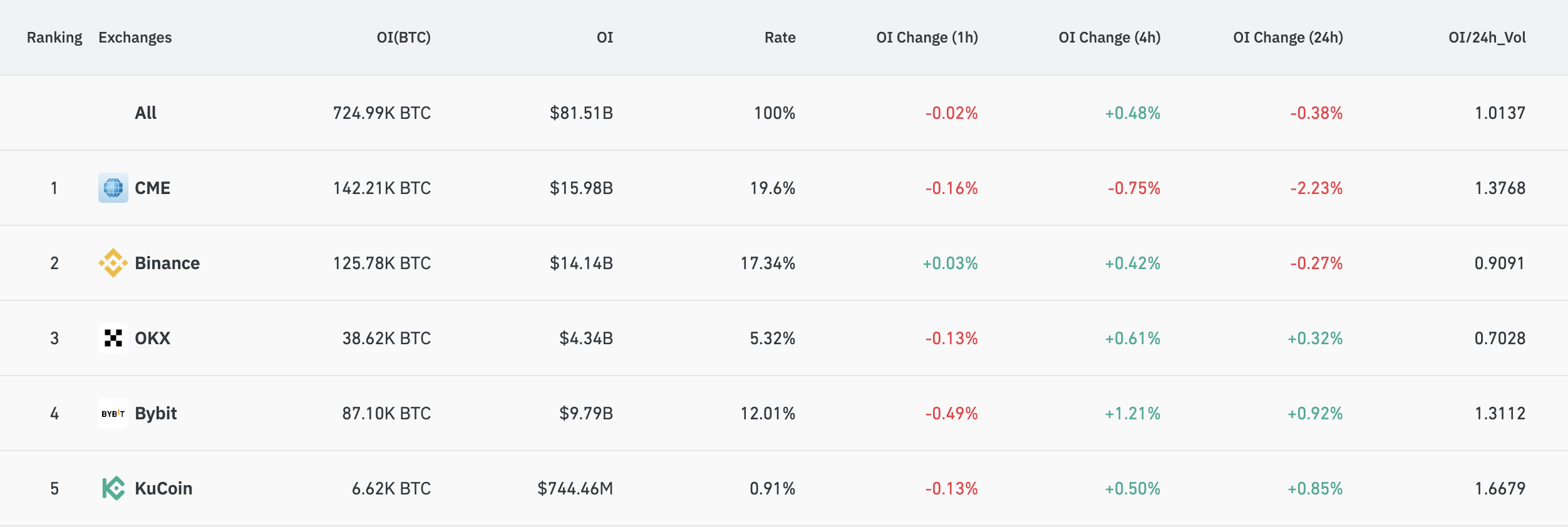

The CME carried an OI of 142,210 BTC worth $159.8 billion, with a 24-hour contraction of 2.23%. I drew another picture at the offshore venue. BYBIT rose 0.92%, OKX rose 0.32% and Kucoin rose 0.85%. Binance slipped just 0.27%.

The divergence line up with the participant profile. Institutions that trim sizes in CME, accounts from crypto origins may maintain or even add modest exposure offshore.

Open interest in volume ratios reinforced the theme of sticky positioning. Both CME and Bibit are above 1.3, with Kucoin above 1.6, meaning OI has risen compared to sales.

The most notable day was September 23rd. The spot fell 2.29% to $112,604, the futures concept lost $1.02 billion, the BTC OI was almost flat, and the options jumped sharply. Future-driven liquidation would have shown clear reductions in BTC OI and broader conceptual erosion.

Instead, this mix shows a book of patient futures paired with a new option hedge. On September 24th, the spot barely sprouted, and the concept was once again eased and options continued to climb. The combination leaves the market positioned more defensively, but there is no evidence of compulsory interpretation.

The weekly correlation confirms this mechanical but important difference. Price and dollar denomination futures moved near Rockstep, but prices and BTC oi were hardly correlated.

An option in which OI is slightly negatively correlated with the spot, reflecting timing to weaker demand for hedges. These relationships do not show a risk of disorderly liquidation, but suggest a stable market structure.

Setup is important in two ways

First, there is no overhang of busy longs, so in-situ stabilization allows for rapid expansion of the concept without the need for fresh positioning. It amplifies the possibility of a relief move if the buyer returns.

Second, optional hedges have expanded to feel relaxed, so bounces can feel capped until those structures collapse or roll down. Hedge activities therefore can suppress daytime volatility while distorting the market towards slower and more sticky price actions.

Splitting the venue adds another layer of nuance. If BIBIT and OKX are added while CME continues to bleed OI, the gap between inequality and funding could widen during US trading hours. That rotation creates tactical relative value opportunities between regulated and offshore markets, particularly during periods of uneven ETF inflows or macro-driven flows.

However, what remains absent is a sign of panic. Futures in BTC terminology are held, with options where hedges are being built, and the market is positioned to absorb the next directional push.

This week concludes with a defensive but orderly Bitcoin. The spot is close to $112,500, the futures units are stable, and optional hedging eases the downside.

Whether the price becomes even more stable or weakened, positioning is set to respond cleanly, not forced.

Moves beyond the mid-$113,000 will rapidly expand conceptual drugs and reduce hedging resistance, but options may continue to be built below.

In either scenario, the market is not vulnerable, but enters the next stretch hedge.