A rescue rebound in BTC could occur if the cumulative short position reaches $113,000. Major coins are showing signs of reaching local bottoms, and there are predictions of further recovery.

One opportunity for a BTC recovery could be a short squeeze that liquidates positions of up to $113,000. Liquidity is on the rebound, which has historically led to rapid gains.

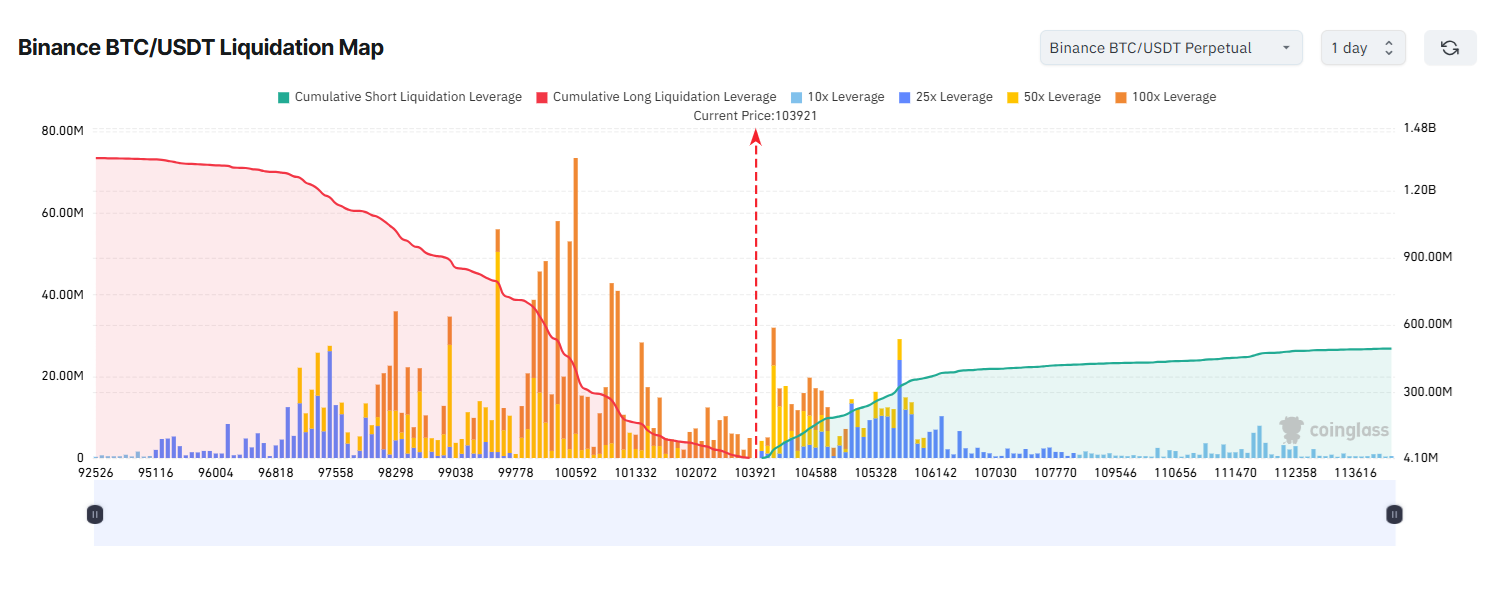

BTC has been rebuilding its liquidity deficit, which led to a rapid recovery above $103,000. |Source: Coin Glass

Although the existence of short-term liquidity does not guarantee price appreciation, it can be an important factor in expanding BTC prices, at least in the short term.

BTC open interest recently recovered by $1 billion in the past day, rising to $33.52 billion. Over 71% of BTC positions are long on average. HyperLiquid is an exception, with over 43% of whales taking short positions.

Although accumulated short liquidity has been high for the past few days, it does not guarantee a non-stop rally. Short liquidity reached $130,000 in October, but there was no significant short squeeze.

On the downside, BTC could dominate long positions, especially the high leverage cluster around $100,500.

BTC is still trading with extreme fear

The BTC index has risen to 23 points from its recent low of 21 points and remains trading with extreme fear.

