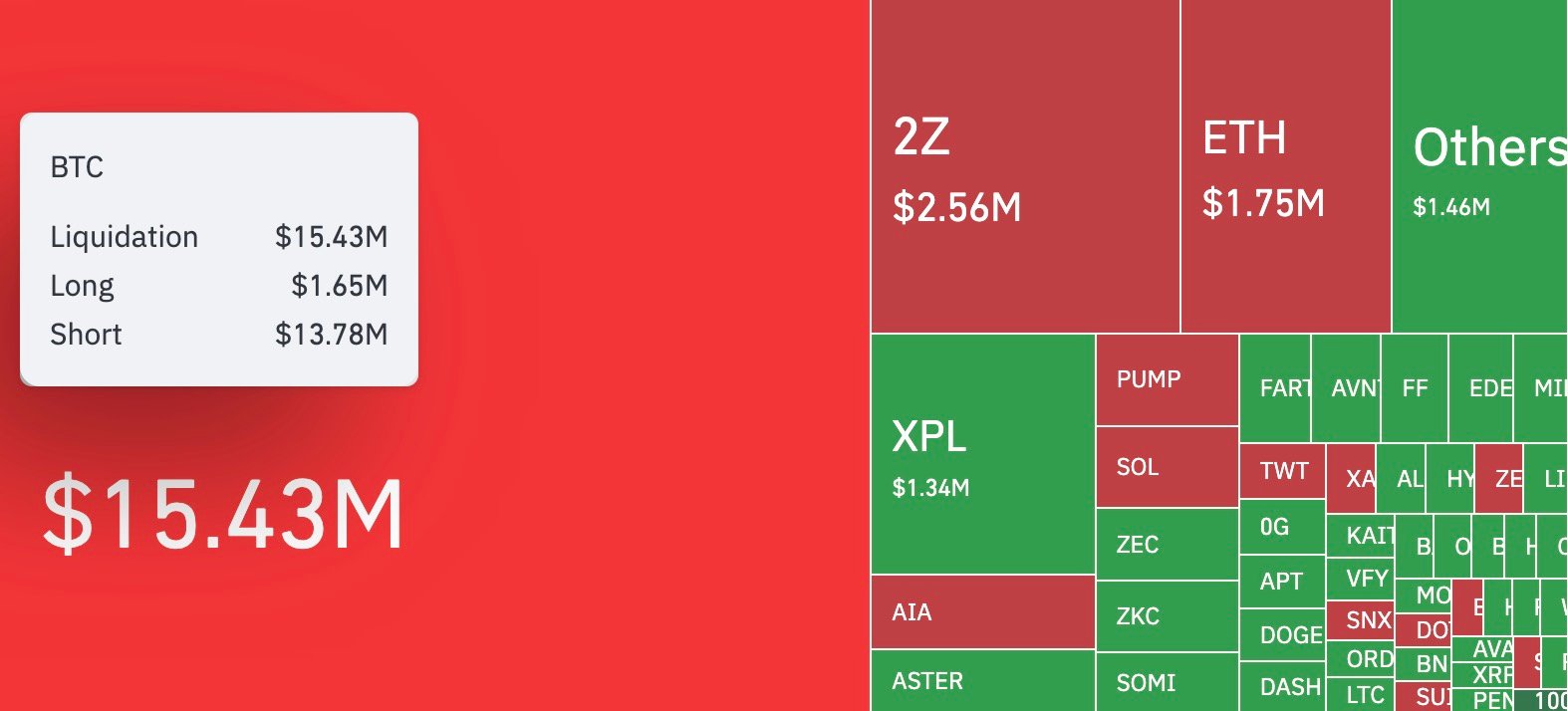

Bitcoin’s derivatives market provided a rare setup as hourly clearing heatmap by Coinglass showed massive distortions for short positions. Within 60 minutes, $15.43 million was wiped out in the BTC position, of which $13.78 million came from shorts and just $1.65 million from long. The numbers show an imbalance of 835.15%.

Bitcoin dominated the session, but the largest single liquidation took place through the Hyperliquid ETH/USD location worth $1,162 million.

Over the past 24 hours, $364.32 million liquidation has been recorded in the crypto market. The shorts accounted for $2699 million, while Longs absorbed $9,733 million. Bitcoin is the core driver, carrying more than $114 million in so-called bear liquidation. The funding rate has also become normal, and there is less desire for aggressive short-circuits.

As usual, the price was drivers and the BTC came back soon after the aperture, just under $120,000. With the huge reduction in shorts, for many market participants, the biggest question now is whether the market can run at round-number levels during US sessions.

meaning

What is certain is that today’s imbalance was, at least in the short term, forced liquidation that tilted the market in favor of bulls and affected the positioning of the entire exchange.

If BTC is above $119,500, it may suggest that this move can be extended from $120,500 to $121,000. This ensures the imbalance impact and the impact of today’s concentrated liquidation waves will affect the structure of the crypto market in Japan.