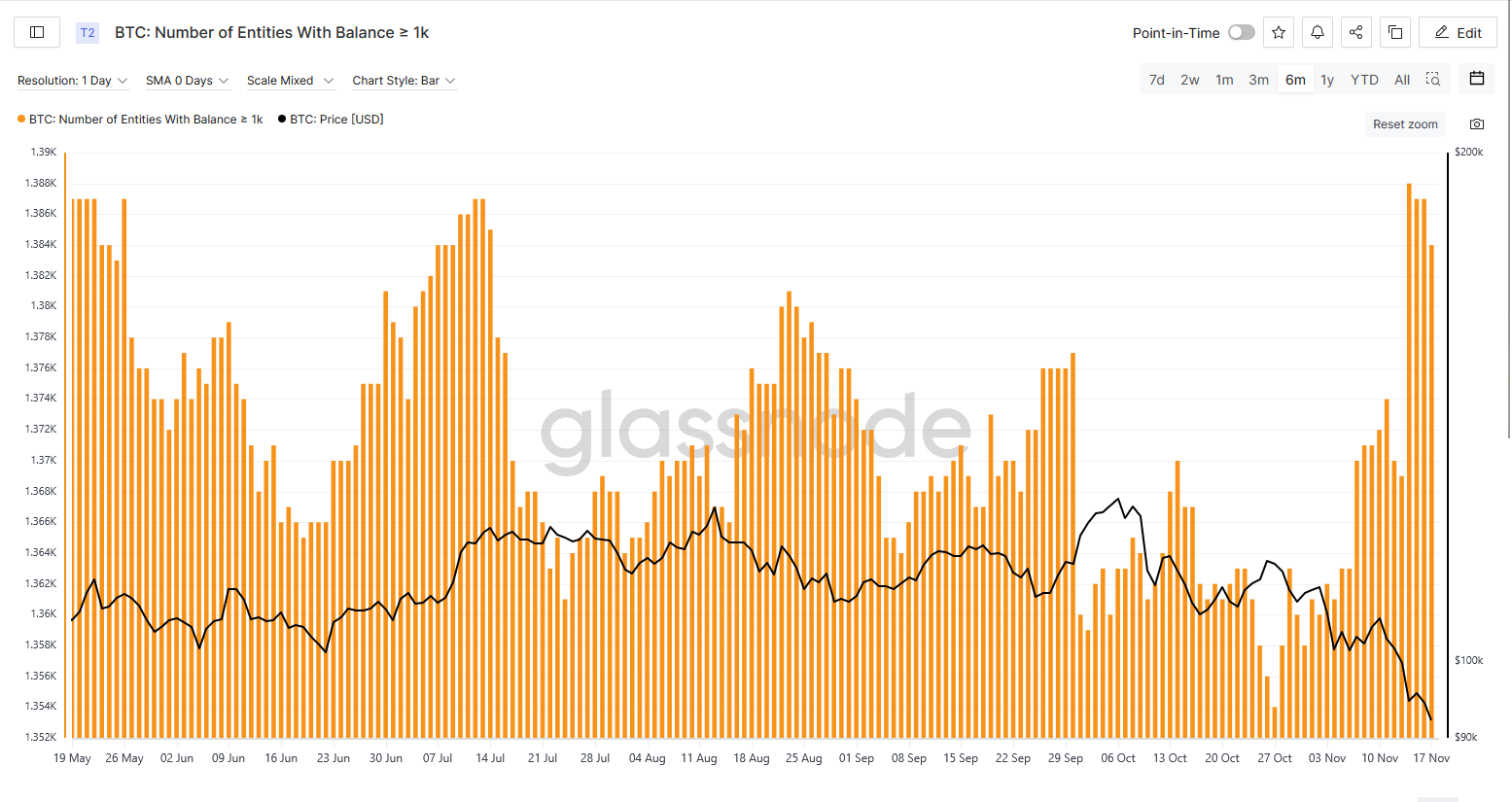

The number of Bitcoin whale wallets has skyrocketed this week following the slump in Bitcoin prices, dropping to $89,550 on Tuesday.

Data from crypto analysis platform Glassnode shows that whales have been accumulating since late October, with a notable spike in the number of Bitcoin whale wallets over 1,000 BTC since Friday.

The number of whale wallets fell to a yearly low of 1,354 on October 27, when BTC was trading at around $114,000, but as of Monday, the number had jumped 2.2% to 1,384, the lowest level in four months.

sauce: glass node

At the same time, Glassnode data shows that small holders of 1 BTC or less are feeling the pressure of the recent price downturn.

The total number of these small wallets decreased from 980,577 on October 27, and hit a yearly low of 977,420 on November 17.

Wallets below 1 BTC will be depleted in 2025. Source: Glassnode

The data shows a common market pattern in cryptocurrencies, where small investors tend to panic sell during market crashes, while whales swoop in and accumulate.

It could also contradict recent theories surrounding “OG dumping,” which claims that older investors have recently driven down Bitcoin’s price by taking profits.

Bitcoin falls below $90,000

Bitcoin fell below a key psychological level on Monday and is currently trading around $89,900. This has lowered the Cryptocurrency Fear and Greed Index to the “Extreme Fear” zone at 11 out of 100.

While some may be feeling the pressure, executives at companies such as Bitwise and Bitmine are suggesting that BTC selling pressure will ease this week and bottom out.

Matt Hogan, chief investment officer at Bitwise Asset Management, argued in an interview with CNBC on Monday that current price levels are a “generational opportunity.”

Related: A rare Bitcoin futures signal could catch traders off guard: Is a bottom forming?

“I think we’re nearing the bottom. I see this as a great buying opportunity for long-term investors. Bitcoin was the first to turn around before this broad market pullback. Bitcoin was kind of the canary in the coal mine that signaled there was some risk in all kinds of risk-on assets,” Hogan said.

Elsewhere, while the “Working at McDonald’s” meme is making a comeback on X, executives like Gemini cryptocurrency exchange co-founder Cameron Winklevoss have taken a more positive view, posting, “This is the last time you can buy Bitcoin for under $90,000!”

Other crypto analysts at X, including TheCryptoDog, also claim that BTC should “rebound soon” considering the current indicators.

“If things play out clearly and simply, $BTC will reach around $87,7000 – some higher TF MA support and horizontal support from previous resistance (the break of which triggered the May rally),” they wrote.

magazine: The big question: Did a time-traveling AI invent Bitcoin?