This leading coin is trading with the highest volatility (1.98%) over the past 6 months. The coin remains unpredictable, with hopes that the recent economic downturn may be over. Although BTC has not yet lost its upward channel and shows no signs of a bear market, its price movements still cause concern.

BTC’s advantage is 58.4%, but this is due to the poor performance of altcoins rather than Bitcoin’s inherent strength.

Is BTC price forming a local bottom?

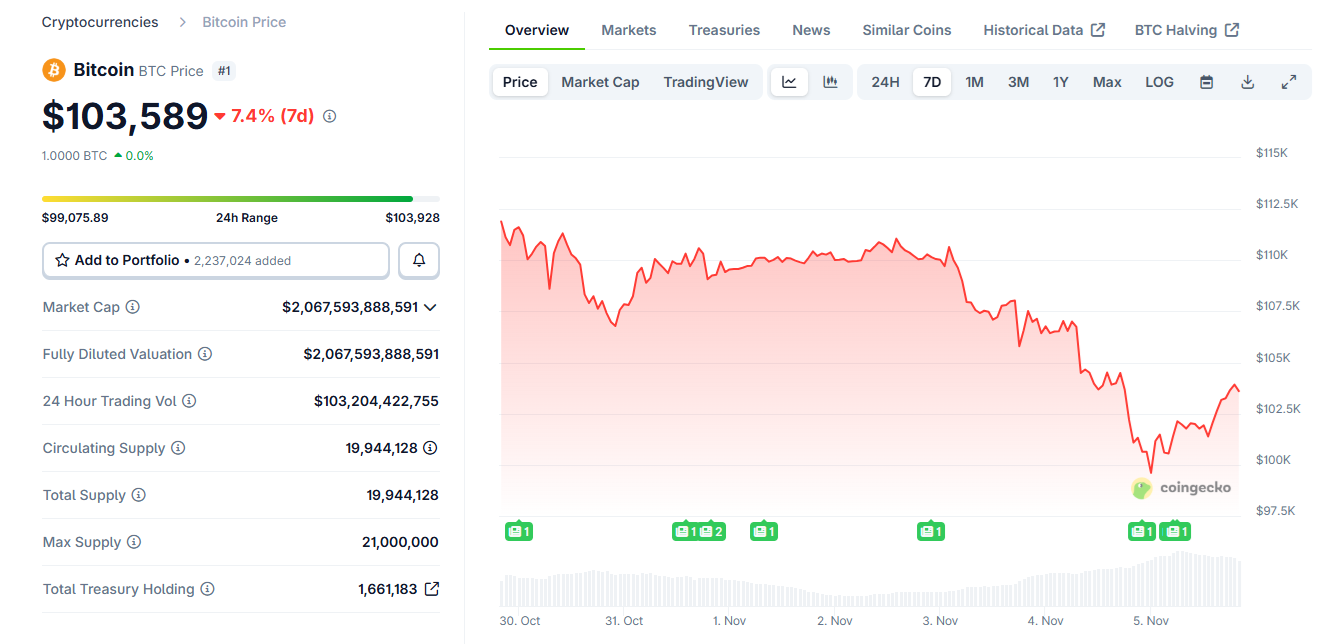

BTC has shown the ability to bounce back, suggesting that the $100,000 range will act as a local bottom.

BTC rebounded from weekly lows and avoided a break below $100,000. Although trading remains uncertain, the coin has shown the ability to bounce back in the short term. |Source: Coin Gecko

Shortly after forming a cluster of highly leveraged short positions up to $105,000, BTC rose again. Within a short period of time, the price recovered to $103,743.15, triggering a market-wide rebound from recent lows.

BTC’s recovery also pushed ETH higher, pushing the token above $3,400.

This move immediately resulted in $5.9 million in short liquidations in BTC and $9.6 million in short ETH positions. Although this is only a fraction of the available liquidity, the short squeeze was at least partially realized. On a 4-hour basis, BTC recorded $18.33 million in short-term liquidations.

On a 24-hour basis, long liquidations continued to dominate, with over $300 million of BTC longs liquidated.

There are other signs of a market bottom. Short-term holders completed another round Surrender. There are also signs that whale spot orders are increasing, leading ETFs to increase their BTC purchases.

The recent market downturn is seen as a change in sentiment and not a break in the overall bullish trend.